Trump's Capital Gains Tax Plan: What It Means For Home Sellers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Capital Gains Tax Plan: What it Means for Home Sellers

Former President Trump's proposed tax plans, while not currently in effect, continue to spark debate and raise crucial questions for homeowners. Understanding the potential implications of his proposed capital gains tax changes is vital for anyone considering selling their home. This article will delve into the specifics, exploring how his plans could have impacted – and might yet impact – your bottom line.

Understanding Capital Gains Tax on Home Sales:

Before diving into Trump's proposed changes, let's clarify the basics. Capital gains tax applies to the profit you make when you sell an asset, including your primary residence, for more than you paid for it. However, the US offers significant tax advantages for homeowners. The Internal Revenue Service (IRS) allows taxpayers to exclude up to $250,000 in capital gains from the sale of their primary residence ($500,000 for married couples filing jointly). This exclusion applies if you've owned and lived in the home for at least two of the five years preceding the sale. This is crucial to know because any changes to the capital gains tax rate directly affect the amount you ultimately pay after this exclusion.

Trump's Proposed Capital Gains Tax Changes:

During his presidency and in subsequent proposals, Trump advocated for significant reductions in capital gains taxes. While the specifics varied, the general aim was to lower the rates for high-income earners. This had the potential to drastically alter the tax landscape for homeowners selling high-value properties. Instead of the current progressive system, where higher earners pay higher rates, Trump's plan aimed for a more simplified, potentially lower, flat rate.

How This Could Have Affected Home Sellers:

- Higher-Value Homes: Homeowners selling properties significantly exceeding the $250,000/$500,000 exclusion would have been most affected. A lower capital gains tax rate, even under a potentially simplified structure, could have resulted in substantial savings.

- Timing of the Sale: The timing of a home sale in relation to any potential changes in capital gains tax rates would have been paramount. Selling before any rate reductions could have meant missing out on potential savings.

- Investment Properties: The impact wouldn't have been limited to primary residences. Investors selling properties would also have seen a change in their tax liability.

The Current Situation and Future Uncertainties:

It's crucial to remember that Trump's proposed tax plans are not currently law. The current capital gains tax rates remain in place. However, the ongoing political discourse and future potential policy shifts mean that staying informed about tax laws remains critical.

What Home Sellers Should Do:

- Consult a Tax Professional: Given the complexity of tax laws and the potential for future changes, seeking personalized advice from a qualified tax advisor or financial planner is paramount. They can help you navigate the current landscape and prepare for any potential future shifts.

- Stay Informed: Keep abreast of any changes to tax legislation through reliable sources like the IRS website and reputable financial news outlets.

- Plan Ahead: Carefully consider your financial situation and consult with a professional before making major financial decisions like selling your home.

Disclaimer: This article provides general information and should not be considered professional tax advice. Consult with a qualified tax professional for personalized guidance. The information provided is based on publicly available information and interpretations of past proposals. Future tax legislation may differ significantly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Capital Gains Tax Plan: What It Means For Home Sellers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025 -

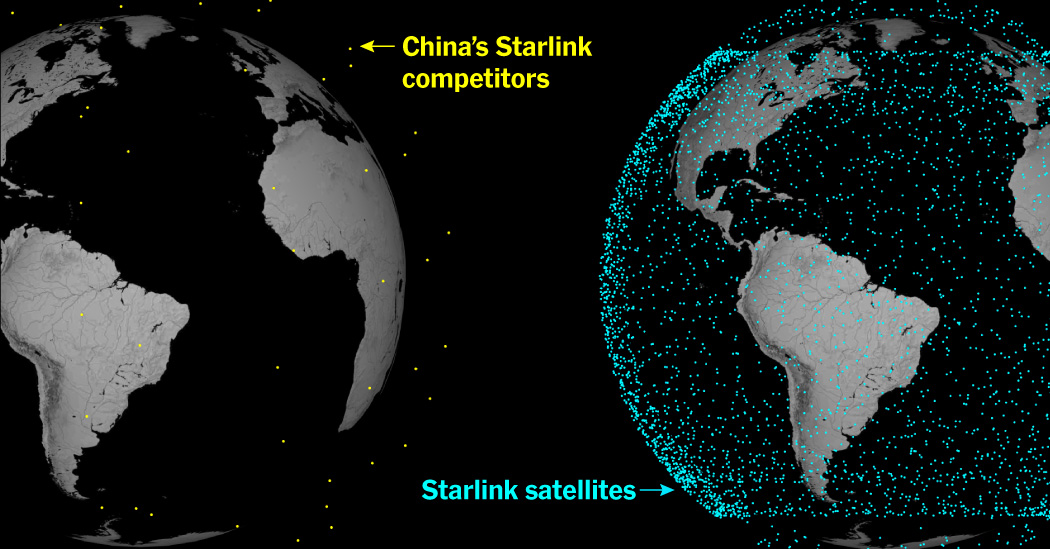

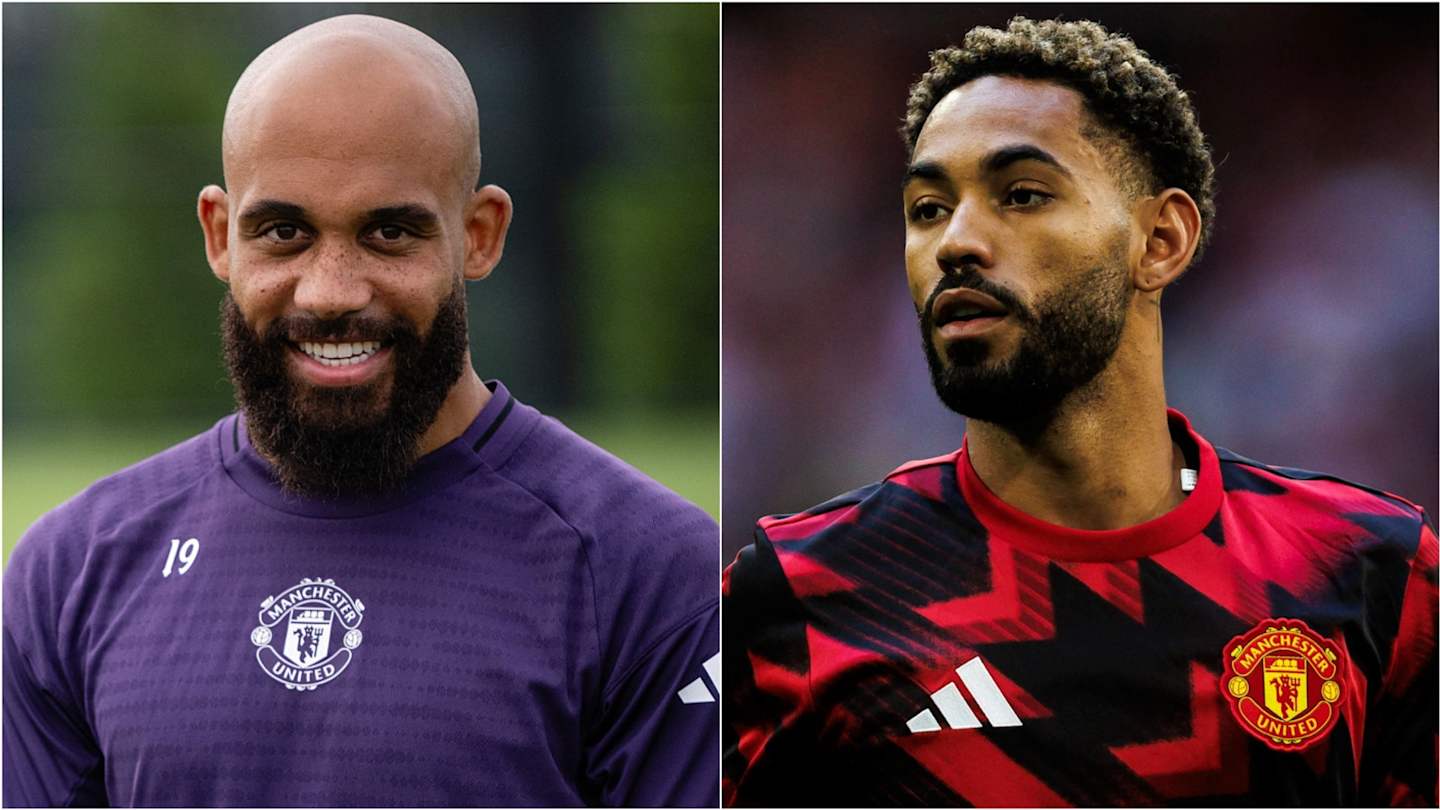

Starlinks Growing Competition Analysis Of Chinas New Drone Technology

Jul 25, 2025

Starlinks Growing Competition Analysis Of Chinas New Drone Technology

Jul 25, 2025 -

Starlink Vs China Analyzing The Satellite Internet Gap

Jul 25, 2025

Starlink Vs China Analyzing The Satellite Internet Gap

Jul 25, 2025 -

Maguiresbridge Tragedy Double Fatal Shooting Two Injured

Jul 25, 2025

Maguiresbridge Tragedy Double Fatal Shooting Two Injured

Jul 25, 2025 -

Chinas Satellite Internet Development A Comparative Analysis With Starlink

Jul 25, 2025

Chinas Satellite Internet Development A Comparative Analysis With Starlink

Jul 25, 2025

Latest Posts

-

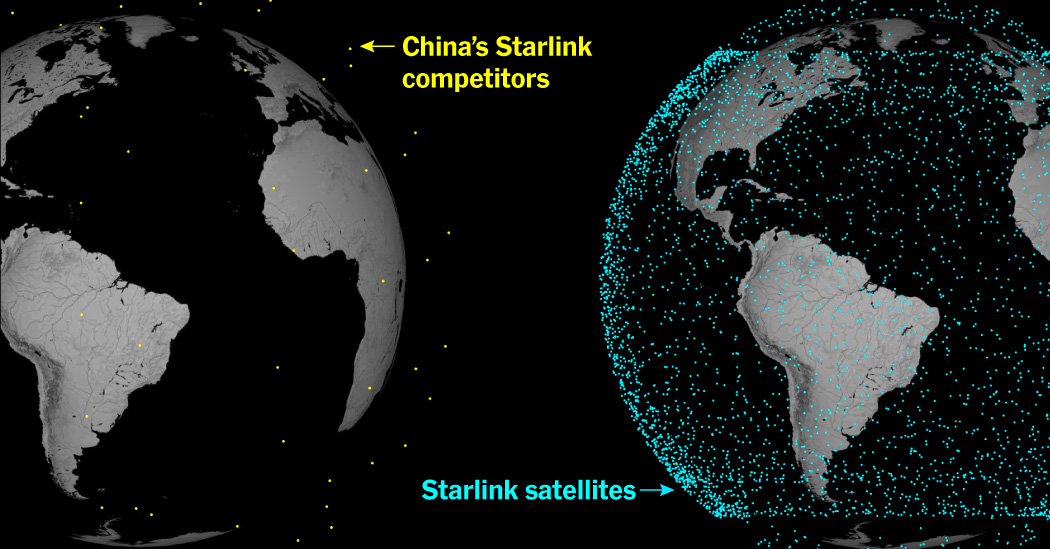

Manchester Uniteds Starting Lineup Vs West Ham Mbeumo And Cunha Combine

Jul 27, 2025

Manchester Uniteds Starting Lineup Vs West Ham Mbeumo And Cunha Combine

Jul 27, 2025 -

South Park Creators Respond To Backlash Over Trump Focused Episode

Jul 27, 2025

South Park Creators Respond To Backlash Over Trump Focused Episode

Jul 27, 2025 -

Arizona Murders Lori Vallow Daybell Receives Life Imprisonment

Jul 27, 2025

Arizona Murders Lori Vallow Daybell Receives Life Imprisonment

Jul 27, 2025 -

Asylum Seekers Face Homelessness After Refusal To Leave Hotels

Jul 27, 2025

Asylum Seekers Face Homelessness After Refusal To Leave Hotels

Jul 27, 2025 -

Mick Jaggers 82nd Birthday A Family Celebration With Melanie Hamrick And Their Son

Jul 27, 2025

Mick Jaggers 82nd Birthday A Family Celebration With Melanie Hamrick And Their Son

Jul 27, 2025