The SiriusXM Holdings Investment Case: Risks And Rewards For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The SiriusXM Holdings Investment Case: Risks and Rewards for Investors

SiriusXM Holdings Inc. (SIRI), the leading satellite radio provider in North America, presents a compelling investment case, but one fraught with both significant potential rewards and considerable risks. For investors considering adding SIRI to their portfolio, a thorough understanding of both sides of the coin is crucial. This article delves into the key factors driving the SiriusXM narrative, outlining the potential for growth and the challenges that lie ahead.

The Allure of SiriusXM: A Deep Dive into the Potential Rewards

Several factors contribute to the optimistic outlook for SiriusXM investors:

-

Dominant Market Position: SiriusXM boasts a near-monopoly in the satellite radio market, providing a strong foundation for recurring revenue streams. This market dominance translates to significant pricing power and a high barrier to entry for competitors.

-

Subscription Model Strength: The subscription-based revenue model provides predictable cash flow, a crucial aspect for investors seeking stability. While churn rates are a factor, the company consistently demonstrates its ability to acquire and retain subscribers.

-

Expansion into Adjacent Markets: SiriusXM's strategic moves beyond satellite radio, including its foray into podcasting and connected car services, offer avenues for growth and diversification. This expansion mitigates reliance on a single revenue stream and positions the company for future success. Their investments in Pandora, for example, show a commitment to broadening their reach.

-

Cost-Cutting Measures and Operational Efficiency: SiriusXM has demonstrated a commitment to streamlining operations and improving efficiency, leading to improved margins and profitability. This focus on cost control contributes to a healthier financial outlook.

-

Potential for Increased Advertising Revenue: As SiriusXM expands its digital offerings and audience, the potential for increased advertising revenue becomes increasingly significant. This revenue stream could further bolster the company's financial performance.

Navigating the Risks: Challenges Facing SiriusXM Investors

Despite the positive aspects, several risks warrant careful consideration:

-

Competition from Streaming Services: The rise of streaming audio services like Spotify and Apple Music poses a significant competitive threat. These platforms offer a vast library of on-demand music and podcasts, appealing to a younger demographic often less inclined towards traditional satellite radio.

-

Technological Disruption: The rapid pace of technological innovation presents a constant threat. The emergence of new technologies could potentially disrupt SiriusXM's business model, rendering its satellite-based infrastructure obsolete.

-

Economic Downturn Sensitivity: As a discretionary spending item, subscriptions to SiriusXM are vulnerable during economic downturns. A recession could lead to subscriber churn and reduced revenue.

-

Dependence on Automotive Sales: A significant portion of SiriusXM's subscriber base comes from new car sales. A decline in the automotive industry could negatively impact subscriber acquisition.

-

Regulatory Changes: Changes in regulations affecting the broadcasting industry could impact SiriusXM's operations and profitability.

Conclusion: A Balanced Perspective on SiriusXM

The SiriusXM investment case presents a mixed bag. The company’s dominant market position and predictable revenue streams offer considerable upside potential. However, the increasing competition from streaming services and the inherent risks associated with technological disruption and economic downturns must be carefully weighed. Investors should conduct thorough due diligence, considering their own risk tolerance and investment horizon before making a decision. While the potential rewards are substantial, the inherent risks require a cautious and informed approach. Consult with a financial advisor before making any investment decisions.

Further Reading:

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The SiriusXM Holdings Investment Case: Risks And Rewards For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Doc Rivers The Answer Milwaukee Bucks Desperate Play To Retain Giannis

May 28, 2025

Is Doc Rivers The Answer Milwaukee Bucks Desperate Play To Retain Giannis

May 28, 2025 -

Stellantis Names Antonio Filosa Its New Ceo A New Era Begins

May 28, 2025

Stellantis Names Antonio Filosa Its New Ceo A New Era Begins

May 28, 2025 -

Liverpool Fc Celebration Full Report On The Parade Incident

May 28, 2025

Liverpool Fc Celebration Full Report On The Parade Incident

May 28, 2025 -

Brooklyn Nets Draft Strategy Climbing The 2024 Nba Draft Board

May 28, 2025

Brooklyn Nets Draft Strategy Climbing The 2024 Nba Draft Board

May 28, 2025 -

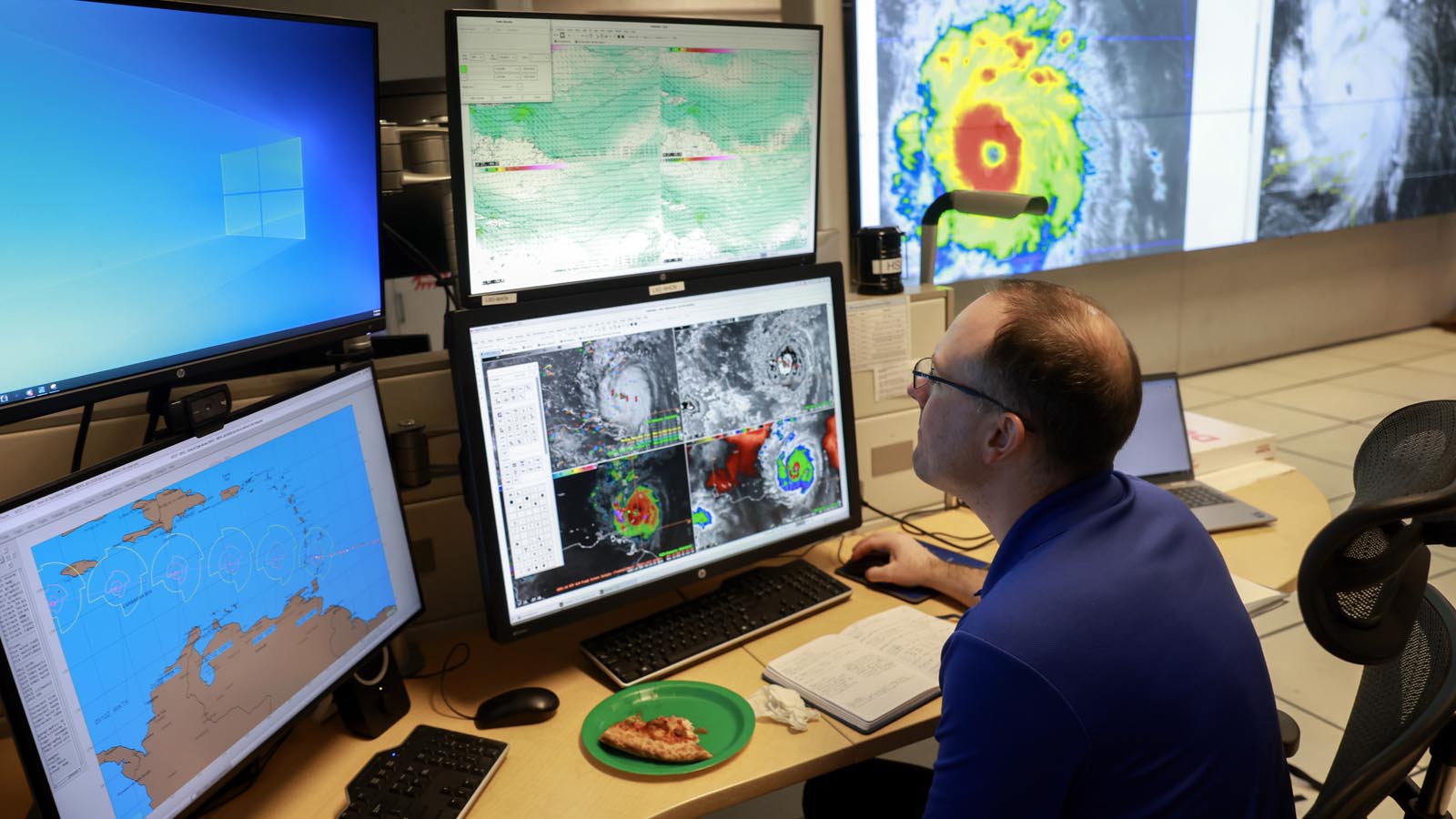

Evaluating Hurricane Prediction Models Your 2025 Guide

May 28, 2025

Evaluating Hurricane Prediction Models Your 2025 Guide

May 28, 2025

Latest Posts

-

Sheinelle Jones Today Show Colleagues Mourn At Uche Ojehs Funeral Service

Jun 01, 2025

Sheinelle Jones Today Show Colleagues Mourn At Uche Ojehs Funeral Service

Jun 01, 2025 -

Car Ramming Suspect Appears In Court Liverpool Incident Update

Jun 01, 2025

Car Ramming Suspect Appears In Court Liverpool Incident Update

Jun 01, 2025 -

Paul Doyle Charged In Connection With Liverpool Fc Victory Parade Crash

Jun 01, 2025

Paul Doyle Charged In Connection With Liverpool Fc Victory Parade Crash

Jun 01, 2025 -

From Injury To Inspiration Sloane Stephens Unwavering Strength

Jun 01, 2025

From Injury To Inspiration Sloane Stephens Unwavering Strength

Jun 01, 2025 -

Barcelona Practice Piastri Dominates Fp 3 Session

Jun 01, 2025

Barcelona Practice Piastri Dominates Fp 3 Session

Jun 01, 2025