Trump Considers Eliminating Capital Gains Tax On Home Sales: Impact On Homeowners

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Considers Eliminating Capital Gains Tax on Home Sales: A Boon for Homeowners or a Fiscal Nightmare?

Former President Donald Trump's potential plan to eliminate capital gains taxes on home sales has ignited a firestorm of debate. The proposal, though lacking concrete details at this stage, has sent ripples through the real estate market and sparked discussions about its potential impact on homeowners and the overall economy. This article delves into the intricacies of this controversial proposal, examining its potential benefits, drawbacks, and broader implications.

Understanding Capital Gains Tax on Home Sales:

Before diving into the specifics of Trump's proposed policy, it's crucial to understand the current landscape. Currently, homeowners can exclude up to $250,000 ($500,000 for married couples filing jointly) in capital gains from the sale of their primary residence. This exclusion applies to profits earned over the course of owning the home, provided they meet certain requirements, including having lived in the home for at least two of the five years preceding the sale. Any profit exceeding this limit is subject to capital gains taxes, which can significantly reduce the proceeds from a home sale.

Trump's Proposal: A Potential Game Changer?

Eliminating the capital gains tax on home sales entirely, as suggested by Trump, would represent a dramatic shift in housing policy. Proponents argue this would:

- Boost Homeownership: By removing a significant financial barrier, more people could afford to buy homes, potentially increasing homeownership rates.

- Stimulate the Economy: Increased home sales would inject capital into the market, creating jobs in the construction and real estate industries.

- Benefit Seniors: Many seniors rely on the sale of their homes to fund their retirement. Eliminating capital gains taxes would provide them with significantly more disposable income.

However, the proposal also faces considerable criticism:

- Increased Inequality: Critics argue that eliminating the tax would disproportionately benefit wealthier homeowners, exacerbating income inequality. Those already owning multiple properties would receive the most substantial benefit.

- Fiscal Implications: The potential revenue loss to the government could be substantial, potentially leading to cuts in other essential social programs or an increase in the national debt. This is a key concern for many economists. [Link to a reputable source discussing the fiscal impact of tax cuts]

- Market Distortion: Some experts worry the policy could inflate home prices, making homeownership even less attainable for first-time buyers and low-income individuals. This could lead to a further imbalance in the housing market.

The Road Ahead: Uncertainty and Analysis

At this juncture, the details of Trump's proposal remain unclear. The feasibility of such a significant tax cut, and its ultimate impact on the housing market and the broader economy, requires thorough analysis. Experts are divided, and further research is needed to fully understand the potential long-term consequences.

What This Means for Homeowners:

While the future remains uncertain, homeowners should monitor developments closely. This proposal, if enacted, could significantly impact their financial decisions regarding home sales. Seeking advice from financial advisors and real estate professionals is crucial before making any major decisions related to homeownership.

Call to Action: Stay informed about this developing story by subscribing to our newsletter for updates on housing market trends and relevant policy changes. [Link to newsletter signup]

Keywords: Trump, capital gains tax, home sales, real estate, housing market, tax reform, economic impact, homeowners, tax policy, fiscal policy, wealth inequality, homeownership, retirement planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Considers Eliminating Capital Gains Tax On Home Sales: Impact On Homeowners. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Israel Urged To Lift Gaza Blockade Amidst Growing Fears Of Widespread Starvation

Jul 25, 2025

Israel Urged To Lift Gaza Blockade Amidst Growing Fears Of Widespread Starvation

Jul 25, 2025 -

Maguiresbridge Incident Two Dead Two Injured In Shooting

Jul 25, 2025

Maguiresbridge Incident Two Dead Two Injured In Shooting

Jul 25, 2025 -

Russo Brothers Take The Reins Matt Shakmans Departure From Doomsday Project

Jul 25, 2025

Russo Brothers Take The Reins Matt Shakmans Departure From Doomsday Project

Jul 25, 2025 -

New Leak Reveals Fantastic Four Post Credits Scenes For Mcu Film

Jul 25, 2025

New Leak Reveals Fantastic Four Post Credits Scenes For Mcu Film

Jul 25, 2025 -

Why Does Space X Prefer Vandenberg For Starlink Satellite Launches

Jul 25, 2025

Why Does Space X Prefer Vandenberg For Starlink Satellite Launches

Jul 25, 2025

Latest Posts

-

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

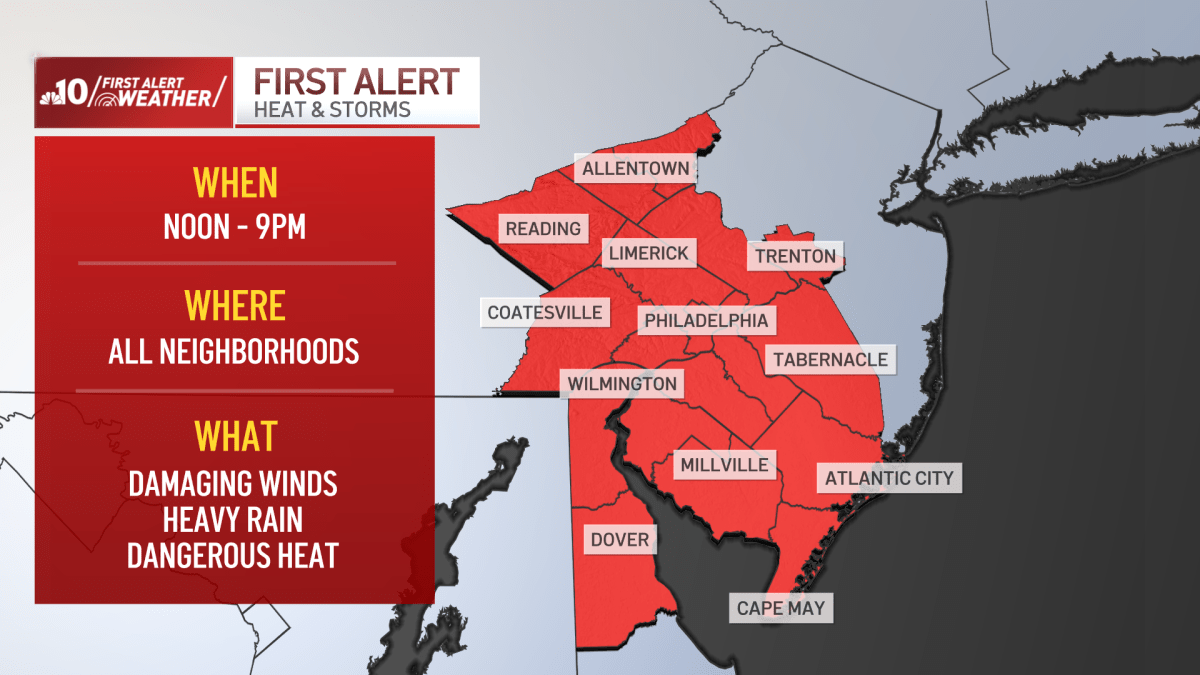

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025 -

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025 -

Latest On Mookie Betts Will He Play In The Upcoming Red Sox Series

Jul 26, 2025

Latest On Mookie Betts Will He Play In The Upcoming Red Sox Series

Jul 26, 2025