Trump's Executive Order Targets "Debanking": What It Means For Banks And Businesses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Executive Order Targets "Debanking": What It Means for Banks and Businesses

Former President Trump's executive order targeting "debanking," the practice of banks severing ties with certain businesses or individuals, has sparked significant debate and uncertainty. This controversial move raises crucial questions about financial inclusion, regulatory oversight, and the potential impact on various industries. Understanding the implications of this executive order is vital for banks, businesses, and consumers alike.

The executive order, while not directly enforced after Trump left office, continues to be a focal point in discussions surrounding financial regulation and political influence on the banking sector. Its core argument centers around the claim that certain banks are unfairly targeting politically disfavored individuals and businesses, leading to a form of "economic warfare." This accusation has fueled ongoing discussions about the balance between responsible banking practices and potential overreach.

What is "Debanking"?

"Debanking," also referred to as "deplatforming" in the financial context, involves a bank terminating its relationship with a client – be it an individual or a business. This can include closing accounts, refusing services, or refusing to process transactions. While banks have always had the right to choose their clients, the accusations surrounding "debanking" often involve claims of political motivation rather than legitimate financial risk assessment.

Key Concerns Raised by the Executive Order:

- Disproportionate Impact on Specific Groups: Critics argue that "debanking" disproportionately affects minority-owned businesses, politically conservative organizations, and individuals holding controversial views, potentially stifling dissent and limiting economic opportunity.

- Lack of Transparency and Due Process: Concerns exist regarding the lack of transparency in the decision-making process behind debanking. Businesses and individuals often lack clear explanations for the termination of their banking relationships, making it challenging to address underlying issues or appeal the decision.

- Potential for Abuse: The executive order highlighted the potential for banks to abuse their power by selectively targeting clients based on political affiliations or ideologies, raising concerns about fairness and equitable access to financial services.

Impact on Banks and Businesses:

The implications of the executive order, regardless of its current legal standing, remain relevant. Banks now face increased scrutiny regarding their client selection processes. They must demonstrate clear, non-discriminatory criteria for terminating relationships to avoid accusations of political bias.

Businesses, particularly those deemed controversial or politically aligned, face increased uncertainty regarding their access to banking services. This uncertainty can hinder operations, limit growth opportunities, and affect their overall financial stability. The lack of access to banking services can create significant challenges for businesses seeking loans, managing payroll, or processing payments.

Looking Ahead:

The debate surrounding "debanking" and the influence of political considerations on banking practices continues. Future regulatory changes and court decisions will likely shape the landscape, determining the balance between a bank's right to choose its clients and the need to ensure fair and equitable access to financial services for all. While the Trump-era executive order is no longer in effect, the issues it raised remain critically important in shaping the future of banking and business in the US.

Further Research: For more in-depth analysis, you can explore resources from the American Bankers Association and the relevant regulatory bodies, such as the Office of the Comptroller of the Currency (OCC). This article provides an overview; however, consulting legal and financial professionals is advisable for specific situations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Executive Order Targets "Debanking": What It Means For Banks And Businesses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chat Gpt Revolutionizes The Ai Landscape A New Era Dawns

Aug 09, 2025

Chat Gpt Revolutionizes The Ai Landscape A New Era Dawns

Aug 09, 2025 -

Detroit Lions Mailbag Post Rakestraw Injury Who Steps Up In The Secondary

Aug 09, 2025

Detroit Lions Mailbag Post Rakestraw Injury Who Steps Up In The Secondary

Aug 09, 2025 -

Son Sampiyon Trendyol Sueper Lig De Yeni Sezonu Aciyor

Aug 09, 2025

Son Sampiyon Trendyol Sueper Lig De Yeni Sezonu Aciyor

Aug 09, 2025 -

Rival Gangs Clash In Ecuador Cnn Gains Unprecedented Access To A Top Commander

Aug 09, 2025

Rival Gangs Clash In Ecuador Cnn Gains Unprecedented Access To A Top Commander

Aug 09, 2025 -

Maintaining Peak Performance Nick Balls Cross Fit Approach To World Championship Success

Aug 09, 2025

Maintaining Peak Performance Nick Balls Cross Fit Approach To World Championship Success

Aug 09, 2025

Latest Posts

-

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025 -

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025 -

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

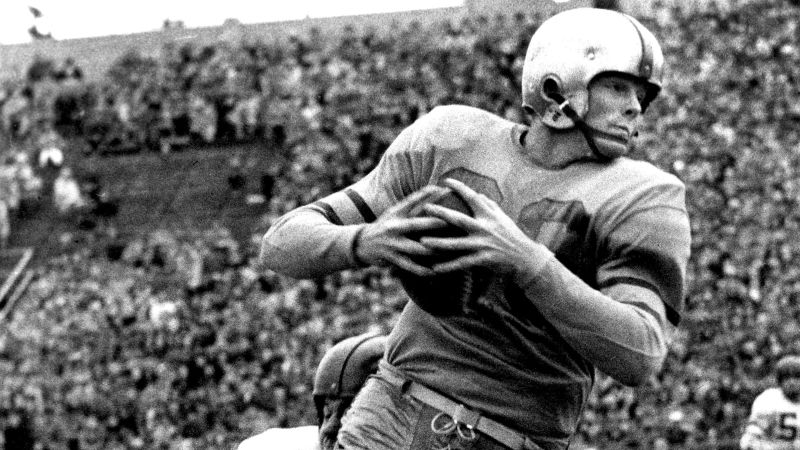

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025