Trump Administration's Sales Pitch: Tax Cuts Take Center Stage In Agenda Push

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Administration's Sales Pitch: Tax Cuts Take Center Stage in Agenda Push

The Trump administration is doubling down on its economic agenda, with significant tax cuts positioned as the centerpiece of its renewed push for legislative wins. This strategy, however, faces significant headwinds, navigating a complex political landscape and persistent economic uncertainty. The administration's sales pitch hinges on the belief that substantial tax reductions will stimulate economic growth, creating jobs and boosting overall prosperity. But critics argue the benefits are unevenly distributed and ultimately unsustainable.

The Core Argument: Trickle-Down Economics Revisited

The administration's core argument rests on the principles of trickle-down economics. By slashing corporate and individual income taxes, the argument goes, businesses will have more capital to invest, leading to increased hiring and higher wages. This increased economic activity, in turn, will generate more tax revenue, offsetting the initial revenue loss from the cuts. This strategy echoes similar tax cut initiatives throughout history, prompting ongoing debate about their efficacy. [Link to article discussing the history of trickle-down economics]

Key Features of the Proposed Tax Cuts:

- Corporate Tax Rate Reduction: A central plank of the proposed cuts involves significantly reducing the corporate tax rate, aiming to make the US more competitive globally.

- Individual Tax Bracket Adjustments: Changes to individual income tax brackets are also anticipated, with potential reductions for various income levels. However, the specifics and the long-term implications remain a subject of intense scrutiny and ongoing debate.

- Incentives for Investment: The administration hopes to incentivize business investment through targeted tax breaks and deductions, further boosting economic activity.

Challenges and Counterarguments:

While the administration champions the economic benefits, critics point to several significant challenges:

- Increased National Debt: The substantial revenue loss from tax cuts is expected to significantly increase the national debt, raising concerns about long-term economic stability and fiscal responsibility. [Link to article on US national debt]

- Unequal Distribution of Benefits: Critics argue that the benefits of tax cuts disproportionately favor wealthy individuals and corporations, exacerbating income inequality. This argument highlights the need for policies that promote a more equitable distribution of wealth.

- Lack of Concrete Evidence: The administration's claims of significant economic growth spurred by tax cuts lack robust empirical evidence, with studies yielding mixed results on the effectiveness of such policies. [Link to study on the effectiveness of tax cuts]

Political Landscape and Future Outlook:

The success of the administration's tax cut agenda hinges heavily on navigating the complex political landscape. Securing congressional support will require overcoming significant opposition from Democrats and even some Republicans who express concerns about the fiscal implications. The ongoing economic uncertainties, including inflation and potential recessionary pressures, further complicate the administration's efforts.

Conclusion:

The Trump administration's renewed push for significant tax cuts represents a bold economic strategy with potentially significant long-term consequences. While proponents argue that it will stimulate economic growth, critics raise concerns about the national debt, income inequality, and the lack of clear evidence supporting its efficacy. The ultimate success or failure of this agenda will depend on a complex interplay of economic factors and the political will to overcome significant opposition. The coming months will be crucial in determining the fate of this ambitious policy initiative and its lasting impact on the US economy.

Call to Action: Stay informed about the latest developments in economic policy by subscribing to our newsletter [Link to Newsletter Signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Administration's Sales Pitch: Tax Cuts Take Center Stage In Agenda Push. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rats Around Here Mike Vrabels Angry Reaction To Polk Report

Aug 23, 2025

Rats Around Here Mike Vrabels Angry Reaction To Polk Report

Aug 23, 2025 -

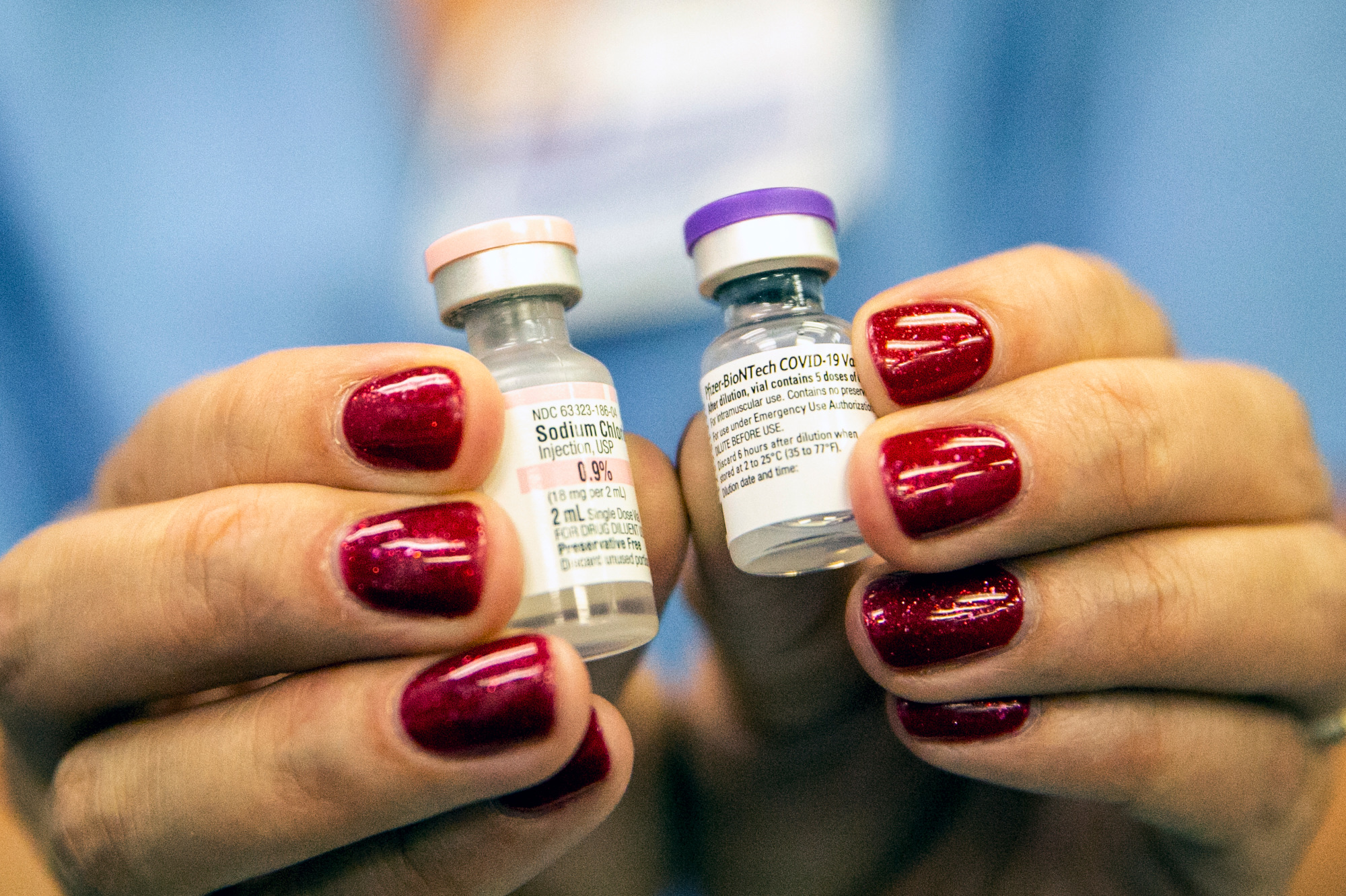

Will Your Insurance Cover The Fall Covid Booster What You Need To Know

Aug 23, 2025

Will Your Insurance Cover The Fall Covid Booster What You Need To Know

Aug 23, 2025 -

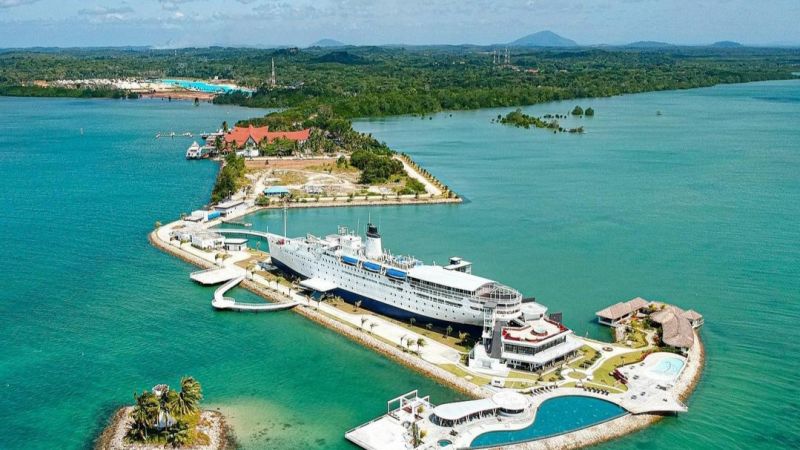

Worlds Oldest Passenger Ship Finds New Life As Luxury Hotel

Aug 23, 2025

Worlds Oldest Passenger Ship Finds New Life As Luxury Hotel

Aug 23, 2025 -

Targets Ceo Departure A Pastors Perspective On The Dei Controversy

Aug 23, 2025

Targets Ceo Departure A Pastors Perspective On The Dei Controversy

Aug 23, 2025 -

Lucy Connolly Released X Post Sparks Controversy And Jail Time

Aug 23, 2025

Lucy Connolly Released X Post Sparks Controversy And Jail Time

Aug 23, 2025

Latest Posts

-

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025 -

New Couple Alert Jennifer Aniston And Jim Curtiss Adorable Behind The Scenes Video

Aug 23, 2025

New Couple Alert Jennifer Aniston And Jim Curtiss Adorable Behind The Scenes Video

Aug 23, 2025 -

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 23, 2025

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 23, 2025 -

Which Fall Vaccines Do I Need A Colorado Doctors Guide

Aug 23, 2025

Which Fall Vaccines Do I Need A Colorado Doctors Guide

Aug 23, 2025 -

Legal Battles Brew Over Marketing Of Toddler Milk Products

Aug 23, 2025

Legal Battles Brew Over Marketing Of Toddler Milk Products

Aug 23, 2025