The Fall Of A Major Subprime Auto Lender: Systemic Risk Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Fall of a Major Subprime Auto Lender: Systemic Risk Analysis

The recent collapse of [Name of Lender], a major player in the subprime auto lending market, has sent shockwaves through the financial industry, raising serious concerns about systemic risk. This event underscores the fragility of the auto loan market and highlights the potential for wider economic consequences. This in-depth analysis explores the factors contributing to the lender's downfall and assesses the potential systemic implications.

The Domino Effect: Understanding the Collapse of [Name of Lender]

[Name of Lender]'s failure wasn't a sudden event; it was the culmination of several interconnected factors. Firstly, the lender's aggressive lending practices, targeting borrowers with poor credit histories, created a portfolio inherently vulnerable to defaults. High interest rates, while lucrative in the short term, ultimately proved unsustainable for many borrowers facing economic hardship. Secondly, rising inflation and interest rates significantly increased the cost of borrowing, further straining borrowers' ability to repay their loans. This is a classic example of interest rate risk within the financial sector. Finally, a lack of robust risk management and oversight contributed to the lender's inability to adapt to the changing economic landscape. The company's reliance on asset-backed securities (ABS) to fund its lending operations also amplified the risk, as the value of these securities plummeted with the increase in defaults.

Systemic Risk: A Spreading Contagion?

The collapse of [Name of Lender] raises crucial questions about systemic risk. While the lender's portfolio was relatively isolated compared to the 2008 mortgage crisis, its failure could trigger a domino effect within the broader financial system. Here's what we need to consider:

- Contagion through ABS Market: The decline in the value of [Name of Lender]'s ABS could trigger losses for other financial institutions holding similar securities, potentially leading to further defaults and instability.

- Impact on Auto Dealerships: The lender's failure directly impacts auto dealerships that relied on its financing options. This could lead to reduced sales and potential bankruptcies within the automotive sector.

- Increased Lending Standards: The event might force other lenders to tighten their lending standards, potentially reducing access to credit for consumers and businesses. This could dampen economic growth.

- Regulatory Scrutiny: Expect increased regulatory scrutiny of the subprime auto lending market, leading to potentially stricter regulations and oversight.

Lessons Learned and Future Outlook

The fall of [Name of Lender] serves as a stark reminder of the inherent risks associated with subprime lending and the importance of robust risk management practices. Moving forward, several key areas need attention:

- Strengthening Regulatory Frameworks: More stringent regulations are needed to ensure responsible lending practices and prevent a recurrence of similar events. This includes stricter oversight of ABS and improved consumer protection measures.

- Improved Risk Assessment Models: Lenders must adopt more sophisticated risk assessment models that accurately account for macroeconomic factors and borrower vulnerability.

- Diversification of Lending Portfolios: Over-reliance on a single segment of the market, such as subprime auto loans, should be avoided.

The future of the subprime auto lending market remains uncertain. However, the fallout from [Name of Lender]'s collapse is likely to reshape the industry, leading to greater scrutiny, tighter regulations, and a more cautious approach to lending. This situation warrants continued monitoring for any further ripple effects across the wider financial ecosystem. Further analysis and potential government intervention are crucial to mitigate the potential for wider systemic damage.

Keywords: Subprime Auto Lending, Systemic Risk, [Name of Lender], Auto Loan Defaults, Financial Crisis, Asset-Backed Securities (ABS), Interest Rate Risk, Economic Impact, Regulatory Reform, Financial Stability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Fall Of A Major Subprime Auto Lender: Systemic Risk Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbc Investigation Leads To Suspension Of Nine Metropolitan Police Officers

Sep 14, 2025

Bbc Investigation Leads To Suspension Of Nine Metropolitan Police Officers

Sep 14, 2025 -

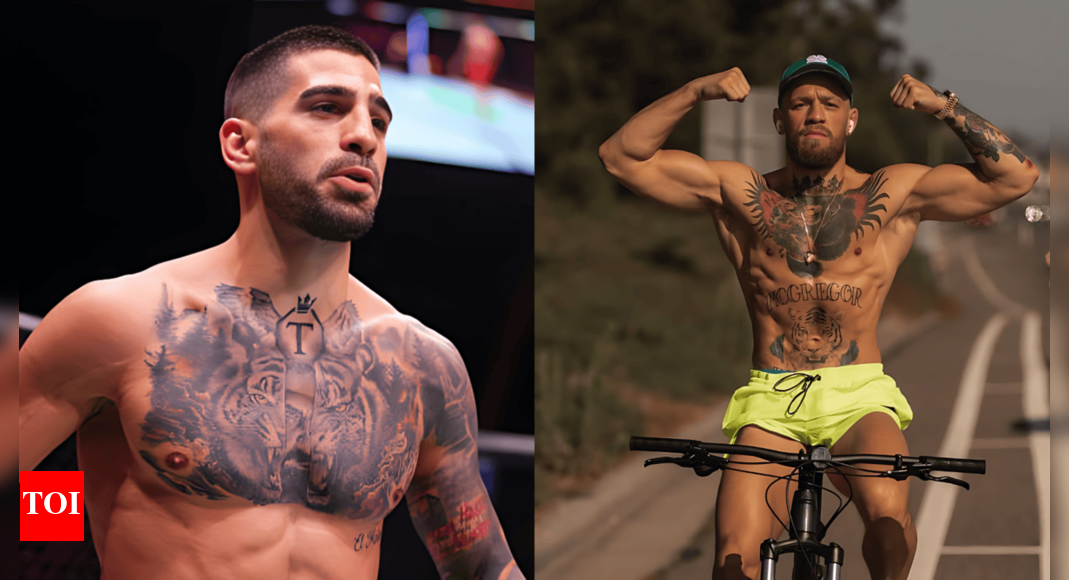

From Octagon To Oval Office Ilia Topurias Unexpected Presidential Aspirations

Sep 14, 2025

From Octagon To Oval Office Ilia Topurias Unexpected Presidential Aspirations

Sep 14, 2025 -

Starmer Faces Mounting Pressure Mps Warn Of Imminent Deadline

Sep 14, 2025

Starmer Faces Mounting Pressure Mps Warn Of Imminent Deadline

Sep 14, 2025 -

Iva Jovic Finalista Del Gdl Open Akron 2025 Ante Emiliana Arango

Sep 14, 2025

Iva Jovic Finalista Del Gdl Open Akron 2025 Ante Emiliana Arango

Sep 14, 2025 -

The Dangers Of High Protein Diets Understanding The Risks

Sep 14, 2025

The Dangers Of High Protein Diets Understanding The Risks

Sep 14, 2025

Latest Posts

-

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025 -

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025 -

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025 -

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025 -

Social Media Outrage 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025

Social Media Outrage 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025