Trump's Tax Bill & Energy Prices: What To Expect For Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tax Bill & Energy Prices: What to Expect for Consumers

The 2017 Tax Cuts and Jobs Act, championed by then-President Donald Trump, significantly altered the American tax landscape. While its impact on individual tax burdens is well-documented, its less-discussed ripple effect on energy prices continues to shape consumers' wallets. Understanding this connection is crucial for navigating the current economic climate.

The Tax Bill's Impact on Energy Production:

The Trump tax cuts included provisions designed to stimulate domestic energy production. These included:

- Reduced corporate tax rates: Lowering the corporate tax rate from 35% to 21% directly benefited energy companies, potentially freeing up capital for investment in exploration, extraction, and infrastructure development. This could lead to increased production and, theoretically, lower energy prices.

- Expensing of capital investments: Allowing businesses to immediately deduct the cost of new equipment accelerated investment in the energy sector. This stimulated quicker expansion and modernization of facilities, potentially improving efficiency and output.

- Changes to the depletion allowance: While complex, adjustments to the depletion allowance – a tax deduction for the extraction of natural resources – impacted the profitability of oil and gas production.

The Indirect Effect on Energy Prices:

While the intent was to boost domestic energy production and lower prices, the reality is more nuanced. The impact on energy prices wasn't a simple cause-and-effect relationship. Several factors played significant roles:

- Global market fluctuations: Global oil prices are influenced by a multitude of factors, including geopolitical events, OPEC decisions, and global demand. The impact of the tax cuts was overshadowed by these larger market forces.

- Supply chain disruptions: Events like the COVID-19 pandemic and the ongoing war in Ukraine caused significant supply chain disruptions, impacting energy prices independent of the tax bill.

- Inflationary pressures: Broader economic inflation influenced energy prices, making it difficult to isolate the specific effect of the tax cuts.

What Consumers Experienced:

Ultimately, consumers experienced a mixed bag. While some saw periods of relatively lower energy prices following the tax cuts, these were often temporary and intertwined with other global factors. In many cases, the price fluctuations were largely unpredictable and unrelated to the direct impact of the tax legislation.

Looking Ahead:

Predicting future energy prices remains a challenge. Factors like renewable energy adoption, technological advancements, and ongoing geopolitical instability will continue to significantly impact energy costs. While the Trump tax bill aimed to stimulate domestic production and lower prices, its actual effect on consumer energy bills was less pronounced than initially hoped.

Key Takeaways for Consumers:

- Energy prices are complex: Many factors influence energy prices beyond the impact of any single piece of legislation.

- Diversification is key: Consider diversifying energy sources whenever possible to mitigate price volatility.

- Energy efficiency matters: Investing in energy-efficient appliances and practices can help lower your overall energy consumption and costs regardless of market fluctuations.

Staying informed about global energy markets and government policies is crucial for making informed decisions about energy consumption and budgeting. Understanding the intricate relationship between tax policy and energy prices helps consumers navigate the complexities of the current economic environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Tax Bill & Energy Prices: What To Expect For Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Details Emerge Air France Passengers Arrest After Water Request And Privacy Violation

Jul 02, 2025

New Details Emerge Air France Passengers Arrest After Water Request And Privacy Violation

Jul 02, 2025 -

Trumps Border Wall Bill House Vs Senate Comparison

Jul 02, 2025

Trumps Border Wall Bill House Vs Senate Comparison

Jul 02, 2025 -

Nation On The Brink Trumps Last Ditch Effort For Legislative Win

Jul 02, 2025

Nation On The Brink Trumps Last Ditch Effort For Legislative Win

Jul 02, 2025 -

Gops Proposed Medicaid Cuts A Financial Crisis For Families

Jul 02, 2025

Gops Proposed Medicaid Cuts A Financial Crisis For Families

Jul 02, 2025 -

Celtics Bolster Roster 5 Million Deal For Ex Timberwolves Forward

Jul 02, 2025

Celtics Bolster Roster 5 Million Deal For Ex Timberwolves Forward

Jul 02, 2025

Latest Posts

-

Fbi Scraps Maryland Campus Plan Staying In Dc

Jul 03, 2025

Fbi Scraps Maryland Campus Plan Staying In Dc

Jul 03, 2025 -

Welfare Bill Crisis Averted Government Makes Significant Concessions

Jul 03, 2025

Welfare Bill Crisis Averted Government Makes Significant Concessions

Jul 03, 2025 -

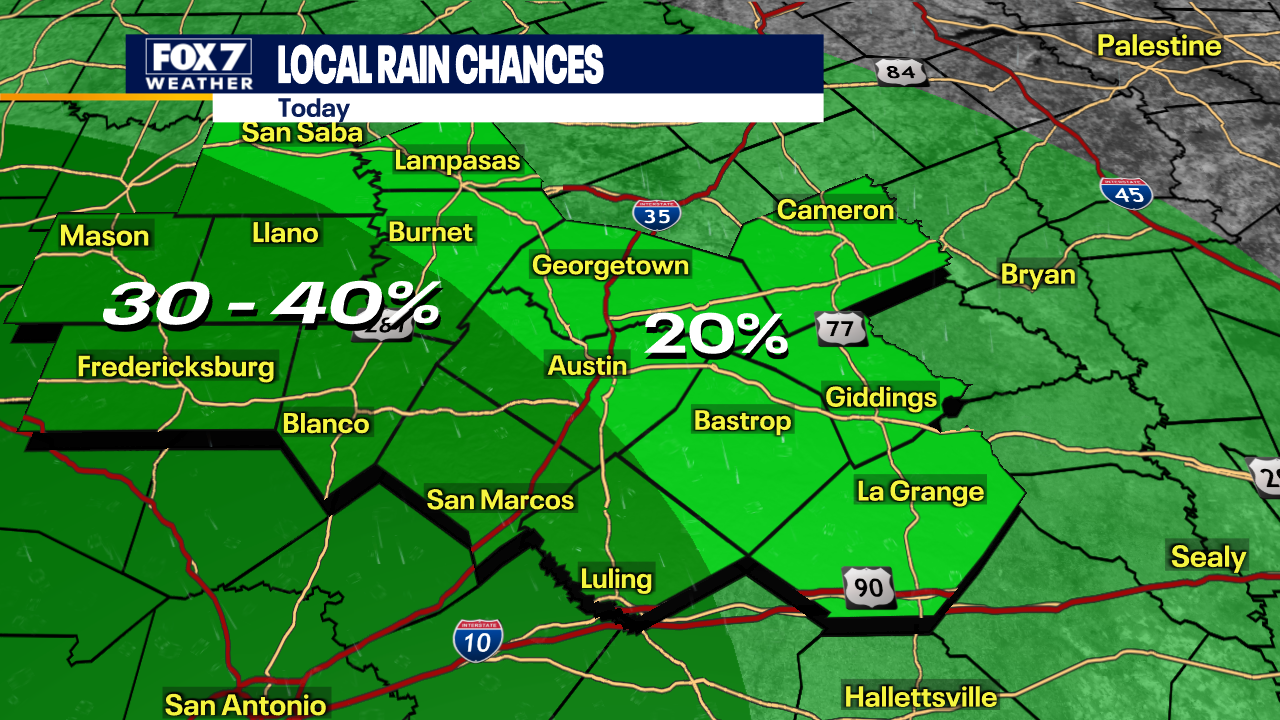

Austin Faces Risk Of Flash Flooding With Incoming Storms

Jul 03, 2025

Austin Faces Risk Of Flash Flooding With Incoming Storms

Jul 03, 2025 -

Fireworks Prices To Soar As Tariffs Impact Stand Owners

Jul 03, 2025

Fireworks Prices To Soar As Tariffs Impact Stand Owners

Jul 03, 2025 -

Televangelist Jimmy Swaggart Dies At 90 A Legacy Marked By Scandal And Ministry

Jul 03, 2025

Televangelist Jimmy Swaggart Dies At 90 A Legacy Marked By Scandal And Ministry

Jul 03, 2025