The Implications Of Buffett's Sale Of Two Long-Term US Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Berkshire Hathaway Sheds Long-Term US Holdings: Implications for Investors

Warren Buffett's Berkshire Hathaway recently announced the sale of significant stakes in two long-term US investments, sending ripples through the financial world. This surprising move, deviating from Buffett's typically long-term investment strategy, has sparked intense speculation about the Oracle of Omaha's outlook on the US economy and the future of these specific sectors. What are the implications for investors? Let's delve into the details.

The Sales: A Departure from Tradition

Berkshire Hathaway offloaded a substantial portion of its holdings in [Insert Company Name 1] and [Insert Company Name 2]. These weren't minor adjustments; these were significant divestments from companies that have been cornerstones of Berkshire's portfolio for years. This departure from Buffett's famously patient, long-term investment approach has raised several key questions. Was it a strategic repositioning, a response to market shifts, or something else entirely?

Possible Reasons Behind the Sale:

Several theories are circulating regarding the rationale behind these divestments. These include:

- Market Valuation: Some analysts suggest that Buffett might believe these companies are currently overvalued, presenting a favorable opportunity to lock in profits. This aligns with Buffett's well-known principle of buying low and selling high.

- Sectoral Shifts: The specific sectors to which these companies belong may be facing headwinds. Changes in consumer behavior, technological disruptions, or regulatory changes could influence Buffett's decision to reduce exposure.

- Portfolio Diversification: Buffett might be reallocating capital towards sectors he deems more promising for future growth. This reallocation could be a proactive measure to enhance the overall portfolio's performance and resilience.

- Unexpected Opportunities: The sale could have freed up capital for more attractive investment opportunities that have emerged recently. Buffett is known for his opportunistic approach to investing.

What This Means for Investors:

The implications of these sales are multifaceted:

- Sector-Specific Impact: The sale could trigger a downward pressure on the stock prices of the companies involved, impacting investors holding these stocks. However, it's crucial to remember that market reactions can be unpredictable.

- Broader Market Sentiment: The move could reflect a broader shift in investor sentiment towards the US economy. This warrants careful consideration of your own investment portfolio and risk tolerance.

- Re-evaluation of Investment Strategies: Buffett's actions prompt investors to reassess their own investment strategies. Are your holdings aligned with the current market realities? Is your risk profile appropriately adjusted?

Looking Ahead:

While analyzing these specific divestments provides valuable insights, it's critical to remember that predicting market movements with certainty is impossible. Buffett's decisions, while insightful, are not guarantees of future market performance. However, his actions often serve as a valuable benchmark for investors to consider and reassess their own investment strategies. It underlines the importance of diligent research, diversification, and a well-defined investment plan, regardless of the actions of even the most successful investors.

Call to Action: Consult with a qualified financial advisor to assess your own investment portfolio and determine whether adjustments are necessary in light of these recent developments. Don't make impulsive decisions based solely on one investor's actions. Remember that thorough research and a long-term perspective are crucial to successful investing.

Keywords: Warren Buffett, Berkshire Hathaway, US Investments, Stock Market, Investment Strategy, Portfolio Diversification, Market Analysis, Financial News, Long-Term Investments, [Insert Company Name 1], [Insert Company Name 2], Oracle of Omaha.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Implications Of Buffett's Sale Of Two Long-Term US Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Warren Buffetts Surprise Sell Off Two Us Investments Hes Abandoning

Jun 05, 2025

Warren Buffetts Surprise Sell Off Two Us Investments Hes Abandoning

Jun 05, 2025 -

New Music Grace Potter Discusses Her Recently Released Album

Jun 05, 2025

New Music Grace Potter Discusses Her Recently Released Album

Jun 05, 2025 -

No Winter Fuel Payment Cut Chancellors U Turn Brings Relief

Jun 05, 2025

No Winter Fuel Payment Cut Chancellors U Turn Brings Relief

Jun 05, 2025 -

High Court Backs Plaintiff In Landmark Reverse Discrimination Case

Jun 05, 2025

High Court Backs Plaintiff In Landmark Reverse Discrimination Case

Jun 05, 2025 -

Broadcom Earnings Analyst And Trader Predictions For Avgo Stock Price

Jun 05, 2025

Broadcom Earnings Analyst And Trader Predictions For Avgo Stock Price

Jun 05, 2025

Latest Posts

-

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025 -

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025 -

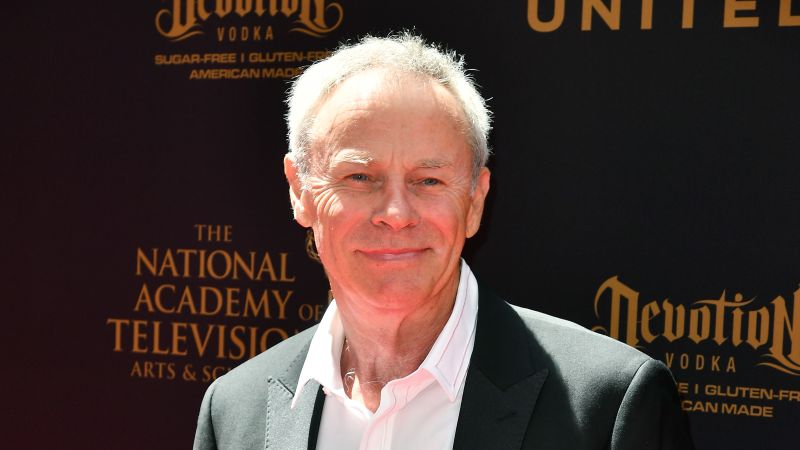

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025