Trump Administration Focuses On Tax Cuts To Sell Sweeping Agenda Law To Voters

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Administration Leans on Tax Cuts to Sell Sweeping Agenda to Voters

The Trump administration is heavily emphasizing the tax cuts included in its sweeping legislative agenda as a key selling point to voters ahead of the midterm elections. This strategy, however, faces significant headwinds as public opinion on the economy remains divided and concerns about the long-term effects of the tax cuts persist.

The administration is framing the tax cuts, enacted in 2017 as part of the Tax Cuts and Jobs Act (TCJA), as a crucial element of its broader economic plan. They argue the cuts stimulated economic growth, created jobs, and boosted wages – claims that are hotly debated among economists. The White House is using various channels, including social media campaigns, targeted advertising, and presidential rallies, to highlight the supposed benefits for working-class families.

H2: Dissecting the Claims: Economic Impact of the Tax Cuts

The administration points to increased business investment and a lower unemployment rate as evidence of the tax cuts' success. However, critics argue that these positive trends were already underway before the TCJA was enacted and that the benefits disproportionately favored corporations and the wealthy. Furthermore, the national debt has significantly increased since the tax cuts were implemented, raising concerns about long-term fiscal sustainability. Independent economic analyses offer mixed results, with some showing modest positive impacts and others finding little evidence of significant growth spurred by the cuts. [Link to reputable economic analysis source 1] [Link to reputable economic analysis source 2]

H2: Public Opinion and the Midterm Elections

The effectiveness of the administration's strategy remains uncertain. While some voters may appreciate the lower tax burden, others express skepticism about the overall economic picture and the fairness of the tax cuts. Recent polls show a mixed public response, with opinions often diverging along partisan lines. The administration’s focus on tax cuts might alienate voters concerned about other pressing issues, such as healthcare, infrastructure, and climate change. This strategy also risks overlooking the broader aspects of the administration’s agenda, potentially overshadowing other achievements or policy initiatives.

H3: The Challenges of Messaging

Effectively communicating the complex economic effects of the tax cuts to the average voter presents a significant challenge. The administration's messaging has been criticized for oversimplifying the issue and downplaying the potential downsides. The lack of clear and consistent messaging across different government agencies further complicates the narrative. The administration needs to overcome this communication hurdle to successfully leverage the tax cuts as a campaign asset.

H2: Looking Ahead: The Long-Term Implications

The long-term consequences of the 2017 tax cuts remain to be seen. The debate over their effectiveness will likely continue for years to come. Understanding the complexities of fiscal policy and the various perspectives surrounding the tax cuts is crucial for informed political engagement. It is important for voters to critically evaluate the claims made by the administration and consult multiple sources before forming an opinion.

Call to Action: Stay informed about the economic debate surrounding the tax cuts and engage in thoughtful discussions about their impact on your community. Understanding the different perspectives is crucial for effective civic participation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Administration Focuses On Tax Cuts To Sell Sweeping Agenda Law To Voters. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

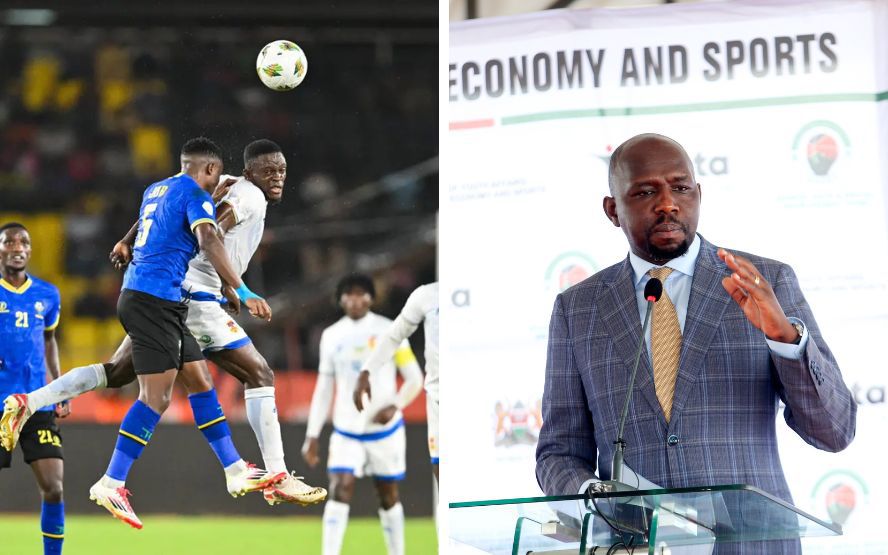

We Shall Play In English Murkomens Confident Message Before Kenya Tanzania Chan Match

Aug 23, 2025

We Shall Play In English Murkomens Confident Message Before Kenya Tanzania Chan Match

Aug 23, 2025 -

Tanzania Officials Dismiss Reports Of Kenyans Blocking Taifa Stars Fans Through Ticket Purchases

Aug 23, 2025

Tanzania Officials Dismiss Reports Of Kenyans Blocking Taifa Stars Fans Through Ticket Purchases

Aug 23, 2025 -

Gcse 9 1 Grading Boundaries Explained For 2025 Exams

Aug 23, 2025

Gcse 9 1 Grading Boundaries Explained For 2025 Exams

Aug 23, 2025 -

Labour Faces Internal Conflict Over Migrant Housing

Aug 23, 2025

Labour Faces Internal Conflict Over Migrant Housing

Aug 23, 2025 -

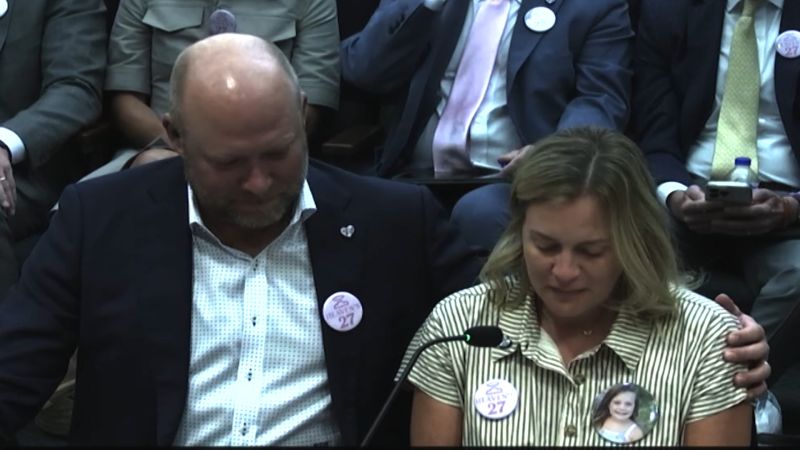

Devastating Camp Mystic Flood Parents Share Childrens Experiences

Aug 23, 2025

Devastating Camp Mystic Flood Parents Share Childrens Experiences

Aug 23, 2025

Latest Posts

-

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025 -

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025