Trump's 50% Steel Tariff: Impact On US And Global Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's 50% Steel Tariff: A Deep Dive into its Impact on US and Global Markets

Donald Trump's 2018 decision to impose a 25% tariff on imported steel and a 10% tariff on imported aluminum sent shockwaves through global markets. While the stated aim was to protect American steelworkers and bolster domestic production, the actual impact was far more complex and continues to be debated today. This article will delve into the multifaceted consequences of this controversial trade policy, exploring its effects on both US and international markets.

The Rationale Behind the Tariffs:

The Trump administration argued that the tariffs were necessary to counter what it perceived as unfair trade practices by other countries, particularly China, which were allegedly flooding the US market with cheap steel, undercutting domestic producers and leading to job losses. This protectionist stance aimed to revitalize the American steel industry, safeguard jobs, and enhance national security.

Immediate Impacts on the US Market:

The immediate aftermath of the tariff announcement saw a surge in domestic steel prices. While this initially benefited some US steel producers, allowing them to increase production and potentially hire more workers, the positive effects were not uniformly distributed. Smaller companies, particularly those reliant on imported steel for their operations, faced significant price increases, impacting their profitability and competitiveness. Furthermore, the higher steel prices were passed down the supply chain, affecting various sectors like construction, automobiles, and manufacturing, contributing to increased inflation.

Global Market Reactions:

The tariffs triggered retaliatory measures from several countries, including the European Union, Canada, and Mexico, who imposed tariffs on various US goods. This sparked a trade war, disrupting global supply chains and leading to uncertainty in international markets. Countries reliant on exporting steel to the US experienced significant economic losses, impacting their industries and workers. The global steel market experienced significant price volatility as trade flows were redirected and production adjusted to the new tariff landscape.

Long-Term Consequences:

The long-term effects of the tariffs remain a subject of ongoing economic analysis. While some argue that the tariffs did stimulate domestic steel production and job creation in the short term, others contend that the overall economic benefits were marginal and outweighed by the negative consequences, such as higher consumer prices and damage to international trade relationships. Studies on the impact vary widely, highlighting the complexity of evaluating the policy's long-term success.

Alternative Perspectives and Policy Recommendations:

Economists offer differing perspectives on the effectiveness of protectionist measures like tariffs. Many argue that free trade promotes economic efficiency and growth, while others advocate for strategic protectionism in specific circumstances. Alternative policies, such as targeted subsidies or investments in domestic research and development, might have been more effective in supporting the US steel industry while minimizing negative externalities.

Conclusion:

Trump's 50% (actually 25%) steel tariff serves as a case study in the complexities of trade policy. While the intention to protect domestic industries and jobs was understandable, the actual impact was far-reaching and multifaceted, affecting both US and global markets. The experience underscores the need for careful consideration of the potential consequences of protectionist measures and the importance of finding balanced solutions that promote both domestic economic growth and international cooperation. Further research and analysis are crucial to fully understand the long-term implications of such policies.

Keywords: Trump tariffs, steel tariffs, aluminum tariffs, trade war, US economy, global economy, protectionism, free trade, international trade, economic impact, steel industry, manufacturing, inflation, supply chain, retaliatory tariffs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's 50% Steel Tariff: Impact On US And Global Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Match Day 7 Relaxing With Popcorn And The Replay

Jun 01, 2025

Post Match Day 7 Relaxing With Popcorn And The Replay

Jun 01, 2025 -

Fatal North Sea Ship Crash Captain Enters Not Guilty Plea

Jun 01, 2025

Fatal North Sea Ship Crash Captain Enters Not Guilty Plea

Jun 01, 2025 -

Spanish Gp Qualifying 2025 Watch Live Get Results And Listen To Radio

Jun 01, 2025

Spanish Gp Qualifying 2025 Watch Live Get Results And Listen To Radio

Jun 01, 2025 -

Man Arrested Following Leicester Incident Involving Car And Pedestrians

Jun 01, 2025

Man Arrested Following Leicester Incident Involving Car And Pedestrians

Jun 01, 2025 -

Urgent Mass Shooting Near Hickory Leaves 12 Shot Police Investigating

Jun 01, 2025

Urgent Mass Shooting Near Hickory Leaves 12 Shot Police Investigating

Jun 01, 2025

Latest Posts

-

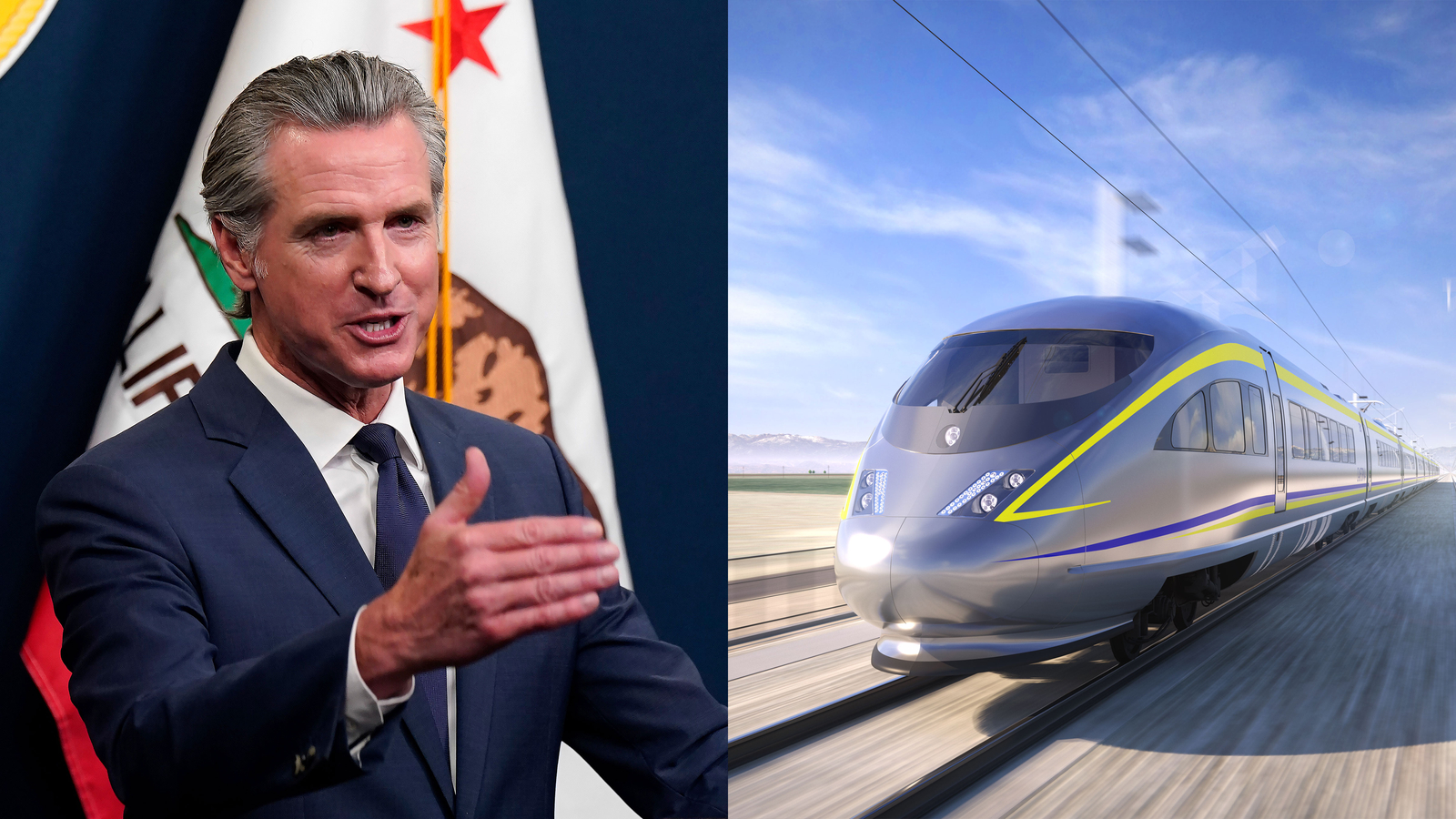

Newsom Signs Bill Mandating Funding Plan For California High Speed Rail

Jul 31, 2025

Newsom Signs Bill Mandating Funding Plan For California High Speed Rail

Jul 31, 2025 -

The Search For Bradys Missing Memoir Hope For Finding A Victims Remains

Jul 31, 2025

The Search For Bradys Missing Memoir Hope For Finding A Victims Remains

Jul 31, 2025 -

Small Business Administration Seeks Input From East Tennessee Owners

Jul 31, 2025

Small Business Administration Seeks Input From East Tennessee Owners

Jul 31, 2025 -

Us Market Attracts Canadian Investment New Bridge A Key Catalyst

Jul 31, 2025

Us Market Attracts Canadian Investment New Bridge A Key Catalyst

Jul 31, 2025 -

More Frequent And Intense Turbulence Whats Causing The Increase

Jul 31, 2025

More Frequent And Intense Turbulence Whats Causing The Increase

Jul 31, 2025