This Week's Social Security Payments: Maximum Amounts Explained ($5,108)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

This Week's Social Security Payments: Maximum Amounts Explained ($5,108)

Record high payments are hitting accounts this week, but how much can you really expect?

Millions of Americans are receiving their Social Security payments this week, and for many, the amounts are higher than ever before. The maximum monthly benefit for those retiring at full retirement age in 2023 reached a record high of $5,108. This significant increase reflects adjustments for inflation, but understanding how these maximums are calculated and what factors influence your individual payment is crucial.

This article will break down the key factors impacting your Social Security benefits and explain what the $5,108 figure truly represents.

Understanding the Maximum Social Security Benefit

The headline-grabbing $5,108 figure represents the maximum monthly benefit for someone who retired at their full retirement age in 2023 and earned the maximum taxable earnings for their entire working life. This is a very specific scenario, and the vast majority of retirees will receive a lower amount.

Several factors significantly impact your individual benefit amount:

- Your earnings history: Your highest 35 years of earnings are used to calculate your average indexed monthly earnings (AIME). Higher earnings over a longer period will result in a higher benefit.

- Your age at retirement: Claiming Social Security before your full retirement age results in permanently reduced benefits. Delaying claiming beyond your full retirement age increases your monthly payment, maximizing at age 70. Knowing your full retirement age is key; it varies depending on your birth year. You can find your FRA using the .

- Your marital status: Spousal benefits and survivor benefits are also available, impacting the overall household income from Social Security.

Factors Affecting Your Payment Below the Maximum

Even if you earned a high income throughout your career, several factors could mean you receive less than the maximum $5,108:

- Early retirement: Retiring before your full retirement age significantly reduces your monthly benefits.

- Inconsistent high earnings: While your highest 35 years are used, gaps in high earnings or periods of lower income will reduce your AIME.

- Recent changes in earnings: Recent increases in the Social Security tax base mean that even high earners might not reach the maximum taxable earnings threshold every year.

What to Do If You Have Questions

Understanding your Social Security benefits can be complex. If you have any questions about your personal benefit amount, we strongly recommend:

- Using the SSA's online retirement estimator: This tool provides a personalized estimate based on your earnings history. You can access it through the .

- Contacting the Social Security Administration directly: Their representatives can answer your specific questions and help you understand your benefits.

Looking Ahead: Future Adjustments

The maximum benefit amount is adjusted annually to account for inflation. Expect further increases in the coming years, although the exact amount will depend on economic conditions. Staying informed about these adjustments is crucial for accurate retirement planning.

In conclusion, while the $5,108 maximum Social Security benefit is a noteworthy figure, it's vital to understand the factors affecting your individual payment. Proactive planning and understanding your personal situation are key to maximizing your Social Security retirement income. Don't hesitate to reach out to the Social Security Administration for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on This Week's Social Security Payments: Maximum Amounts Explained ($5,108). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Birmingham Capital Management Co Inc Al Adjusts Bank Of America Bac Investment

May 28, 2025

Birmingham Capital Management Co Inc Al Adjusts Bank Of America Bac Investment

May 28, 2025 -

Harvard And Trump A Controversial Clash Revealing A Maga Fundraising Scheme

May 28, 2025

Harvard And Trump A Controversial Clash Revealing A Maga Fundraising Scheme

May 28, 2025 -

Rising Beef Prices A Major Contributor To Increased Food Inflation

May 28, 2025

Rising Beef Prices A Major Contributor To Increased Food Inflation

May 28, 2025 -

Us Travelers To Canada Understanding The Recent Boycott And Its Effects

May 28, 2025

Us Travelers To Canada Understanding The Recent Boycott And Its Effects

May 28, 2025 -

Federal Crackdown On Black Lung Disease Weakened A Threat To Miners Health

May 28, 2025

Federal Crackdown On Black Lung Disease Weakened A Threat To Miners Health

May 28, 2025

Latest Posts

-

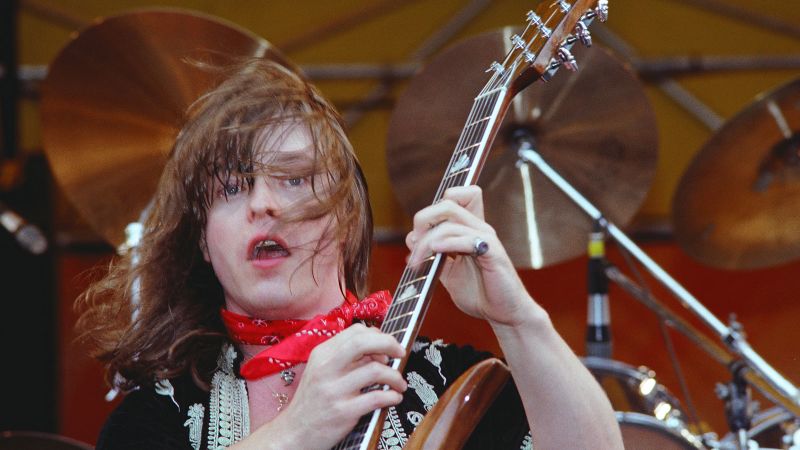

Rick Derringer Guitarist For Weird Al Yankovic Dies At 77

May 29, 2025

Rick Derringer Guitarist For Weird Al Yankovic Dies At 77

May 29, 2025 -

Met Police Faces Backlash Call Handlers Resignation Over Reinstatement Decision

May 29, 2025

Met Police Faces Backlash Call Handlers Resignation Over Reinstatement Decision

May 29, 2025 -

Significant Report On Cannabis London Mayors Call For Decriminalisation

May 29, 2025

Significant Report On Cannabis London Mayors Call For Decriminalisation

May 29, 2025 -

Explosive Testimony In Diddy Trial Ex Employee Claims Death Threat Against Kid Cudi

May 29, 2025

Explosive Testimony In Diddy Trial Ex Employee Claims Death Threat Against Kid Cudi

May 29, 2025 -

Henrique Rocha Estreia Vitoriosa Em Roland Garros

May 29, 2025

Henrique Rocha Estreia Vitoriosa Em Roland Garros

May 29, 2025