Traders Position For Potential 0.5% Fed Interest Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Traders Position for Potential 0.5% Fed Interest Rate Cut: A Market on the Brink?

The whispers are growing louder. After months of aggressive interest rate hikes, speculation is rife that the Federal Reserve (Fed) could be poised to deliver a significant interest rate cut – a hefty 0.5% reduction – at its upcoming meeting. This unprecedented move, if it happens, would send shockwaves through global markets, already grappling with high inflation and economic uncertainty. But is a 0.5% cut truly on the cards, or are traders merely betting on a market reaction?

The Case for a 0.5% Rate Cut:

Several factors fuel this dramatic prediction. The recent banking sector turmoil, highlighted by the collapse of Silicon Valley Bank and Signature Bank, has injected considerable volatility into the financial system. This instability has prompted concerns about a potential credit crunch, potentially triggering a recession. Furthermore, weakening economic data, including slowing job growth and declining consumer confidence, suggests that the Fed's aggressive tightening cycle may be having a more pronounced impact than initially anticipated. Some analysts believe a 0.5% cut is necessary to prevent a deeper economic downturn and avoid a more severe financial crisis.

Economic Indicators Pointing Towards a Rate Cut:

- Falling Inflation: While inflation remains stubbornly high, there are signs it's beginning to cool, offering the Fed some room to maneuver. [Link to relevant inflation data source, e.g., Bureau of Labor Statistics].

- Weakening Employment Data: Recent job reports show a slowdown in job creation, signaling a possible softening of the labor market. [Link to relevant employment data source, e.g., Bureau of Labor Statistics].

- Banking Sector Instability: The recent banking crisis highlights systemic vulnerabilities and the need for swift action to prevent further contagion. [Link to reputable financial news source discussing the banking crisis].

The Counterargument: A More Gradual Approach?

Not everyone is convinced a 0.5% cut is imminent. Some economists argue that such a drastic move would be premature and could fuel inflation further. They advocate for a more measured approach, perhaps a smaller 0.25% cut or even maintaining the current rate depending on upcoming economic data. The Fed's commitment to price stability remains a key factor, and a significant rate cut could be viewed as undermining that commitment. The uncertainty surrounding the true extent of the economic slowdown also contributes to this cautious outlook.

What Traders Are Doing:

Despite the uncertainty, many traders are already positioning themselves for a potential 0.5% rate cut. This involves adjusting their portfolios to anticipate the likely market reactions. For example, investments traditionally considered "safe havens," such as government bonds, might see reduced demand as investors shift towards riskier assets in anticipation of a more stimulative monetary policy. The volatility presents both significant opportunities and risks, requiring careful analysis and risk management.

Looking Ahead:

The upcoming Fed meeting is undoubtedly one of the most anticipated monetary policy decisions in recent memory. The market is holding its breath, waiting to see whether the Fed opts for a bold 0.5% rate cut, a more modest reduction, or maintains the status quo. Regardless of the Fed's decision, the impact on global markets will be significant, highlighting the interconnectedness of the global economy and the crucial role played by central bank policy.

Call to Action: Stay informed about the latest economic news and developments to make informed investment decisions. Consider consulting with a financial advisor before making any significant changes to your investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Traders Position For Potential 0.5% Fed Interest Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pennsylvania Court Case Luigi Mangione To Face Trial On Several Charges

Sep 11, 2025

Pennsylvania Court Case Luigi Mangione To Face Trial On Several Charges

Sep 11, 2025 -

Downtown Chicago Robbery Suspect Wounded By Security Guard

Sep 11, 2025

Downtown Chicago Robbery Suspect Wounded By Security Guard

Sep 11, 2025 -

Is Gavin Newsoms Anti Trump Stance Elevating His National Standing

Sep 11, 2025

Is Gavin Newsoms Anti Trump Stance Elevating His National Standing

Sep 11, 2025 -

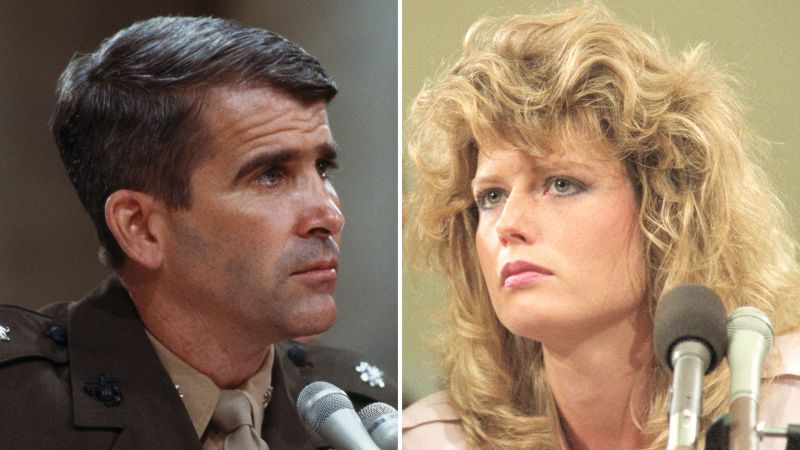

Oliver Norths Wife Fawn Hall Their Relationship Amidst Scandal

Sep 11, 2025

Oliver Norths Wife Fawn Hall Their Relationship Amidst Scandal

Sep 11, 2025 -

Key Labour Figures Vie For Deputy Leader Phillipson In The Running

Sep 11, 2025

Key Labour Figures Vie For Deputy Leader Phillipson In The Running

Sep 11, 2025

Latest Posts

-

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025 -

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025 -

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025 -

Luxury Hotel Bills Spark Debate Aocs Spending Under Fire During Sanders Partnership

Sep 11, 2025

Luxury Hotel Bills Spark Debate Aocs Spending Under Fire During Sanders Partnership

Sep 11, 2025 -

Joe Rogan Questions Khabib Nurmagomedovs Ufc Legacy An Asterisk Debate

Sep 11, 2025

Joe Rogan Questions Khabib Nurmagomedovs Ufc Legacy An Asterisk Debate

Sep 11, 2025