The Unseen Dangers: Exploring The Risks Of Fed Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Unseen Dangers: Exploring the Risks of Fed Rate Cuts

The Federal Reserve's (Fed) interest rate decisions wield immense power over the U.S. economy and global markets. While rate cuts are often seen as a panacea for economic slowdowns, stimulating growth by making borrowing cheaper, a closer examination reveals a complex web of potential downsides. Understanding these unseen dangers is crucial for investors, businesses, and consumers alike. This article delves into the risks associated with Fed rate cuts, moving beyond the simplistic narrative of immediate economic stimulus.

The Allure of Lower Rates: A Double-Edged Sword

Lower interest rates are designed to incentivize borrowing and spending. Businesses can invest more readily, consumers can take out larger loans for homes and cars, and overall economic activity is theoretically boosted. This is the widely understood benefit. However, the effectiveness of rate cuts depends heavily on various factors, including the underlying cause of the economic slowdown and the prevailing market sentiment. A rate cut in the face of structural economic issues, for example, might only provide a temporary fix, masking deeper problems.

Potential Risks of Fed Rate Cuts:

-

Increased Inflation: One of the most significant risks is the resurgence of inflation. When money is readily available and borrowing is cheap, increased demand can outpace supply, pushing prices higher. This is particularly problematic if the economy is already operating near its capacity. [Link to article on inflation].

-

Asset Bubbles: Easy monetary policy can inflate asset bubbles, particularly in the real estate and stock markets. While rising asset prices initially seem positive, a subsequent burst can have devastating consequences, leading to financial instability and economic recession. [Link to article on asset bubbles].

-

Weakened Dollar: Rate cuts can weaken the U.S. dollar relative to other currencies. This can make imports more expensive and potentially fuel inflation. Furthermore, a weaker dollar can impact international trade and investment flows.

-

Increased National Debt: Lower interest rates reduce the cost of servicing the national debt in the short term. However, they can also encourage increased government borrowing, leading to a larger national debt burden in the long run. This can hinder future economic growth and create fiscal challenges.

-

Zombie Companies: Low interest rates can keep financially weak ("zombie") companies alive, artificially prolonging their existence. These companies may be inefficient and unproductive, hindering the reallocation of capital to more viable businesses.

Beyond the Headlines: A Nuanced Perspective

The impact of Fed rate cuts is far from uniform. Different sectors and demographics experience the effects differently. For example, while lower rates benefit borrowers, they can hurt savers who rely on interest income. The decision to cut rates is a delicate balancing act, requiring careful consideration of the potential risks and benefits.

The Importance of Market Analysis:

Understanding the context behind a rate cut is paramount. Investors and businesses should analyze the overall economic situation, inflation trends, and global market conditions to assess the likely impact of a rate cut. Relying solely on the headline announcement is insufficient. Consult with financial professionals to develop a strategy aligned with your risk tolerance and financial goals.

Conclusion: Navigating Uncertainty

While Fed rate cuts can provide short-term economic stimulus, it's crucial to acknowledge the potential long-term risks. Increased inflation, asset bubbles, and a weakened dollar are just some of the challenges that can arise. A thorough understanding of these risks, coupled with prudent financial planning, is essential for navigating the complexities of the current economic landscape. Staying informed about economic developments and market trends will help you make informed decisions and protect your financial well-being.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Unseen Dangers: Exploring The Risks Of Fed Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pennsylvania Court Action Luigi Mangione Summoned

Sep 11, 2025

Pennsylvania Court Action Luigi Mangione Summoned

Sep 11, 2025 -

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025 -

Ally Sebastien Lecornu Takes The Reins Frances New Pm

Sep 11, 2025

Ally Sebastien Lecornu Takes The Reins Frances New Pm

Sep 11, 2025 -

Accused Killer Luigi Mangione Must Appear In Blair County Court

Sep 11, 2025

Accused Killer Luigi Mangione Must Appear In Blair County Court

Sep 11, 2025 -

State And Madison Shooting Man Injured In Chicago Loop Cta Blue Line Delays

Sep 11, 2025

State And Madison Shooting Man Injured In Chicago Loop Cta Blue Line Delays

Sep 11, 2025

Latest Posts

-

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025 -

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025 -

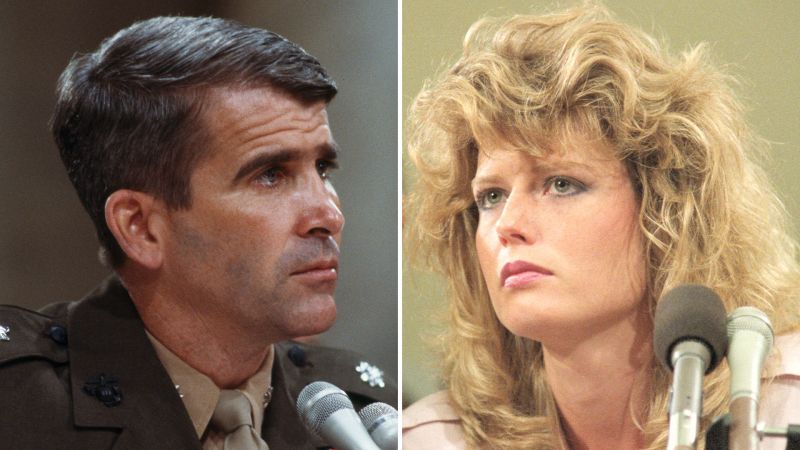

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025 -

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025 -

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025