Trading Analysis: Identifying Key Bitcoin Liquidation Clusters Between $113k And $121k

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trading Analysis: Identifying Key Bitcoin Liquidation Clusters Between $113k and $121k

Bitcoin's price action continues to fascinate and frustrate traders alike. While the long-term bullish narrative remains strong for many, recent price volatility and significant liquidation events highlight potential resistance zones. This analysis dives deep into the key Bitcoin liquidation clusters observed between $113,000 and $121,000, offering insights for both seasoned traders and newcomers looking to understand the market dynamics.

Understanding Bitcoin Liquidations:

Before delving into specific price levels, it's crucial to understand what Bitcoin liquidations represent. A liquidation occurs when a trader's position is automatically closed by an exchange due to insufficient margin. This often happens during sharp price movements, leading to a cascade effect and further price volatility. Analyzing these liquidation clusters provides valuable information about potential support and resistance levels. You can find detailed information on specific exchanges' liquidation data through their respective APIs or publicly available dashboards, though caution should be exercised when relying solely on this data.

The $113k - $121k Resistance Zone:

Our analysis reveals several significant Bitcoin liquidation clusters concentrated between $113,000 and $121,000. These clusters represent areas where a substantial number of leveraged long positions were liquidated during previous price drops. This suggests a strong psychological barrier and potential resistance for future price increases.

-

$113,000 - $115,000: This lower range shows a notable concentration of liquidated long positions. Traders who entered positions at these levels expecting further price appreciation were forced to exit at a loss. This zone could act as significant support if the price retraces.

-

$118,000 - $121,000: This upper range displays another dense cluster of liquidations. This indicates a significant number of traders were caught out by a price reversal in this area. This zone is likely to pose a strong resistance level to any further upward momentum.

Implications for Traders:

The presence of these liquidation clusters holds significant implications for traders:

-

Resistance Levels: These clusters highlight potential resistance levels where future price increases might stall. Traders should be cautious about entering long positions in these ranges without a robust risk management strategy. Consider using stop-loss orders to protect against potential losses.

-

Support Levels: Conversely, these areas could potentially act as support levels if the price retraces. A bounce off these levels could signal a buying opportunity for more risk-tolerant traders. However, confirming support requires additional technical analysis and confirmation from other indicators.

-

Volatility: The presence of significant liquidation events indicates inherent volatility in these price ranges. Traders should expect sharp price swings and be prepared for rapid changes in market conditions.

Beyond the Numbers: Macroeconomic Factors:

While technical analysis like liquidation cluster identification is crucial, it's equally important to consider macroeconomic factors influencing Bitcoin's price. Regulatory changes, inflation rates, and overall market sentiment all play a significant role. For a comprehensive trading strategy, incorporating fundamental analysis alongside technical indicators is vital. Resources like [link to reputable financial news source] and [link to reputable crypto news source] can provide valuable macroeconomic insights.

Conclusion:

The identified Bitcoin liquidation clusters between $113,000 and $121,000 represent significant areas of potential resistance and support. Understanding these clusters and incorporating them into your trading strategy is crucial for navigating the inherent volatility of the Bitcoin market. Remember that this analysis is for informational purposes only and should not be considered financial advice. Always conduct your own thorough research and manage your risk effectively before making any trading decisions. Stay informed, stay vigilant, and happy trading!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trading Analysis: Identifying Key Bitcoin Liquidation Clusters Between $113k And $121k. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Redevelopment Of Disused Railway Land 40 000 New Homes On The Way

Aug 01, 2025

Redevelopment Of Disused Railway Land 40 000 New Homes On The Way

Aug 01, 2025 -

Promising Results Study Links Lifestyle Changes To Early Alzheimers Treatment Success

Aug 01, 2025

Promising Results Study Links Lifestyle Changes To Early Alzheimers Treatment Success

Aug 01, 2025 -

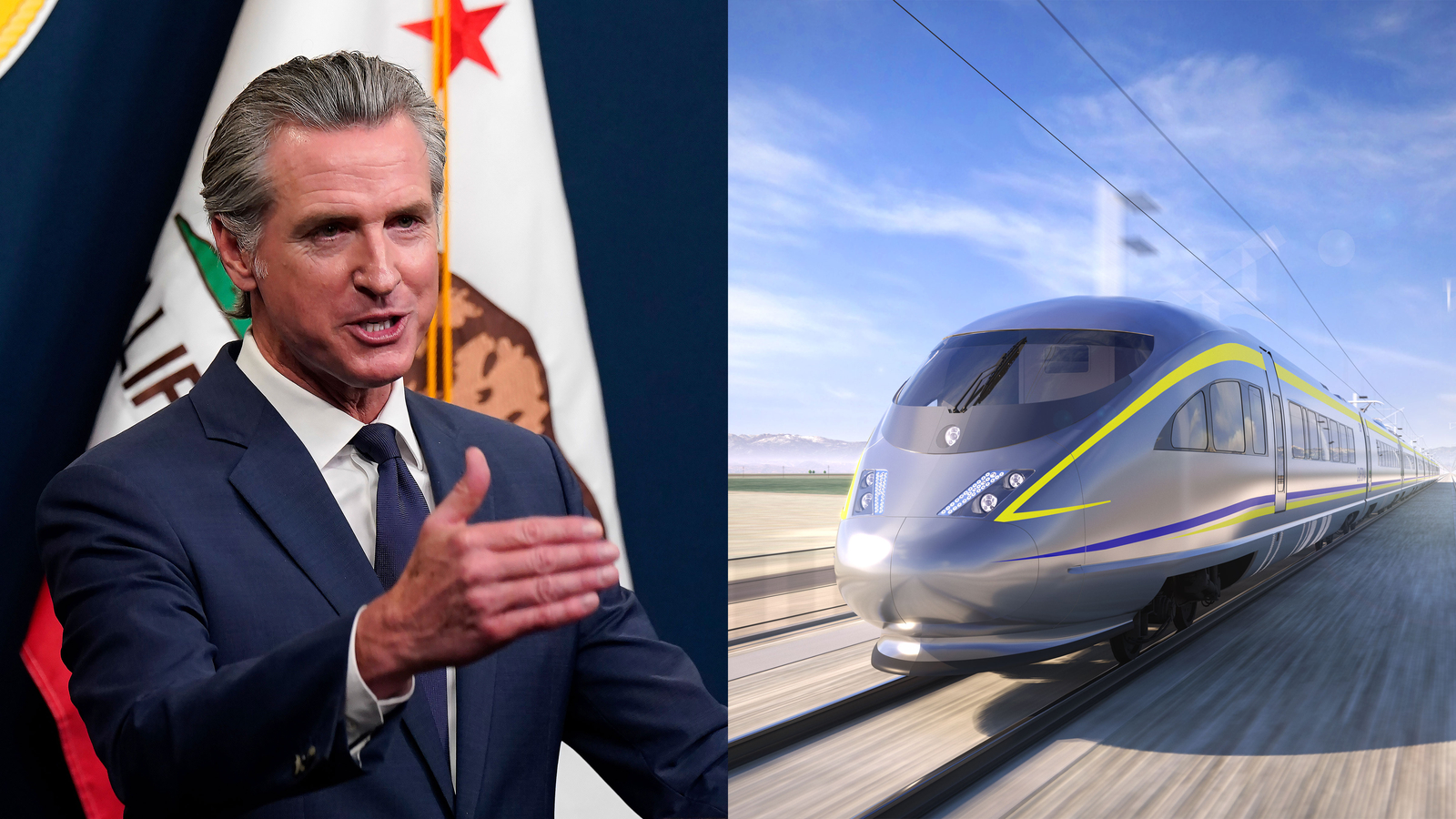

Newsom Signs Bill Securing Funding For Californias High Speed Rail

Aug 01, 2025

Newsom Signs Bill Securing Funding For Californias High Speed Rail

Aug 01, 2025 -

Canadas Palestine Move Trump Issues Trade Deal Warning

Aug 01, 2025

Canadas Palestine Move Trump Issues Trade Deal Warning

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Latest Posts

-

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025 -

Back To Basics Trump Brings Back The Presidential Fitness Test For Schools

Aug 02, 2025

Back To Basics Trump Brings Back The Presidential Fitness Test For Schools

Aug 02, 2025 -

Trumps 200 Million White House Ballroom Construction Starts September

Aug 02, 2025

Trumps 200 Million White House Ballroom Construction Starts September

Aug 02, 2025