The Robinhood Stock Outlook: Factors Driving Investor Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Robinhood Stock Outlook: Factors Driving Investor Interest

Robinhood, the commission-free trading app that exploded onto the scene, has seen its share price fluctuate wildly since its initial public offering (IPO). While initially lauded for democratizing investing, the company has faced challenges, leaving investors wondering: what's the future of Robinhood stock? This article delves into the key factors driving investor interest, both positive and negative, to paint a clearer picture of the Robinhood stock outlook.

The Allure of Robinhood: A Democratized Investing Platform

Robinhood's initial success stemmed from its user-friendly interface and commission-free trading, attracting a surge of millennial and Gen Z investors. This accessibility lowered the barrier to entry for many, contributing to a significant increase in retail trading activity. This democratization of investing, however, also presented challenges, as we'll explore later.

Factors Boosting Investor Confidence:

-

Expanding Product Offerings: Robinhood has moved beyond simple stock trading, expanding into options, cryptocurrencies, and even a cash management account. This diversification provides multiple revenue streams and caters to a broader range of investor needs. The introduction of [link to Robinhood's newest feature, if applicable] is a prime example of their strategic growth.

-

Growing User Base: Despite challenges, Robinhood continues to attract new users, demonstrating persistent demand for its platform. [Insert relevant statistic on user growth if available]. This sustained user growth indicates a potentially large and expanding customer base for future revenue generation.

-

Focus on Technological Innovation: Robinhood consistently invests in improving its technology and user experience. This commitment to innovation keeps the platform competitive and attractive to tech-savvy investors. Their ongoing development of [mention specific tech improvements, e.g., AI-powered features] shows a dedication to staying ahead of the curve.

Challenges Facing Robinhood and Their Impact on Stock Outlook:

-

Regulatory Scrutiny: The company has faced increased regulatory scrutiny regarding its trading practices and customer protection measures. These regulatory challenges can significantly impact operational costs and investor confidence.

-

Competition: The brokerage industry is highly competitive. Established players and newer fintech companies continue to vie for market share, putting pressure on Robinhood's profitability and growth.

-

Dependence on Transaction Revenue: Robinhood's revenue model heavily relies on transaction-based revenue. Market volatility and decreased trading activity can directly impact its financial performance. Diversifying revenue streams is crucial for long-term stability.

-

Meme Stock Volatility: Robinhood's association with the volatile trading of "meme stocks" has drawn both attention and criticism, highlighting the risks associated with retail investor behavior.

Analyzing the Robinhood Stock Outlook: A Balanced Perspective

The Robinhood stock outlook presents a mixed bag. While its user-friendly platform and expanding product offerings are attractive, regulatory challenges and intense competition remain significant hurdles. Investors should carefully consider these factors, alongside a thorough analysis of the company's financial statements and future growth prospects before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

What's Next for Robinhood?

The future of Robinhood will depend largely on its ability to navigate regulatory hurdles, adapt to evolving market conditions, and successfully diversify its revenue streams. Continued technological innovation and a focus on enhancing customer experience will also play critical roles. Keeping a close eye on the company's quarterly earnings reports and industry news will be crucial for understanding its ongoing trajectory.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in stocks carries inherent risks, and you could lose money. Always conduct your own thorough research or consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Robinhood Stock Outlook: Factors Driving Investor Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Movie

Jun 06, 2025

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Movie

Jun 06, 2025 -

Landmark Ruling Supreme Court Expands Access To Reverse Discrimination Claims

Jun 06, 2025

Landmark Ruling Supreme Court Expands Access To Reverse Discrimination Claims

Jun 06, 2025 -

The Unending Search Madeleine Mc Cann A Case That Haunts

Jun 06, 2025

The Unending Search Madeleine Mc Cann A Case That Haunts

Jun 06, 2025 -

Robinhood Markets Inc Hood Stock Price Increase A 6 46 Jump On June 3rd

Jun 06, 2025

Robinhood Markets Inc Hood Stock Price Increase A 6 46 Jump On June 3rd

Jun 06, 2025 -

Disqualification For Rob Cross Ex Darts Champions Tax Problems

Jun 06, 2025

Disqualification For Rob Cross Ex Darts Champions Tax Problems

Jun 06, 2025

Latest Posts

-

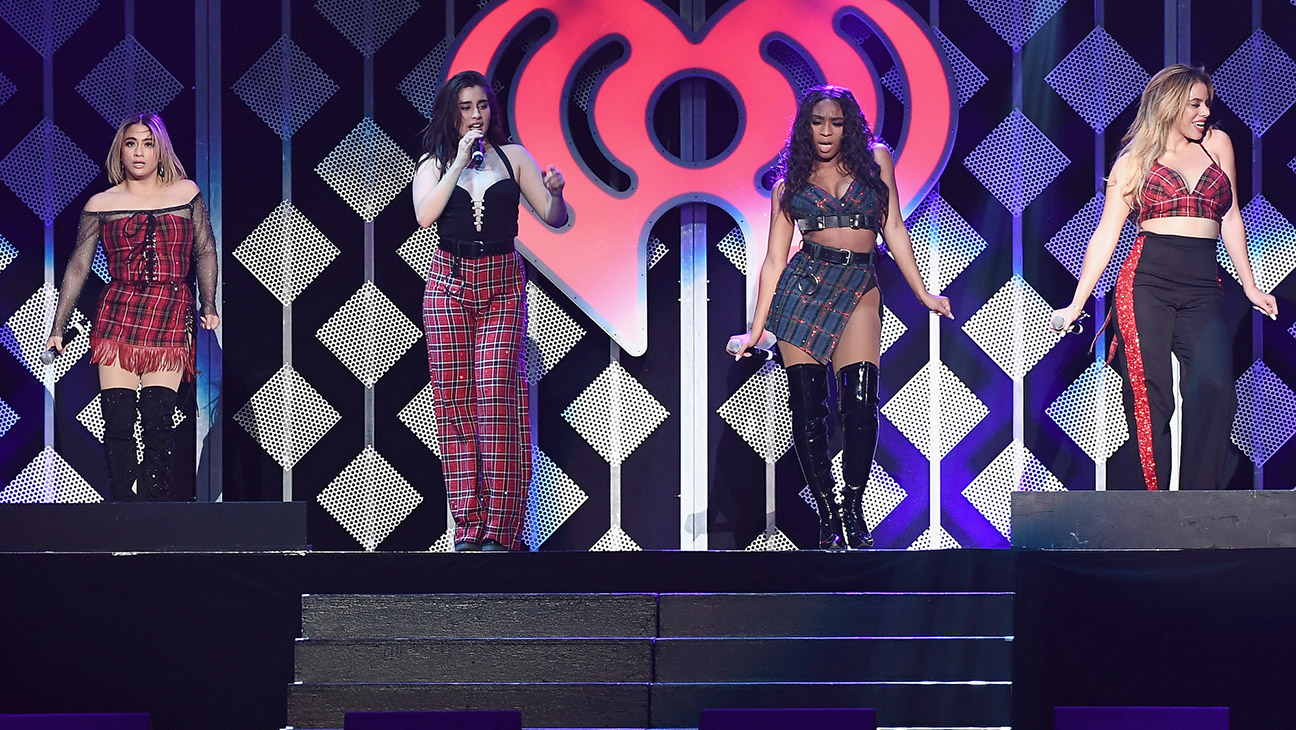

Fifth Harmonys Future Reunion Talks Without Camila Cabello

Jun 06, 2025

Fifth Harmonys Future Reunion Talks Without Camila Cabello

Jun 06, 2025 -

19 Year Olds Death Wisconsin Man Convicted Of Murder And Dismemberment Following First Date

Jun 06, 2025

19 Year Olds Death Wisconsin Man Convicted Of Murder And Dismemberment Following First Date

Jun 06, 2025 -

Applied Digitals Stock Soars 48 On Massive Core Weave Ai Deal

Jun 06, 2025

Applied Digitals Stock Soars 48 On Massive Core Weave Ai Deal

Jun 06, 2025 -

Stars De Boer Sacked Western Conference Finals Defeat Seals Coachs Fate

Jun 06, 2025

Stars De Boer Sacked Western Conference Finals Defeat Seals Coachs Fate

Jun 06, 2025 -

Ais Evolving Behavior A Ceos Perspective On Emerging Risks

Jun 06, 2025

Ais Evolving Behavior A Ceos Perspective On Emerging Risks

Jun 06, 2025