The Dark Side Of Shared Ownership: From Dream To Despair

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Dark Side of Shared Ownership: From Dream to Despair

Owning a home – the quintessential symbol of the British dream. But for many, the allure of shared ownership has quickly turned into a nightmare. This seemingly affordable route to homeownership is increasingly revealing a darker side, leaving some owners trapped in a cycle of debt and frustration. This article explores the hidden pitfalls of shared ownership and offers advice for prospective buyers.

Shared ownership, where you buy a percentage of a property and pay rent on the remaining share, has long been marketed as a stepping stone onto the property ladder. It's designed to help first-time buyers and those on lower incomes access the housing market, particularly in areas with high property prices. However, the reality can be significantly different from the glossy brochures.

The Allure and the Reality: A Stark Contrast

The initial appeal is undeniable. Lower upfront costs and smaller monthly mortgages seem incredibly attractive, especially in competitive markets. But this initial affordability often masks a complex web of hidden fees and restrictive rules that can quickly erode the dream.

- Escalating Service Charges: These charges, covering building maintenance and upkeep, can be unpredictable and dramatically increase over time. Many shared ownership schemes have seen substantial rises, leaving owners struggling to keep up with payments.

- Limited Control: Shared ownership inherently means less control over your property. Decisions regarding renovations, alterations, or even redecorating often require the approval of the housing association or freeholder, leading to frustrating delays and limitations.

- Selling Your Share: Selling a shared ownership property can be surprisingly complex and time-consuming. Finding a buyer willing to take on the remaining share and comply with the scheme's rules can be challenging, potentially leaving you stuck in a difficult situation. Furthermore, the sale process often involves lengthy paperwork and numerous approvals.

- Staircasing Difficulties: Staircasing, the process of buying more shares in your property, is often presented as a simple route to full ownership. However, in practice, it can be hampered by restrictive rules, lengthy waiting times, and unexpected costs. This can trap owners in a cycle of partial ownership, never quite reaching their goal of full homeownership.

- Hidden Fees: Beyond service charges, be aware of potential hidden fees. These can include administrative fees, valuation fees, and legal costs associated with staircasing or selling your share. Thorough research is crucial to avoid unexpected financial burdens.

Navigating the Shared Ownership Maze: Tips for Prospective Buyers

If you're considering shared ownership, arm yourself with knowledge and proceed with caution:

- Thoroughly Research the Scheme: Don't solely rely on marketing materials. Independently investigate the scheme's history, including previous service charge increases and any complaints lodged by residents.

- Seek Independent Financial Advice: Consult a qualified financial advisor to understand the long-term financial implications and ensure it aligns with your overall financial goals.

- Read the Lease Agreement Carefully: The lease agreement contains crucial details about your rights, responsibilities, and restrictions. Engage a solicitor to review it before committing.

- Understand the Staircasing Process: Research the specific staircasing process for the scheme, including the costs involved, waiting times, and any restrictions.

- Consider the Long-Term Costs: Don't just focus on the initial purchase price. Project potential service charge increases and factor them into your long-term budget.

Conclusion: A Balanced Perspective

While shared ownership can offer a pathway to homeownership for some, it's crucial to understand the potential downsides. By being informed, prepared, and seeking expert advice, you can significantly reduce the risks and increase your chances of a positive experience. Remember, the dream of homeownership shouldn't come at the cost of financial ruin. Carefully weigh the pros and cons before embarking on this journey. This requires thorough research and a realistic understanding of the financial and practical commitments involved. Don't hesitate to seek advice from independent professionals to ensure you make an informed decision.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Dark Side Of Shared Ownership: From Dream To Despair. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Summer Heat Surge Georgia Issues Heat Health Advisory

Jun 18, 2025

Summer Heat Surge Georgia Issues Heat Health Advisory

Jun 18, 2025 -

Wnba Picks 5 Top Player Props And Bets For Tuesday June 17 2025

Jun 18, 2025

Wnba Picks 5 Top Player Props And Bets For Tuesday June 17 2025

Jun 18, 2025 -

Raising Twins In Cincinnati Challenges Rewards And Local Support Systems

Jun 18, 2025

Raising Twins In Cincinnati Challenges Rewards And Local Support Systems

Jun 18, 2025 -

Georgia Summer Heat Prepare For Record High Temperatures And Humidity

Jun 18, 2025

Georgia Summer Heat Prepare For Record High Temperatures And Humidity

Jun 18, 2025 -

Iranian Public Opinion The Impact Of Israeli Strikes And The Gaza Analogy

Jun 18, 2025

Iranian Public Opinion The Impact Of Israeli Strikes And The Gaza Analogy

Jun 18, 2025

Latest Posts

-

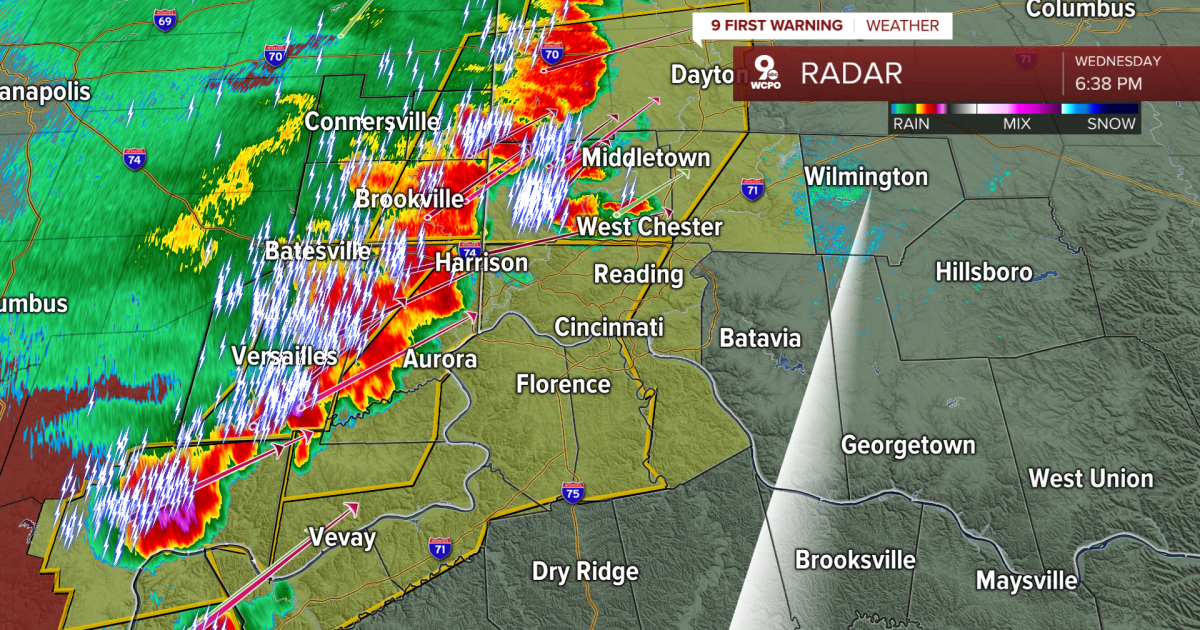

Urgent Weather Alert Severe Thunderstorm Watch In Effect

Jun 18, 2025

Urgent Weather Alert Severe Thunderstorm Watch In Effect

Jun 18, 2025 -

R Kellys Attorneys Claim Prison Staff Drugged Him Before Hospitalization

Jun 18, 2025

R Kellys Attorneys Claim Prison Staff Drugged Him Before Hospitalization

Jun 18, 2025 -

Is Logan Hendersons Mlb Call Up Imminent Week 11 Fantasy Baseball Outlook

Jun 18, 2025

Is Logan Hendersons Mlb Call Up Imminent Week 11 Fantasy Baseball Outlook

Jun 18, 2025 -

Migrant Smuggling Surge Taxi Boats Used For Channel Crossings

Jun 18, 2025

Migrant Smuggling Surge Taxi Boats Used For Channel Crossings

Jun 18, 2025 -

Youth Baseball Pitching Identifying And Cultivating Talent

Jun 18, 2025

Youth Baseball Pitching Identifying And Cultivating Talent

Jun 18, 2025