The Financial System's Weaknesses: Sam Altman's Urgent Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial System's Weaknesses: Sam Altman's Urgent Concerns Spark Global Debate

Sam Altman, CEO of OpenAI and a prominent figure in the tech world, has recently voiced serious concerns about the fragility of the global financial system. His warnings, far from being dismissed as the musings of a Silicon Valley entrepreneur, are sparking intense debate among economists and policymakers worldwide. Altman's anxieties aren't about a specific impending crisis, but rather a systemic weakness that could trigger unforeseen consequences. This article delves into his concerns and explores the potential implications for the global economy.

Altman's Key Concerns: A Systemic Vulnerability

Altman hasn't explicitly detailed a specific failure point, but his concerns revolve around the interconnectedness and complexity of the modern financial system. He highlights the potential for cascading failures, where a seemingly small event in one part of the system could trigger a domino effect, leading to widespread instability. This echoes concerns raised by many financial experts over the years regarding the potential for another 2008-style financial crisis.

-

Opacity and Lack of Transparency: Altman, like many critics, points to the lack of transparency in many aspects of the financial system. The intricate web of derivatives, shadow banking, and complex financial instruments makes it difficult to fully understand the system's risks and vulnerabilities. This opacity makes it harder to regulate effectively and increases the likelihood of unforeseen crises.

-

Over-reliance on Technology: While technology has revolutionized finance, Altman also warns about the risks associated with over-reliance on complex algorithms and automated trading systems. A major technological failure or a sophisticated cyberattack could have devastating consequences, potentially crippling the system's ability to function. This vulnerability is further heightened by the increasing interconnectedness of global financial networks.

-

Regulatory Gaps: Existing regulations may not adequately address the complexities and evolving nature of the modern financial landscape. Altman likely suggests that regulatory frameworks need to be updated and strengthened to account for the rise of new technologies and financial instruments, including cryptocurrency and decentralized finance (DeFi). This requires international cooperation and a proactive approach to mitigate future risks.

The Implications for the Global Economy

The potential consequences of a systemic failure are severe. A major financial crisis could trigger a global recession, impacting jobs, investments, and overall economic stability. This could lead to social unrest and geopolitical instability, making it a concern for governments and international organizations alike.

What Can Be Done? Addressing the Weaknesses

Addressing these weaknesses requires a multifaceted approach:

-

Increased Transparency and Regulation: Improving transparency in financial markets is crucial. Stricter regulations, particularly for complex financial instruments and shadow banking, are needed to mitigate systemic risk. International cooperation is essential to ensure consistent and effective regulation across borders.

-

Investing in Cybersecurity: Protecting the financial system from cyberattacks is paramount. Significant investment in cybersecurity infrastructure and robust regulatory frameworks are needed to mitigate the risk of technological failures.

-

Stress Testing and Scenario Planning: Regular stress tests and scenario planning can help identify vulnerabilities and prepare for potential crises. This proactive approach can help policymakers and financial institutions develop effective contingency plans.

Conclusion: A Call for Proactive Measures

Sam Altman's concerns, though potentially alarming, serve as a crucial wake-up call. Ignoring the inherent weaknesses within the global financial system would be a grave mistake. Proactive measures, including increased transparency, strengthened regulations, and enhanced cybersecurity, are necessary to prevent a future financial catastrophe and ensure the long-term stability of the global economy. The time for action is now, before another crisis exposes the fragility of the system.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial System's Weaknesses: Sam Altman's Urgent Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mc Cutchen Makes History Exceeds Legendary Pirate In Career Stats

Jul 24, 2025

Mc Cutchen Makes History Exceeds Legendary Pirate In Career Stats

Jul 24, 2025 -

Dylan Cease Trade Speculation Mets Padres In Reported Discussions

Jul 24, 2025

Dylan Cease Trade Speculation Mets Padres In Reported Discussions

Jul 24, 2025 -

Artie Burns Knee Injury Seahawks Cornerback Sidelined At Dolphins Camp

Jul 24, 2025

Artie Burns Knee Injury Seahawks Cornerback Sidelined At Dolphins Camp

Jul 24, 2025 -

700 Million Debt Mike Lynch And Business Partner Face Hp Enterprise Judgment

Jul 24, 2025

700 Million Debt Mike Lynch And Business Partner Face Hp Enterprise Judgment

Jul 24, 2025 -

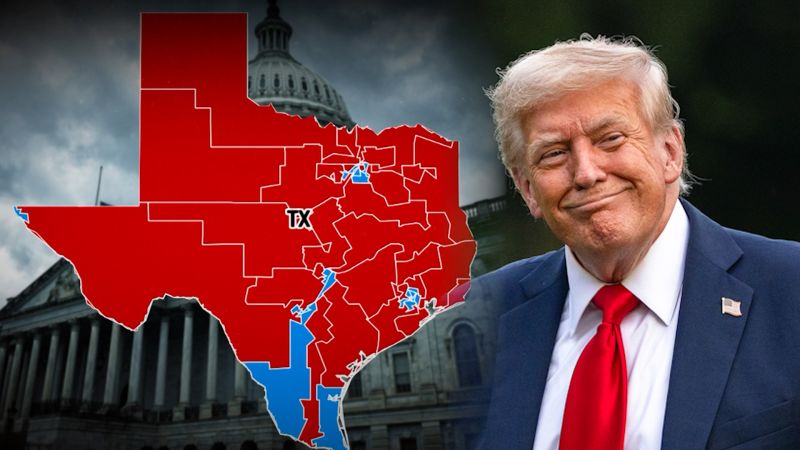

Fight Back Democrats Confront Trumps Political Actions In Texas

Jul 24, 2025

Fight Back Democrats Confront Trumps Political Actions In Texas

Jul 24, 2025

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win