Trump's Capital Gains Tax Plan: What It Means For Home Sales And Homeowners

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Capital Gains Tax Plan: What it Means for Home Sales and Homeowners

Donald Trump's proposed changes to capital gains taxes have sent ripples through the real estate market, leaving many homeowners wondering: what does this mean for me? Understanding the potential impact on home sales and individual finances is crucial, especially for those considering selling their property or making significant investments in real estate. This article will break down the complexities of Trump's proposed plan and its potential consequences for homeowners.

Understanding Capital Gains Tax

Before diving into the specifics of Trump's plan, let's clarify what capital gains tax is. Capital gains tax is levied on the profit you make when you sell an asset for more than you paid for it. For homeowners, this typically applies to the sale of a primary residence. The amount of tax you owe depends on your tax bracket and how long you owned the property. The current law allows for significant exclusions for long-term capital gains on the sale of a primary residence (generally, up to $250,000 for single filers and $500,000 for married couples filing jointly).

Trump's Proposed Changes: A Look Back

While Trump's specific proposals evolved throughout his presidency, the core principle often involved altering capital gains tax rates. Some proposals suggested lowering capital gains taxes across the board, potentially benefiting high-income taxpayers selling properties for substantial profits. Other proposals focused on targeted tax cuts or deductions that could indirectly impact home sales. It's crucial to remember that these proposals were subject to change and faced significant political hurdles.

Potential Impacts on Home Sales

Lower capital gains taxes could potentially stimulate the housing market in several ways:

- Increased Seller Incentive: Lower taxes on profits could encourage more homeowners to sell their properties, increasing the inventory of homes available for purchase.

- Higher Asking Prices: With lower tax burdens, sellers might be willing to list their homes at higher prices, potentially affecting affordability.

- Increased Investment: Lower capital gains taxes might encourage investors to purchase more properties, driving up demand and potentially prices.

Impact on Homeowners: The Complexities

The impact on individual homeowners is multifaceted and depends heavily on several factors:

- Your Tax Bracket: Higher-income homeowners would likely see a more significant benefit from lower capital gains taxes than those in lower tax brackets.

- Length of Ownership: The length of time you owned the property significantly influences the tax implications. Long-term capital gains are typically taxed at a lower rate than short-term gains.

- Profit Margin: The larger your profit from the sale, the greater the impact of any tax changes.

Navigating the Uncertainty: Advice for Homeowners

Given the ever-changing landscape of tax policy, homeowners should:

- Consult a Tax Professional: Seek professional advice from a qualified tax advisor to understand how current and potential future tax laws might impact your specific financial situation.

- Plan Ahead: Develop a long-term financial plan that considers various tax scenarios.

- Stay Informed: Keep abreast of any changes in tax legislation and their potential implications for your financial planning.

Conclusion:

Trump's proposed capital gains tax changes had the potential to significantly influence the housing market and individual homeowners. While the specifics of these proposals are no longer directly applicable given the current administration, understanding the general principles of capital gains tax and its impact on real estate remains vital. Prospective home sellers and buyers should always consult with financial professionals to navigate this complex area of financial planning. Staying informed about relevant tax laws and regulations is crucial for making sound financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Capital Gains Tax Plan: What It Means For Home Sales And Homeowners. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Washington 2025 Tennis Key Matches And Highlights Wu Norrie Shelton

Jul 25, 2025

Washington 2025 Tennis Key Matches And Highlights Wu Norrie Shelton

Jul 25, 2025 -

From America To Normandy A Dream Achieved

Jul 25, 2025

From America To Normandy A Dream Achieved

Jul 25, 2025 -

Post Wimbledon Ben Shelton Impresses At The Dc Open

Jul 25, 2025

Post Wimbledon Ben Shelton Impresses At The Dc Open

Jul 25, 2025 -

From Shakman To The Russos The Changing Hands Of The Doomsday Film

Jul 25, 2025

From Shakman To The Russos The Changing Hands Of The Doomsday Film

Jul 25, 2025 -

Challenges And Delays Plague Chinas Massive Satellite Launch Plan

Jul 25, 2025

Challenges And Delays Plague Chinas Massive Satellite Launch Plan

Jul 25, 2025

Latest Posts

-

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025 -

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

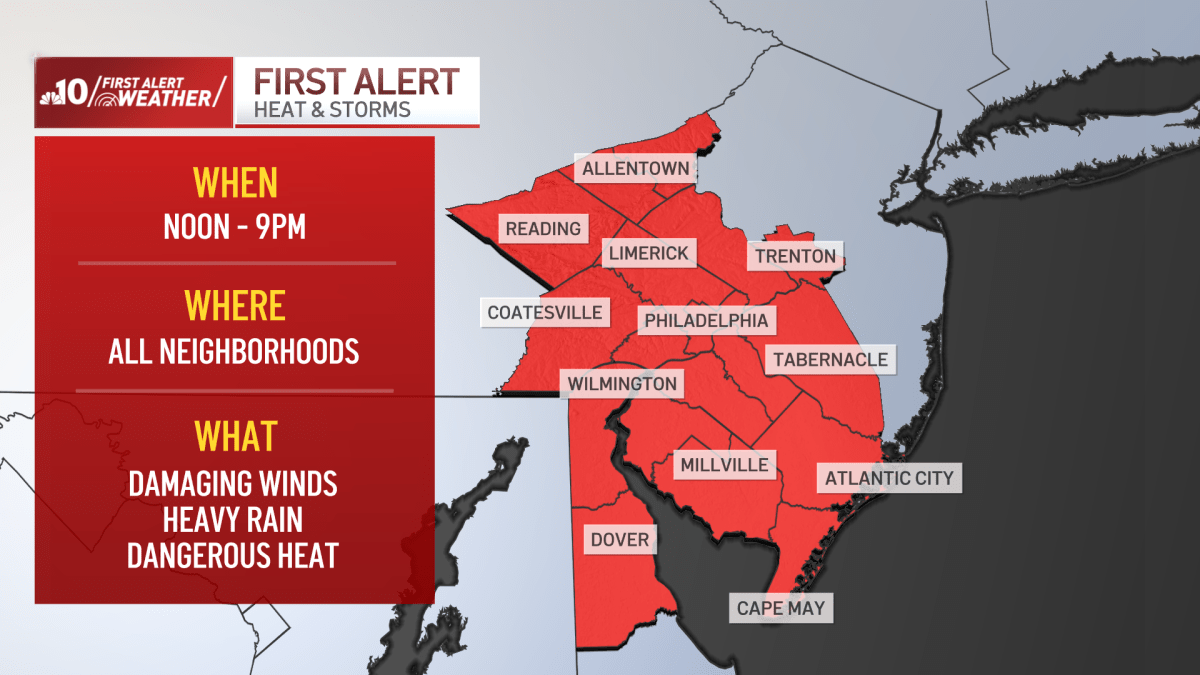

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025