Trump's Proposed Tax Credit: A Deep Dive Into The National School Voucher Program

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Proposed Tax Credit: A Deep Dive into the National School Voucher Program

Donald Trump's proposed national school voucher program, delivered as a significant tax credit, has ignited a firestorm of debate across the United States. This plan, a cornerstone of his educational platform, promises to revolutionize the nation's education system, but its potential impact – both positive and negative – warrants careful consideration. This article provides a comprehensive overview of the proposal, examining its mechanics, potential benefits, and the considerable criticisms it faces.

Understanding the Proposed Tax Credit

Trump's plan centers around a substantial tax credit for parents who choose to send their children to private schools, including religious institutions. Instead of direct government funding, the proposal uses a tax credit mechanism, effectively shifting the financial burden from the federal government to individual taxpayers. The exact amount of the proposed tax credit remains somewhat fluid, with figures varying across different iterations of the plan. However, the core concept remains consistent: a significant financial incentive for parents opting for private education. This makes it drastically different from existing voucher programs, many of which are state-funded and often have limitations on eligibility or the types of schools that can participate.

Potential Benefits: Choice and Competition

Proponents argue the tax credit system offers several key benefits:

- Increased School Choice: Parents would gain greater control over their children's education, potentially selecting schools that better align with their values and their child's learning style. This is a key argument for those who believe competition among schools drives educational improvements.

- Improved Educational Outcomes: Competition spurred by the increased number of students in private schools could, proponents suggest, lead to higher educational standards and better student performance across the board.

- Economic Benefits for Private Schools: The influx of students could bolster the private school sector, creating jobs and stimulating local economies.

Criticisms and Concerns: Equity and Funding

However, the proposal faces significant criticism:

- Equity Concerns: Critics argue that such a program would exacerbate existing inequalities in the education system. Low-income families, who are less likely to benefit from a tax credit, would be disproportionately affected, further widening the achievement gap between affluent and disadvantaged students. [Link to article on education inequality].

- Funding Concerns: The true cost of the tax credit is a major point of contention. While proponents highlight the shift in funding, critics argue the overall cost to taxpayers could be substantial, potentially straining federal resources and diverting funds from public education. [Link to analysis of the plan's fiscal impact].

- Religious Freedom Issues: The inclusion of religious schools raises concerns about the separation of church and state, potentially leading to legal challenges and sparking debates about religious freedom in the context of public funding. [Link to Supreme Court case on school vouchers].

- Accountability and Oversight: Ensuring accountability and oversight of private schools receiving indirect government funding through the tax credit mechanism would be crucial. Without robust mechanisms in place, the potential for fraud or substandard education increases.

The Road Ahead: Political and Practical Challenges

The future of Trump's proposed national school voucher program remains uncertain. The plan faces significant political hurdles, requiring bipartisan support to navigate its path through Congress. Furthermore, practical challenges related to implementation, funding, and oversight need careful consideration.

Conclusion:

Trump's proposed tax credit for a national school voucher program presents a complex and multifaceted issue with far-reaching implications for the American education system. While proponents envision increased school choice and competition, critics express serious concerns about equity, funding, and the separation of church and state. A thorough and balanced examination of these competing arguments is crucial to inform future policy debates. The long-term effects of such a sweeping change are difficult to predict and will likely be a subject of continued analysis and discussion for years to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Proposed Tax Credit: A Deep Dive Into The National School Voucher Program. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

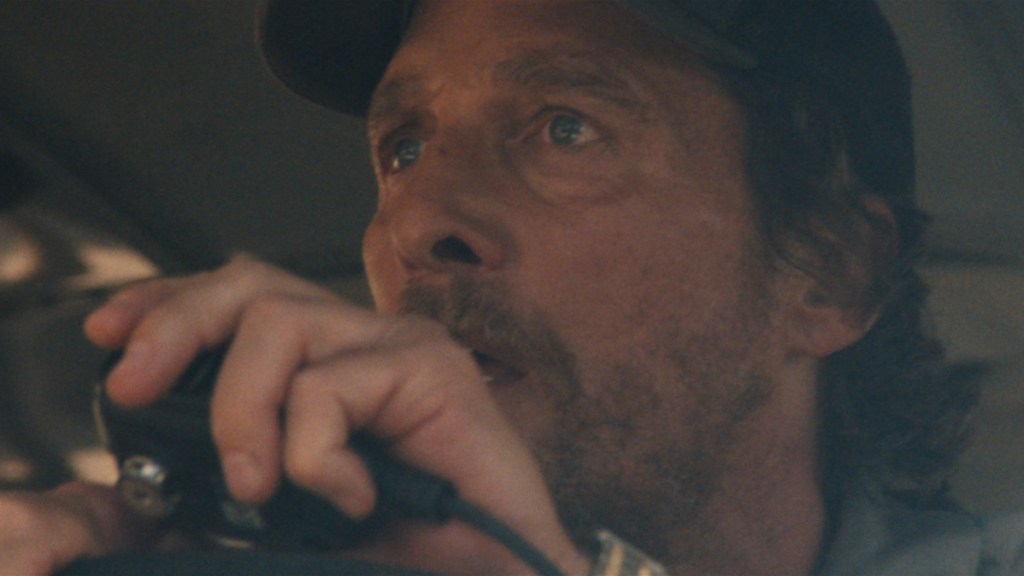

Paul Greengrass The Lost Bus Mc Conaughey In A High Stakes Rescue Mission

Jun 08, 2025

Paul Greengrass The Lost Bus Mc Conaughey In A High Stakes Rescue Mission

Jun 08, 2025 -

Sunderlands Jobe Bellingham Borussia Dortmund Secure Teenage Star In Club Record Deal

Jun 08, 2025

Sunderlands Jobe Bellingham Borussia Dortmund Secure Teenage Star In Club Record Deal

Jun 08, 2025 -

Kepa Arrizabalaga Arsenals Imminent Goalkeeping Acquisition

Jun 08, 2025

Kepa Arrizabalaga Arsenals Imminent Goalkeeping Acquisition

Jun 08, 2025 -

Live Updates Louisville Vs Miami Baseball Super Regional Game Score And Highlights

Jun 08, 2025

Live Updates Louisville Vs Miami Baseball Super Regional Game Score And Highlights

Jun 08, 2025 -

American Airlines Wrong Plane Wrong Airport Italy Trip Ends In U Turn

Jun 08, 2025

American Airlines Wrong Plane Wrong Airport Italy Trip Ends In U Turn

Jun 08, 2025

Latest Posts

-

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025 -

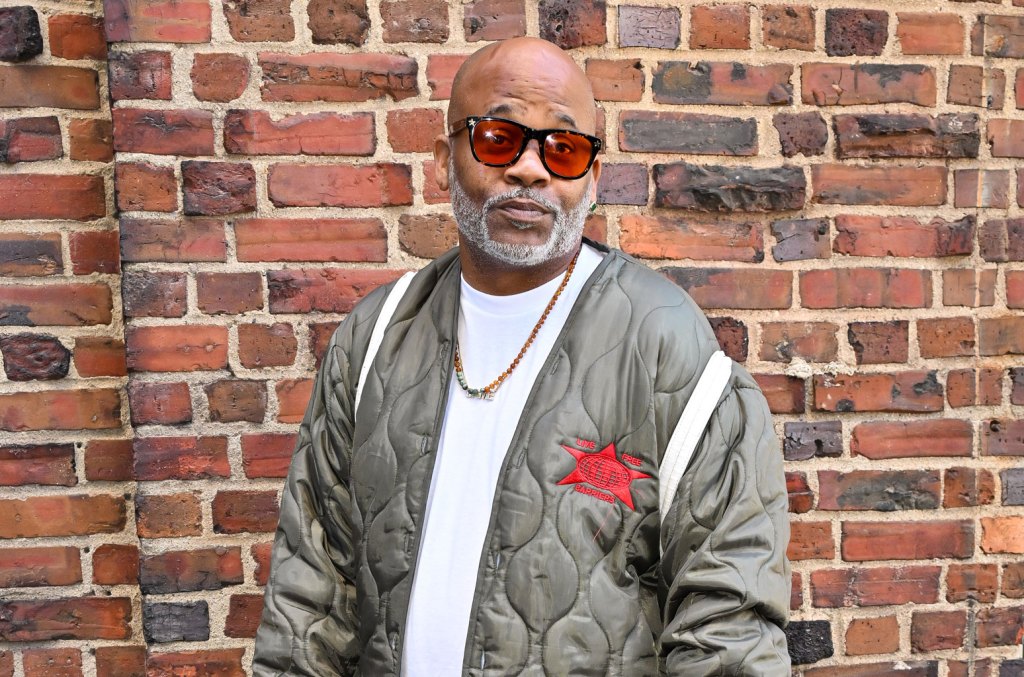

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025 -

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025 -

Co Stars React Noah Schnapp On Millie Bobby Browns New Baby

Sep 14, 2025

Co Stars React Noah Schnapp On Millie Bobby Browns New Baby

Sep 14, 2025 -

Arango Derrota A Jacquemot Y Avanza A La Final En Guadalajara

Sep 14, 2025

Arango Derrota A Jacquemot Y Avanza A La Final En Guadalajara

Sep 14, 2025