Trump's "No Tax On Tips" Policy: Clarity Needed For US Workers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's "No Tax on Tips" Policy: Clarity Needed for US Workers

The lingering question of tip taxation under a potential Trump presidency is causing confusion and anxiety among millions of US workers. Donald Trump's past pronouncements on eliminating taxes on tips have left many in the service industry wondering what the future holds. While the idea of tax-free tips sounds appealing, the reality is far more complex and requires significant clarification. This article delves into the complexities of the issue, examining the potential impact on workers, businesses, and the overall economy.

Understanding the Current System:

Currently, tips received by US workers are considered taxable income by the Internal Revenue Service (IRS). This means that employees are responsible for reporting their tip income, along with their regular wages, when filing their taxes. While some employers may include reported tips in employee paychecks, the ultimate responsibility for accurate reporting rests with the individual. Failure to accurately report tip income can lead to significant penalties and tax liabilities. This existing system, while imperfect, provides a framework for tax collection and ensures a degree of fairness in the tax system.

Trump's Proposed Change: A Vague Promise?

During his previous presidential campaigns, Trump suggested eliminating taxes on tips, a policy that resonated with many service industry workers struggling with fluctuating incomes and unpredictable tax burdens. However, the specifics of such a policy have remained largely undefined. The implications of eliminating tip taxation are far-reaching and require careful consideration of several factors:

- Lost Revenue for the Government: Eliminating tip taxes would undoubtedly result in a significant reduction in government revenue. This could lead to cuts in essential public services or increased reliance on other forms of taxation.

- Impact on Employers: The current system often relies on employers to track and report tip income. A complete elimination of tip taxation could shift this responsibility entirely to the individual worker, potentially increasing the administrative burden on both employees and the IRS.

- Fairness and Equity Concerns: The current system, despite its flaws, attempts to ensure a degree of fairness across different income levels. Eliminating taxes on tips could disproportionately benefit higher-earning workers in the service industry, exacerbating existing income inequality.

The Need for Transparency and Detailed Policy Proposals:

The lack of clarity surrounding Trump's proposed policy on tip taxation is a major concern. For millions of US workers, understanding how their income will be taxed is crucial for financial planning and budgeting. A comprehensive policy proposal should address the following:

- Specific Mechanisms for Implementation: How would the IRS track and verify tip income if it's no longer subject to taxation?

- Alternative Revenue Streams: If tip taxation is eliminated, how will the government compensate for the loss of revenue?

- Impact on Low-Wage Workers: Will there be safeguards to ensure that low-wage workers are not disproportionately affected by this policy change?

Conclusion: More Than Just a Slogan

Trump's "no tax on tips" pledge, while appealing on the surface, requires careful scrutiny and detailed policy proposals. The lack of clarity surrounding this issue raises significant concerns about its feasibility and potential consequences. For the millions of Americans who rely on tips for their livelihood, clear and transparent information is crucial to understanding the potential impact on their financial well-being. Without substantial clarification, the promise remains a vague slogan rather than a concrete policy solution. We urge for a robust public debate on this issue, ensuring that all voices—from workers to policymakers—are heard.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's "No Tax On Tips" Policy: Clarity Needed For US Workers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fandango And Wwe Bring Premium Live Events To Cinemas Summer Slam Kicks Off Nationwide Theatrical Release

Jul 23, 2025

Fandango And Wwe Bring Premium Live Events To Cinemas Summer Slam Kicks Off Nationwide Theatrical Release

Jul 23, 2025 -

Fandango And Wwe Partner To Bring Premium Live Events To Cinemas

Jul 23, 2025

Fandango And Wwe Partner To Bring Premium Live Events To Cinemas

Jul 23, 2025 -

Wwe Summer Slam Live Events Expand To Regal Cinemas

Jul 23, 2025

Wwe Summer Slam Live Events Expand To Regal Cinemas

Jul 23, 2025 -

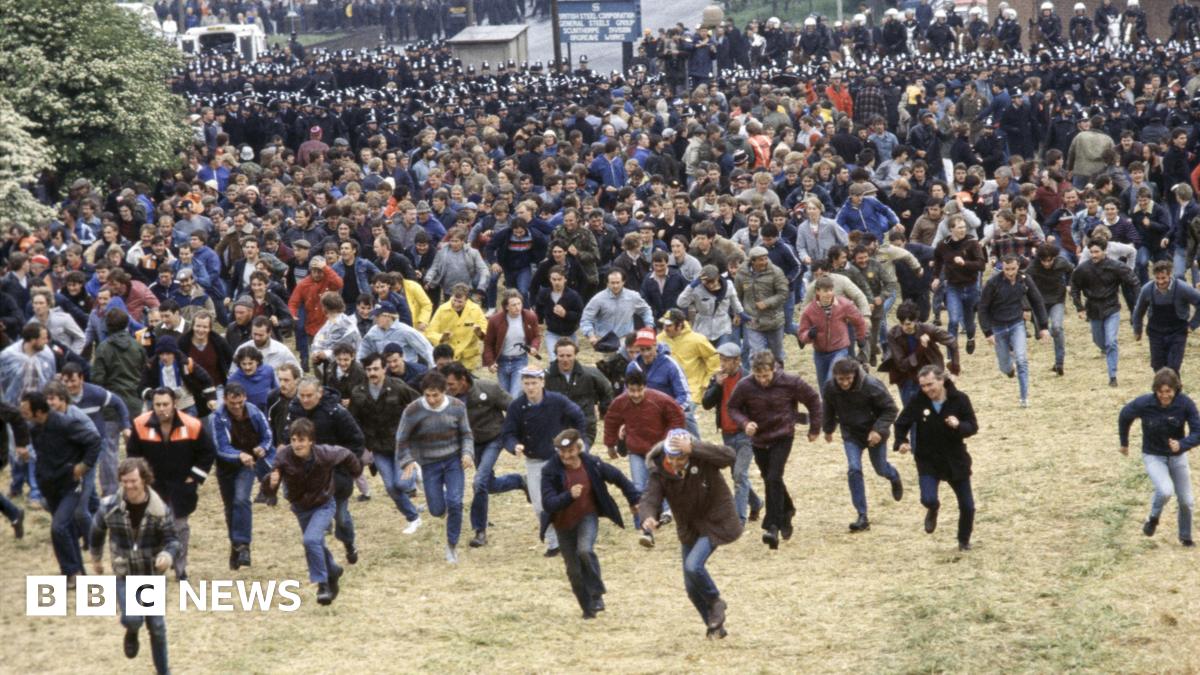

Orgreave Inquiry Confirmed Yvette Cooper Announces National Investigation

Jul 23, 2025

Orgreave Inquiry Confirmed Yvette Cooper Announces National Investigation

Jul 23, 2025 -

Uks F 35 B Fighter Jet Stranded In Kerala Awaiting Departure

Jul 23, 2025

Uks F 35 B Fighter Jet Stranded In Kerala Awaiting Departure

Jul 23, 2025