The Curious Case Of Wall Street's Odd Trading Patterns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Curious Case of Wall Street's Odd Trading Patterns: Are Algorithmic Anomalies the New Normal?

Wall Street, the engine of global finance, is known for its volatility. But lately, something feels…different. A rising tide of unusual trading patterns has analysts and regulators scratching their heads, prompting questions about the growing influence of algorithmic trading and the potential for market manipulation. This isn't your grandfather's stock market; the curious case of increasingly erratic trading activity demands a closer look.

The Rise of the Machines:

The proliferation of algorithmic trading (algo-trading) is a key suspect in this unfolding mystery. These sophisticated computer programs, designed to execute trades at lightning speed based on pre-programmed rules, account for a significant portion of daily volume. While beneficial for efficiency and liquidity in many ways, their sheer speed and complexity make them prone to unforeseen consequences. One common anomaly is the occurrence of "flash crashes," where prices plummet dramatically in a short period before rebounding just as quickly, often attributed to algorithmic interactions and feedback loops. These events highlight the inherent risks associated with relying heavily on automated trading systems.

Identifying the Anomalies:

Several unusual trading patterns are raising eyebrows:

- Increased Frequency of "Spoofing": This involves placing large orders to manipulate prices, only to cancel them before execution. It's a deceptive tactic designed to mislead other traders and profit from their reactions.

- HFT (High-Frequency Trading) Dominance: High-frequency trading firms, leveraging incredibly fast algorithms, now dominate market share. Their actions, while often opaque, can significantly impact overall market dynamics. Understanding their influence is crucial for maintaining market integrity.

- Unpredictable Price Swings: Beyond flash crashes, markets are experiencing increasingly unpredictable and sharp price movements, even in the absence of significant news or economic events. This volatility can be unsettling for investors and makes accurate forecasting incredibly difficult.

- Correlation Breakdown: Traditional correlations between asset classes are weakening, making portfolio diversification strategies more challenging. This suggests a shift in underlying market forces, possibly driven by algorithmic interactions.

Regulatory Challenges and Future Outlook:

Regulators are grappling with the challenge of overseeing this increasingly complex and opaque market. Traditional regulatory frameworks may be inadequate to address the speed and sophistication of algo-trading. The SEC and other global bodies are actively working on improved surveillance technologies and regulatory frameworks to better detect and deter manipulative practices.

What Does it Mean for Investors?

The implications for ordinary investors are significant. Increased volatility and unpredictable market movements necessitate a more cautious and informed approach to investment. Diversification, robust risk management, and a thorough understanding of your investment strategy are more important than ever. Consider consulting a financial advisor to navigate these uncertain waters.

Conclusion:

The curious case of Wall Street's odd trading patterns highlights the evolving landscape of modern finance. While algorithmic trading offers benefits, it also presents significant challenges that demand careful consideration and proactive regulatory action. Understanding these anomalies and adapting investment strategies accordingly is crucial for navigating the increasingly complex world of financial markets. The future of finance may depend on finding a balance between technological innovation and robust regulatory oversight. Staying informed and adaptable is key to thriving in this new era.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Curious Case Of Wall Street's Odd Trading Patterns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Extensive Grooming And Abuse Rochdale Gangs Guilty Verdict

Jun 14, 2025

Extensive Grooming And Abuse Rochdale Gangs Guilty Verdict

Jun 14, 2025 -

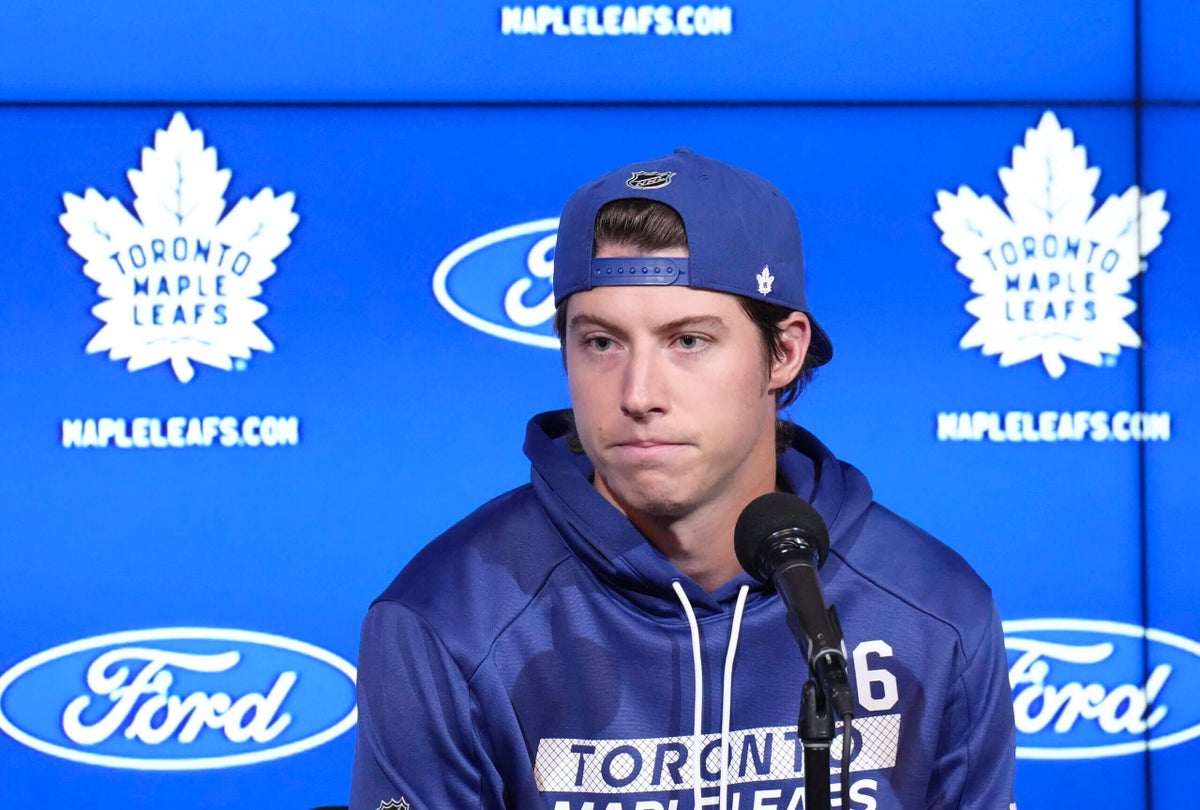

Mitch Marners Future Contract Negotiations And The Pressure To Perform

Jun 14, 2025

Mitch Marners Future Contract Negotiations And The Pressure To Perform

Jun 14, 2025 -

No Love Island Usa Tonight June 11th Schedule Update And Next Episode

Jun 14, 2025

No Love Island Usa Tonight June 11th Schedule Update And Next Episode

Jun 14, 2025 -

Elon Musk Teases Teslas Groundbreaking New Product Release Date Approaching

Jun 14, 2025

Elon Musk Teases Teslas Groundbreaking New Product Release Date Approaching

Jun 14, 2025 -

Woman Pulled From Burning Vehicle Thanks To Bystanders

Jun 14, 2025

Woman Pulled From Burning Vehicle Thanks To Bystanders

Jun 14, 2025

Latest Posts

-

Liga Pro En Vivo Barcelona Sc Enfrenta A Manta Fc Jornada 16

Jun 15, 2025

Liga Pro En Vivo Barcelona Sc Enfrenta A Manta Fc Jornada 16

Jun 15, 2025 -

Rhoc Season 19 Trailer Slade Smileys Shocking Revelation About Tamra Judge

Jun 15, 2025

Rhoc Season 19 Trailer Slade Smileys Shocking Revelation About Tamra Judge

Jun 15, 2025 -

September 7th Carlo Acutis Canonization As The First Millennial Saint

Jun 15, 2025

September 7th Carlo Acutis Canonization As The First Millennial Saint

Jun 15, 2025 -

Spencers Struggles Examining A Potential Loss Of Form

Jun 15, 2025

Spencers Struggles Examining A Potential Loss Of Form

Jun 15, 2025 -

National Portrait Gallery Chief Steps Down Two Weeks After Trumps Demand

Jun 15, 2025

National Portrait Gallery Chief Steps Down Two Weeks After Trumps Demand

Jun 15, 2025