The Financial System's Weaknesses: Insights From OpenAI CEO Sam Altman

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial System's Weaknesses: Insights from OpenAI CEO Sam Altman

Sam Altman, CEO of OpenAI, recently offered a stark warning about the vulnerabilities within the global financial system. His comments, delivered during a high-profile interview, sparked immediate debate among economists and policymakers, highlighting concerns that extend beyond the usual anxieties surrounding inflation and recession. This article delves into Altman's key insights and analyzes their potential implications.

Altman, known for his forward-thinking perspective on artificial intelligence and its societal impact, shifted his focus to a less-discussed but equally critical area: the fragility of our financial infrastructure. His concerns weren't solely about immediate crises, but rather about systemic weaknesses that could trigger unforeseen consequences.

H2: Key Concerns Highlighted by Sam Altman

Altman's concerns weren't explicitly detailed, but his remarks hinted at several key weaknesses within the current financial system:

-

Over-reliance on outdated technology: The financial system relies heavily on legacy systems, making it vulnerable to cyberattacks and operational failures. Modernization efforts have been slow, leaving critical infrastructure exposed. This echoes concerns raised by regulators globally about the need for robust cybersecurity measures in the financial sector. A major breach could have cascading effects, crippling markets and impacting global stability.

-

Lack of transparency and accountability: The complexity of modern financial instruments and interconnectedness of global markets can obscure risks. This lack of transparency makes it difficult to identify and address vulnerabilities before they escalate into major crises. Greater transparency and improved regulatory oversight are vital to mitigating this risk.

-

The potential for AI-driven manipulation: While Altman is a champion of AI, he acknowledged the potential for malicious actors to leverage AI for sophisticated financial fraud and market manipulation. This includes sophisticated deepfakes and algorithmic trading strategies designed to exploit vulnerabilities in the system. Developing robust countermeasures to this emerging threat is crucial.

-

Inadequate stress testing for unforeseen events: Current stress tests often focus on predictable scenarios, leaving the system unprepared for “black swan” events – unpredictable crises that can have devastating consequences. The need for more sophisticated and comprehensive stress testing methodologies that incorporate unforeseen events is critical.

H2: The Call for Systemic Reform

Altman's comments aren't merely a critique; they represent a call to action. He implicitly advocates for a comprehensive overhaul of the financial system, emphasizing the urgent need for:

-

Increased investment in cybersecurity and infrastructure modernization: Outdated systems are a major liability. Significant investment is needed to upgrade technology, bolster cybersecurity defenses, and improve the resilience of financial institutions.

-

Enhanced regulatory oversight and transparency: Strengthening regulatory frameworks and promoting greater transparency in financial markets are essential to mitigate risks and prevent future crises. This includes improving data sharing and collaboration between regulators and financial institutions.

-

Proactive development of AI-based risk mitigation strategies: While AI poses risks, it can also be leveraged to identify and manage those risks more effectively. Investing in AI-powered risk assessment and fraud detection tools is crucial.

-

Development of more robust stress testing methodologies: Financial institutions need to develop more sophisticated stress testing frameworks that incorporate a wider range of potential scenarios, including unpredictable “black swan” events.

H2: Conclusion: A Wake-Up Call for the Financial World?

Sam Altman's insights serve as a powerful reminder of the inherent vulnerabilities within the global financial system. His warning isn't about an imminent collapse, but rather a call for proactive reform to prevent future crises. The financial industry and policymakers must heed this call, engaging in a collaborative effort to strengthen the system's resilience and ensure its long-term stability. Failure to do so could have far-reaching and potentially devastating consequences for the global economy. The time for action is now. What are your thoughts on Altman's assessment? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial System's Weaknesses: Insights From OpenAI CEO Sam Altman. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ketamine Supplier Pleads Guilty Doctor Linked To Death Case

Jul 24, 2025

Ketamine Supplier Pleads Guilty Doctor Linked To Death Case

Jul 24, 2025 -

Mlb Trade Deadline Padres Eyeing Pitcher Trade Nationals Open To Mac Kenzie Gore Deals

Jul 24, 2025

Mlb Trade Deadline Padres Eyeing Pitcher Trade Nationals Open To Mac Kenzie Gore Deals

Jul 24, 2025 -

Mc Cutchens Latest Achievement A Pirates Legacy Moment

Jul 24, 2025

Mc Cutchens Latest Achievement A Pirates Legacy Moment

Jul 24, 2025 -

Ketamine Supply Charge Doctor Admits Guilt In Perry Related Case

Jul 24, 2025

Ketamine Supply Charge Doctor Admits Guilt In Perry Related Case

Jul 24, 2025 -

Uk Brew Dog Pubs Facing Closure Impact And Future Plans

Jul 24, 2025

Uk Brew Dog Pubs Facing Closure Impact And Future Plans

Jul 24, 2025

Latest Posts

-

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

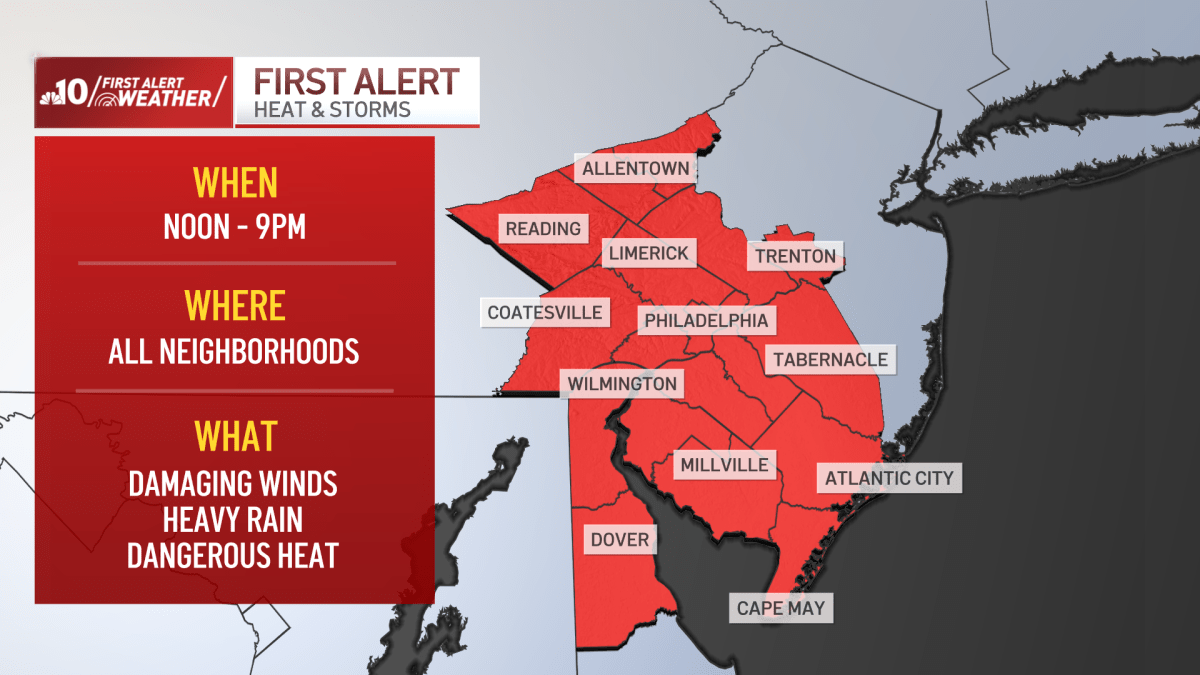

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025 -

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025