The Hidden Costs Of Shared Ownership: Buyers Beware

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Hidden Costs of Shared Ownership: Buyers Beware

Thinking about shared ownership as a stepping stone onto the property ladder? It might seem like a dream – a chance to own a piece of a property without the hefty upfront cost of a full mortgage. But before you sign on the dotted line, be warned: shared ownership comes with a surprising number of hidden costs that can quickly turn your dream into a financial nightmare. This article will expose those hidden costs, empowering you to make informed decisions about your property purchase.

What is Shared Ownership?

Shared ownership schemes allow you to buy a percentage of a property (typically between 25% and 75%), paying a mortgage on that share. You then pay rent on the remaining share to a housing association or landlord. While the initial outlay is lower than buying outright, several significant costs often go unnoticed by prospective buyers.

Unveiling the Hidden Costs:

-

Service Charges: These fees cover the upkeep of communal areas, buildings insurance, and grounds maintenance. These charges can fluctuate and unexpectedly increase, putting a strain on your budget. Always request detailed breakdowns of past and projected service charges before committing. Failing to do so could lead to unpleasant financial surprises down the line.

-

Ground Rent: You'll pay ground rent to the freeholder, typically annually. This amount might seem small initially, but it can increase significantly over time, especially with older schemes. Carefully review the ground rent clause in your lease agreement; some schemes have escalating ground rents that can become prohibitive.

-

Staircasing Costs: This refers to the costs associated with buying a larger share of the property. While staircasing is a great way to eventually own the property outright, the associated legal and administrative fees can be substantial, often adding thousands of pounds to the overall cost.

-

Management Fees: Housing associations or landlords often charge management fees to cover administrative tasks related to your shared ownership agreement. These can be substantial and should be factored into your overall budget.

-

Leasehold Restrictions: Shared ownership properties often come with leasehold restrictions, limiting your ability to make alterations or improvements to the property. These restrictions can impact your resale value and potentially limit your enjoyment of your home.

Hidden Costs vs. Traditional Homeownership:

While the initial deposit and mortgage payments might be lower in shared ownership, the cumulative impact of service charges, ground rent, management fees, and potential staircasing costs can quickly outweigh the savings. Comparing the total cost of ownership over several years against a traditional mortgage is crucial. Seek independent financial advice to get a clearer picture.

Due Diligence is Paramount:

Before committing to a shared ownership scheme, you must conduct thorough due diligence. This includes:

- Reviewing the lease agreement carefully: Understand all the terms and conditions, including ground rent escalations and restrictions.

- Obtaining a detailed breakdown of all costs: Don't rely on estimates; get concrete figures for service charges, ground rent, and management fees.

- Checking the financial stability of the housing association or landlord: Ensure they are financially sound and capable of managing the property effectively.

- Seeking independent financial advice: A financial advisor can help you assess the long-term financial implications of shared ownership.

Conclusion:

Shared ownership can be a viable pathway to homeownership, but it's crucial to be aware of the hidden costs involved. By understanding these potential expenses and performing thorough research, you can make an informed decision that aligns with your financial goals and avoids potential pitfalls. Don't let the allure of a seemingly affordable entry point blind you to the potential long-term financial obligations. Your future financial well-being depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Hidden Costs Of Shared Ownership: Buyers Beware. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cdc Advisors Alarm Rfk Jr S Actions Threaten U S Vaccination Program

Jun 18, 2025

Cdc Advisors Alarm Rfk Jr S Actions Threaten U S Vaccination Program

Jun 18, 2025 -

Indiana Fever Vs Connecticut Sun Live Stream And Tv Schedule Tonight

Jun 18, 2025

Indiana Fever Vs Connecticut Sun Live Stream And Tv Schedule Tonight

Jun 18, 2025 -

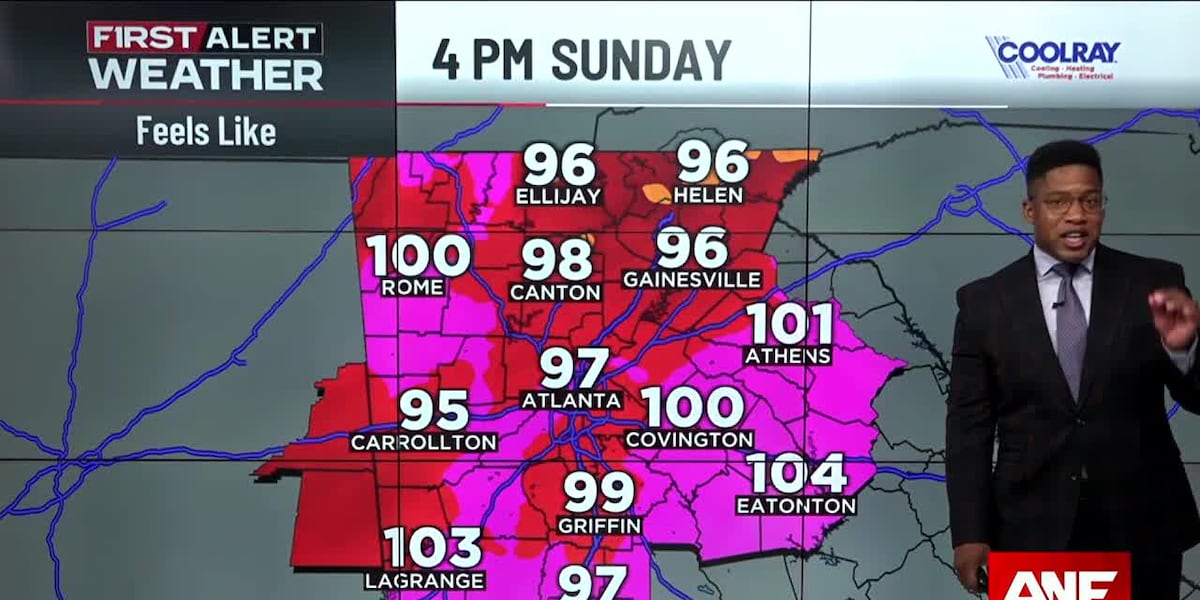

First Alert Forecast Tuesday Brings Higher Risk Of Afternoon Storms

Jun 18, 2025

First Alert Forecast Tuesday Brings Higher Risk Of Afternoon Storms

Jun 18, 2025 -

Atlanta Storm Watch Heavy Rain And Strong Winds Hitting North Georgia

Jun 18, 2025

Atlanta Storm Watch Heavy Rain And Strong Winds Hitting North Georgia

Jun 18, 2025 -

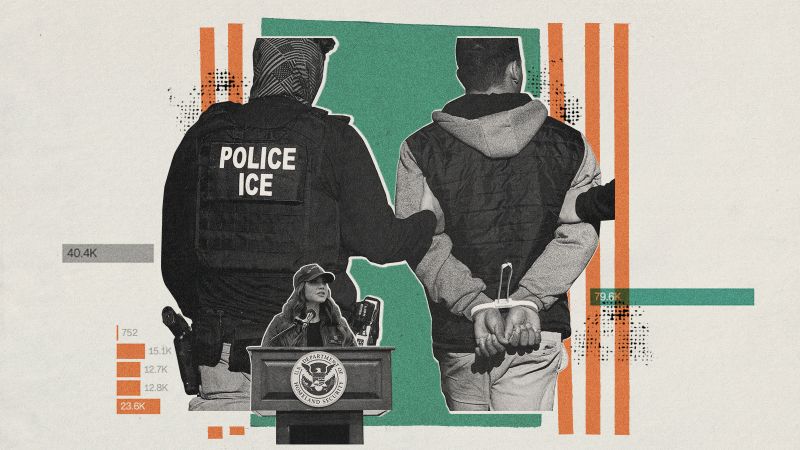

Immigration Enforcement Data Reveals Low Rate Of Serious Criminal Convictions Among Ice Detainees

Jun 18, 2025

Immigration Enforcement Data Reveals Low Rate Of Serious Criminal Convictions Among Ice Detainees

Jun 18, 2025

Latest Posts

-

Sean Diddy Combs Trial Court Adjourns After Text Message Evidence

Jun 18, 2025

Sean Diddy Combs Trial Court Adjourns After Text Message Evidence

Jun 18, 2025 -

Controversial Endorsement Pirro Backs Criminal Probe Into January 6th Prosecution Team

Jun 18, 2025

Controversial Endorsement Pirro Backs Criminal Probe Into January 6th Prosecution Team

Jun 18, 2025 -

Air India Crash Families Demand Better Support And Accountability

Jun 18, 2025

Air India Crash Families Demand Better Support And Accountability

Jun 18, 2025 -

Is Shared Ownership Right For You A Realistic Look

Jun 18, 2025

Is Shared Ownership Right For You A Realistic Look

Jun 18, 2025 -

Jacob Morrisons Masterclass Coastal Carolinas Triumph At The College World Series

Jun 18, 2025

Jacob Morrisons Masterclass Coastal Carolinas Triumph At The College World Series

Jun 18, 2025