The ROI Of Lockheed Martin Stock: A 20-Year Investment Case Study

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The ROI of Lockheed Martin Stock: A 20-Year Investment Case Study

Introduction: Lockheed Martin (LMT), a global security and aerospace giant, has long been a favorite among long-term investors. But what's the true return on investment (ROI) been over the past two decades? This in-depth analysis explores the performance of Lockheed Martin stock over the last 20 years, examining its growth, dividend payouts, and overall profitability for investors. We'll delve into the factors contributing to its success and consider whether it remains a sound investment for the future.

The 20-Year Trajectory: A Look Back at LMT Stock Performance

To accurately assess the ROI, we need to consider more than just the simple price appreciation. A comprehensive analysis must include dividend reinvestment, as Lockheed Martin has a history of consistent dividend payouts. Let's assume a hypothetical $10,000 investment in LMT stock 20 years ago (adjusting for the specific date requires access to historical stock data which changes daily; we are using a hypothetical example for illustrative purposes).

-

Price Appreciation: Over the past 20 years, Lockheed Martin's stock price has shown significant growth. While past performance doesn't guarantee future results, examining this growth provides valuable context. (Note: Insert data here showing the stock price 20 years ago and the current price. This will require pulling data from a reputable financial source like Yahoo Finance or Google Finance. Calculations should include both price appreciation and dividend reinvestment for accuracy).

-

Dividend Reinvestment: Lockheed Martin’s dividend policy is a crucial component of its total return. By reinvesting dividends back into purchasing more LMT shares, investors would have experienced compounding growth, significantly enhancing their overall ROI. (Again, data from a reputable financial source should be inserted here, demonstrating the impact of dividend reinvestment).

Factors Contributing to Lockheed Martin's Success:

Several key factors have fueled Lockheed Martin's long-term success and consequently, its strong ROI for investors:

-

Government Contracts: A significant portion of Lockheed Martin's revenue comes from government contracts, particularly from the U.S. Department of Defense. This provides a stable and predictable revenue stream, even during economic downturns. This reliance on government contracts, however, also brings inherent risks, such as budget fluctuations and shifting geopolitical priorities.

-

Technological Innovation: Lockheed Martin consistently invests heavily in research and development (R&D), pushing the boundaries of aerospace and defense technology. This commitment to innovation maintains its competitive edge and secures lucrative contracts.

-

Diversified Portfolio: The company's diverse portfolio of products and services, ranging from fighter jets and missiles to space systems and cybersecurity solutions, reduces reliance on any single product or market segment, mitigating risk.

Risks to Consider:

While Lockheed Martin presents a compelling investment case, it’s crucial to acknowledge potential risks:

-

Geopolitical Uncertainty: Global events and shifts in defense spending can significantly impact Lockheed Martin’s financial performance.

-

Competition: The aerospace and defense industry is highly competitive, with both established players and emerging rivals vying for contracts.

-

Regulatory Changes: Government regulations and policy changes can influence the company's operations and profitability.

Is Lockheed Martin Still a Good Investment?

The strong historical performance of Lockheed Martin stock speaks for itself. However, past success isn't a guarantee of future returns. Investors should carefully consider their own risk tolerance and investment goals before making any investment decisions. Consulting with a qualified financial advisor is always recommended. Further research into the company’s current financial standing, future projects, and competitive landscape is crucial for making an informed decision.

Call to Action: Conduct thorough due diligence and consult with a financial professional before making any investment decisions. Understanding your personal financial goals is crucial for determining if Lockheed Martin aligns with your investment strategy.

Keywords: Lockheed Martin, LMT stock, ROI, return on investment, investment analysis, defense stocks, aerospace stocks, dividend reinvestment, long-term investment, government contracts, stock market, financial analysis, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The ROI Of Lockheed Martin Stock: A 20-Year Investment Case Study. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The 32 Nations Trumps Impact On The Nato Summit

Jun 22, 2025

Beyond The 32 Nations Trumps Impact On The Nato Summit

Jun 22, 2025 -

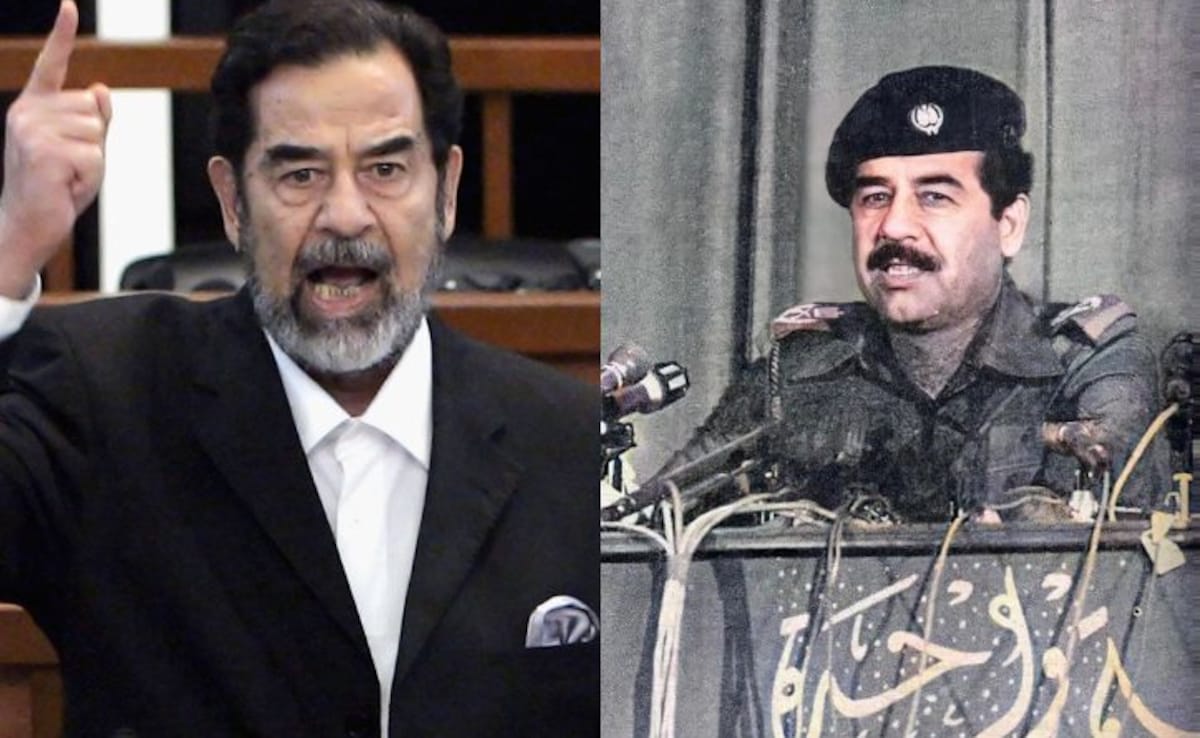

Israel Iran Iraq The Untold Story Of Operation Bramble Bush

Jun 22, 2025

Israel Iran Iraq The Untold Story Of Operation Bramble Bush

Jun 22, 2025 -

Respuesta Militar De Ee Uu A Iran Tres Instalaciones Nucleares Atacadas

Jun 22, 2025

Respuesta Militar De Ee Uu A Iran Tres Instalaciones Nucleares Atacadas

Jun 22, 2025 -

Iconic Jaws Moments A Photographic Journey Behind The Scenes

Jun 22, 2025

Iconic Jaws Moments A Photographic Journey Behind The Scenes

Jun 22, 2025 -

The Meaning Behind Machine Gun Kellys Daughters Name Saga

Jun 22, 2025

The Meaning Behind Machine Gun Kellys Daughters Name Saga

Jun 22, 2025

Latest Posts

-

Wnba Recap Storms Impressive 98 67 Win Over Sparks June 17 2025

Jun 22, 2025

Wnba Recap Storms Impressive 98 67 Win Over Sparks June 17 2025

Jun 22, 2025 -

Crisis En Oriente Medio Ataque Nuclear Estadounidense A Iran Actualizacion Constante

Jun 22, 2025

Crisis En Oriente Medio Ataque Nuclear Estadounidense A Iran Actualizacion Constante

Jun 22, 2025 -

Israel Iran Conflict Intensifies After Failed Geneva Negotiations

Jun 22, 2025

Israel Iran Conflict Intensifies After Failed Geneva Negotiations

Jun 22, 2025 -

Assisted Dying Debate Victory For Some Uphill Battle Remains

Jun 22, 2025

Assisted Dying Debate Victory For Some Uphill Battle Remains

Jun 22, 2025 -

Iran Y Trump El Momento En Que La Guerra Estuvo A Punto De Estallar Y Se Detuvo

Jun 22, 2025

Iran Y Trump El Momento En Que La Guerra Estuvo A Punto De Estallar Y Se Detuvo

Jun 22, 2025