The Perils Of Easy Money: Examining The Risks Of Fed Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Perils of Easy Money: Examining the Risks of Fed Rate Cuts

The Federal Reserve's recent discussions surrounding potential interest rate cuts have ignited a firestorm of debate among economists and investors alike. While rate cuts can stimulate economic growth in the short term, a closer examination reveals a complex web of potential risks that could outweigh the benefits. This article delves into the perils of "easy money" and explores the potential downsides of the Fed easing monetary policy.

The Allure of Lower Rates:

Lower interest rates are often seen as a panacea for economic woes. They encourage borrowing and spending, boosting business investment and consumer confidence. This can lead to increased employment and a surge in economic activity. The logic is simple: cheaper borrowing costs translate to more money flowing through the economy. However, this seemingly straightforward solution ignores several crucial potential consequences.

The Risks of Easy Money:

The dangers of aggressively cutting interest rates are multifaceted and often overlooked in the rush for short-term economic gains. Here are some key risks:

-

Inflationary Pressures: When money becomes readily available, demand can outstrip supply, leading to rising prices. This inflationary pressure erodes purchasing power and can destabilize the economy, particularly if wages fail to keep pace with rising costs. This is especially concerning in the current environment of already elevated inflation.

-

Asset Bubbles: Easy money can inflate asset bubbles, particularly in the housing market and stock markets. While a booming stock market might initially seem positive, a subsequent burst can have devastating consequences, leading to financial instability and market crashes. We’ve seen this scenario play out before, most notably in the 2008 financial crisis.

-

Increased National Debt: Lower interest rates can encourage increased government borrowing, leading to a ballooning national debt. This can burden future generations with immense financial liabilities and limit the government's ability to respond to future crises. Managing a large national debt requires careful fiscal planning and responsible spending.

-

Currency Depreciation: Lower interest rates can weaken a nation's currency, making imports more expensive and potentially leading to trade imbalances. A weaker dollar can also increase the cost of borrowing for businesses and individuals who have debts denominated in foreign currencies.

-

Moral Hazard: The expectation of government intervention and bailouts can lead to excessive risk-taking by businesses and individuals. This "moral hazard" can create systemic instability, making the financial system more vulnerable to shocks.

Alternative Solutions:

Before resorting to rate cuts, policymakers should consider alternative approaches to stimulate economic growth. These include:

-

Targeted Fiscal Policy: Government spending on infrastructure projects or targeted tax cuts can stimulate specific sectors of the economy without the broad-ranging consequences of interest rate manipulation.

-

Regulatory Reform: Streamlining regulations and reducing bureaucratic burdens can encourage business investment and innovation.

-

Investment in Human Capital: Investing in education and training can improve workforce productivity and long-term economic growth.

Conclusion:

While the temptation to use interest rate cuts as a quick fix for economic downturns is understandable, it's crucial to acknowledge the potential long-term risks. The Fed must carefully weigh the short-term benefits against the potential for inflation, asset bubbles, and increased national debt. A balanced approach that considers alternative solutions is essential to ensure sustainable and responsible economic growth. The path forward requires careful consideration and a long-term perspective, prioritizing stability over short-term gains. Failing to do so could have severe and lasting consequences for the global economy.

Call to Action: What are your thoughts on the potential risks of Fed rate cuts? Share your opinion in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Perils Of Easy Money: Examining The Risks Of Fed Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Parental Rights Under Siege Schools Transgender Policies And The Fight For Parental Voice

Sep 11, 2025

Parental Rights Under Siege Schools Transgender Policies And The Fight For Parental Voice

Sep 11, 2025 -

Nepals Prime Minister Steps Down Understanding The Gen Z Led Protests And Their Impact

Sep 11, 2025

Nepals Prime Minister Steps Down Understanding The Gen Z Led Protests And Their Impact

Sep 11, 2025 -

Gregg Wallace Sues Bbc Master Chef Star Takes Legal Action

Sep 11, 2025

Gregg Wallace Sues Bbc Master Chef Star Takes Legal Action

Sep 11, 2025 -

Chicago Loop Shooting Man Shot Near State And Madison Cta Blue Line Disruption

Sep 11, 2025

Chicago Loop Shooting Man Shot Near State And Madison Cta Blue Line Disruption

Sep 11, 2025 -

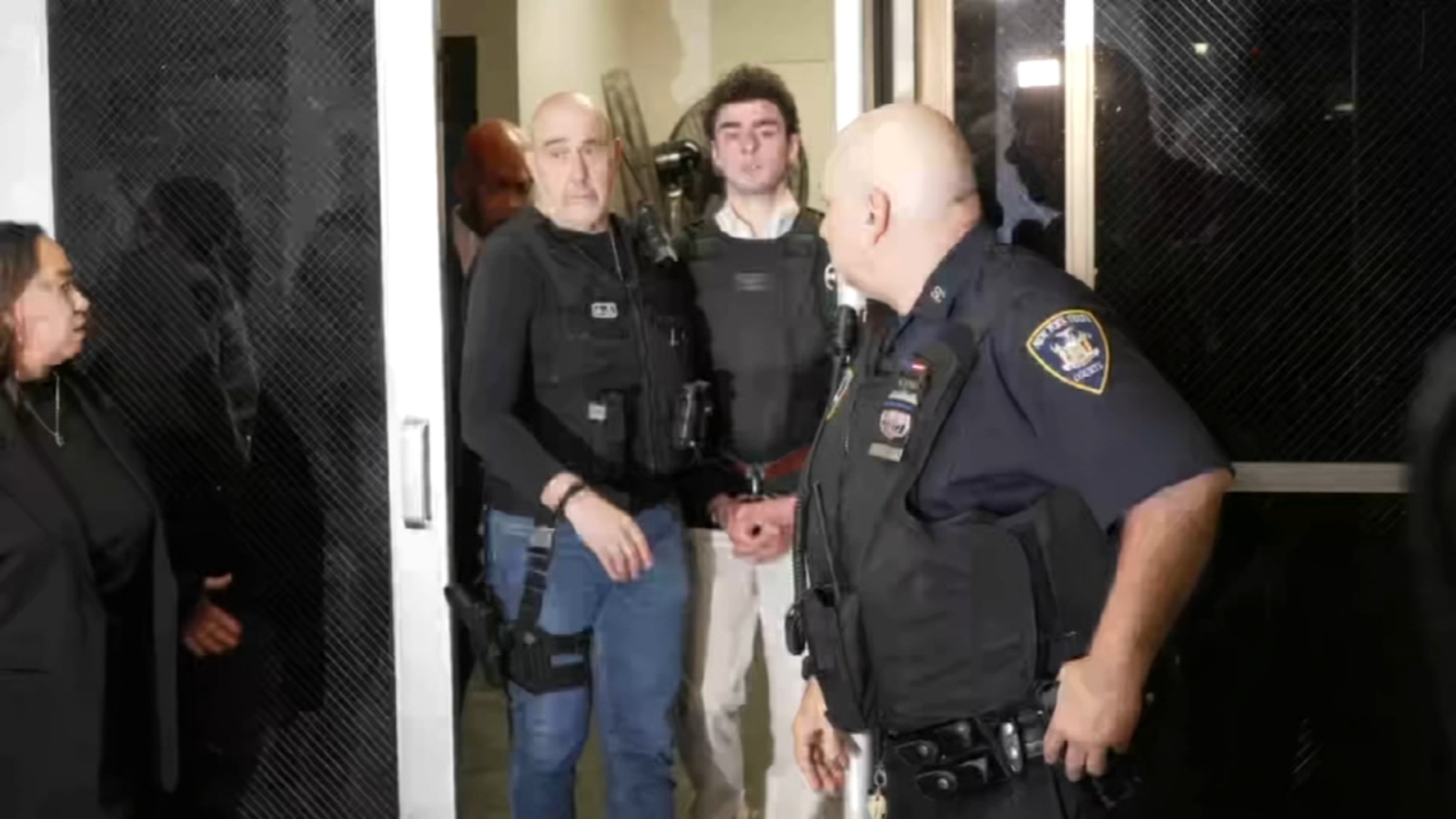

Mangiones In Person Court Appearance Required In United Healthcare Ceo Murder Case

Sep 11, 2025

Mangiones In Person Court Appearance Required In United Healthcare Ceo Murder Case

Sep 11, 2025

Latest Posts

-

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025 -

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025 -

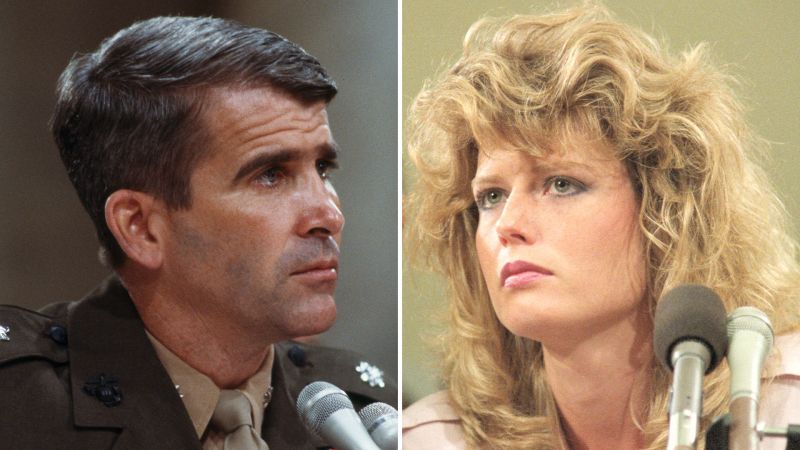

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025 -

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025 -

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025