The SiriusXM Holdings Investment Case: Risks And Rewards Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The SiriusXM Holdings Investment Case: Risks and Rewards Analyzed

SiriusXM Holdings (SIRI), a leading provider of satellite radio and streaming audio services, presents a compelling investment case, but one that requires careful consideration of both its significant potential and inherent risks. For investors seeking exposure to the evolving media landscape, SiriusXM offers a unique blend of established revenue streams and growth opportunities, but understanding the potential pitfalls is crucial before making any investment decisions.

The Allure of SiriusXM: A Strong Foundation and Growth Potential

SiriusXM's primary advantage lies in its substantial subscriber base and recurring revenue model. Its satellite radio service boasts millions of subscribers, providing a predictable and relatively stable revenue stream. This subscription model provides a degree of insulation from the volatility experienced by ad-driven media companies. Furthermore, the company's strategic expansion into streaming services, podcasts, and connected car technologies positions it for future growth in a rapidly changing media ecosystem. This diversification mitigates reliance on a single revenue source, strengthening its long-term viability.

Key Growth Drivers for SiriusXM:

- Expanding Streaming Services: SiriusXM's Pandora and Stitcher platforms are attracting a younger demographic, crucial for long-term growth. Investing in these platforms and integrating them seamlessly with the core satellite radio offering is key to their continued success.

- Connected Car Integration: The increasing prevalence of connected cars presents a significant opportunity. Factory-installed SiriusXM radios in new vehicles represent a crucial avenue for subscriber acquisition and retention.

- Podcast Expansion: The podcasting market is booming, and SiriusXM's strategic acquisitions and investments in this space are positioning them to capitalize on this trend. High-quality, exclusive podcast content is essential for attracting and retaining listeners.

- Strategic Partnerships: Collaborations with major automakers and other entertainment companies broaden reach and diversify revenue streams, contributing to the overall health of the company.

Navigating the Risks: Challenges Facing SiriusXM

Despite its strengths, SiriusXM faces several challenges that investors must consider:

- Competition: The streaming audio market is incredibly competitive, with established players like Spotify and Apple Music, as well as emerging competitors, vying for market share. SiriusXM must innovate and adapt to remain competitive.

- Churn Rate: Maintaining subscriber numbers is crucial. High churn rates can negatively impact revenue and profitability. Improving customer experience and offering compelling content are key to reducing churn.

- Economic Sensitivity: Consumer spending habits influence subscription rates. Economic downturns could lead to subscriber cancellations, impacting revenue.

- Technological Disruption: The rapid pace of technological change in the media industry necessitates continuous investment in innovation and adaptation to maintain relevance. Failure to keep up with technological advancements could render existing services obsolete.

- Regulatory Risks: Changes in regulations affecting the broadcasting or media industries could have unforeseen consequences.

Conclusion: Weighing the Risks and Rewards

The SiriusXM investment case presents a compelling mix of potential rewards and inherent risks. The company’s strong subscriber base and recurring revenue model provide a stable foundation, while its strategic investments in streaming, podcasts, and connected car technologies offer substantial growth opportunities. However, investors must carefully evaluate the competitive landscape, churn rate sensitivity, economic factors, and the ever-evolving technological landscape. Thorough due diligence is paramount before investing in SiriusXM Holdings. Conducting thorough research and consulting with a financial advisor are highly recommended before making any investment decisions. This analysis provides a framework for understanding the complexities of this investment, but it's not financial advice. Remember to always assess your individual risk tolerance and financial goals before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The SiriusXM Holdings Investment Case: Risks And Rewards Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Financial Avengers Inc Portfolio Breakdown Bank Of America Bac At Number Eight

May 27, 2025

Financial Avengers Inc Portfolio Breakdown Bank Of America Bac At Number Eight

May 27, 2025 -

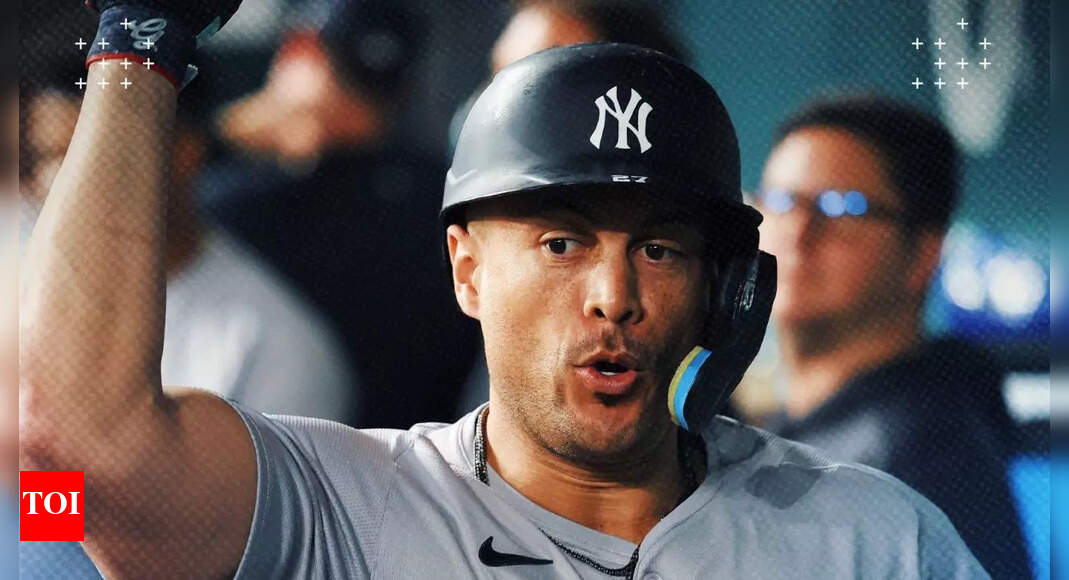

Stanton Injury A Blow To The New York Yankees Season

May 27, 2025

Stanton Injury A Blow To The New York Yankees Season

May 27, 2025 -

Stanton To Mariners Breaking Down The Latest Trade Speculation

May 27, 2025

Stanton To Mariners Breaking Down The Latest Trade Speculation

May 27, 2025 -

Nadals Tearful French Open Farewell A Champions Emotional Exit

May 27, 2025

Nadals Tearful French Open Farewell A Champions Emotional Exit

May 27, 2025 -

Anglo Saxon Burial Unearths Mysterious Vessel Contents Unveiled

May 27, 2025

Anglo Saxon Burial Unearths Mysterious Vessel Contents Unveiled

May 27, 2025

Latest Posts

-

Preserve The Causeway Visitors Urged To Refrain From Coin Insertion

May 30, 2025

Preserve The Causeway Visitors Urged To Refrain From Coin Insertion

May 30, 2025 -

High Profile Escapes Why The Us Is Captivated By Manhunts

May 30, 2025

High Profile Escapes Why The Us Is Captivated By Manhunts

May 30, 2025 -

Us Suspends Student Visa Appointments Expands Social Media Scrutiny

May 30, 2025

Us Suspends Student Visa Appointments Expands Social Media Scrutiny

May 30, 2025 -

Roland Garros Sucesso Brasileiro Com Vitoria Inesperada De Henrique Rocha

May 30, 2025

Roland Garros Sucesso Brasileiro Com Vitoria Inesperada De Henrique Rocha

May 30, 2025 -

Deadly Odisha Wedding Bomb Teacher Gets Life In Prison

May 30, 2025

Deadly Odisha Wedding Bomb Teacher Gets Life In Prison

May 30, 2025