Trump's "Unprecedented" Tax Credit: Reforming Education Through National School Vouchers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's "Unprecedented" Tax Credit: Reforming Education Through National School Vouchers

A controversial proposal shaking up the American education system.

Donald Trump's proposed national school voucher program, touted as an "unprecedented" tax credit, has ignited a firestorm of debate across the United States. This ambitious plan, promising to revolutionize education by empowering parents with school choice, faces significant hurdles and widespread opposition. Understanding its intricacies, potential benefits, and drawbacks is crucial for anyone interested in the future of American education.

The Core Proposal: A National School Voucher Tax Credit

At its heart, Trump's plan involves a substantial tax credit for parents who choose private schools or other educational alternatives for their children. While the exact details remain subject to change and further political maneuvering, the core concept hinges on providing significant financial assistance to families, effectively subsidizing tuition at non-public schools. This differs significantly from existing voucher programs, many of which are localized and often limited in scope. Proponents frame this as a necessary step to inject competition into the education system and break the perceived monopoly of public schools.

Arguments For: Empowering Parents, Fostering Competition

Supporters of the national school voucher tax credit argue that it empowers parents with greater control over their children's education. They believe that increased school choice will lead to better educational outcomes by allowing parents to select schools that best meet their children's individual needs and learning styles. Furthermore, they contend that increased competition among schools – both public and private – will drive innovation and improve the overall quality of education. This increased competition, they argue, will ultimately benefit all students.

- Increased Parental Choice: Parents can select schools aligned with their values and children's needs.

- Improved Educational Outcomes: Competition drives innovation and better results.

- Addressing Inequities: Provides opportunities for students in under-resourced communities.

Arguments Against: Funding Concerns, Constitutional Issues, and Potential for Segregation

Critics raise significant concerns about the potential financial implications of such a large-scale program. The cost of a national voucher system could be astronomical, potentially straining the federal budget and diverting funds from already underfunded public schools. Furthermore, legal challenges regarding the separation of church and state are likely, given the potential for public funds to flow to religious schools. There are also serious concerns that such a system could exacerbate existing inequalities, leading to further segregation within the education system.

- Financial Burden: The cost of a national voucher program could be prohibitive.

- Constitutional Concerns: Public funding of religious schools raises legal questions.

- Exacerbated Segregation: Potential for increased segregation based on socioeconomic status and race.

The Road Ahead: Political Landscape and Future Prospects

The future of Trump's proposed national school voucher tax credit remains uncertain. The plan faces significant political opposition, and its passage through Congress would require considerable bipartisan support – a challenging feat in the current political climate. Even if enacted, implementation would present a myriad of logistical and administrative challenges. The debate surrounding this proposal will undoubtedly continue to shape the national conversation on education reform for years to come. Further analysis and discussion are crucial to fully understand the potential impact of this far-reaching policy.

Further Research: For more in-depth information, explore resources from the National Education Association (NEA) and the American Federation of Teachers (AFT) for contrasting viewpoints on school choice and voucher programs. You can also research existing state-level voucher programs to gain insights into their effectiveness and challenges. This allows for a more informed and nuanced understanding of this complex and critical issue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's "Unprecedented" Tax Credit: Reforming Education Through National School Vouchers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

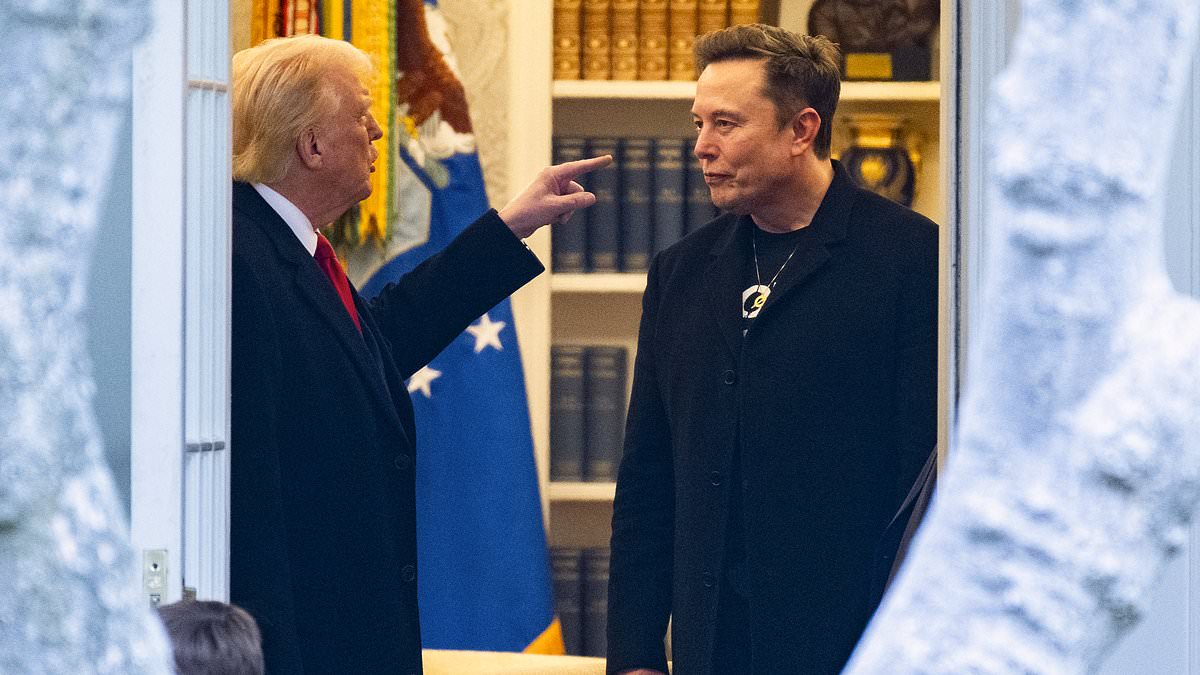

The Trump Musk Feud Escalating Tensions And Uncertain Consequences

Jun 07, 2025

The Trump Musk Feud Escalating Tensions And Uncertain Consequences

Jun 07, 2025 -

Donde Ver El Partido Andorra Inglaterra Hoy Guia Completa De Canales Y Streaming

Jun 07, 2025

Donde Ver El Partido Andorra Inglaterra Hoy Guia Completa De Canales Y Streaming

Jun 07, 2025 -

Influential Trump Aide At Center Of Musk Feud

Jun 07, 2025

Influential Trump Aide At Center Of Musk Feud

Jun 07, 2025 -

Louisvilles 8 1 Rout Of Miami One Win Separates Cardinals From College World Series

Jun 07, 2025

Louisvilles 8 1 Rout Of Miami One Win Separates Cardinals From College World Series

Jun 07, 2025 -

Women In West Virginia Fear Prosecution After Prosecutors Miscarriage Warning

Jun 07, 2025

Women In West Virginia Fear Prosecution After Prosecutors Miscarriage Warning

Jun 07, 2025

Latest Posts

-

Sean Diddy Combs Rape Trial Accuser Jane Doe Takes The Stand

Jun 08, 2025

Sean Diddy Combs Rape Trial Accuser Jane Doe Takes The Stand

Jun 08, 2025 -

Swiateks Clay Court Strategy Rankings Are Irrelevant Performance Is Key

Jun 08, 2025

Swiateks Clay Court Strategy Rankings Are Irrelevant Performance Is Key

Jun 08, 2025 -

Cost Of Holidays Prohibitive For Many Cancer Patients Charity Report

Jun 08, 2025

Cost Of Holidays Prohibitive For Many Cancer Patients Charity Report

Jun 08, 2025 -

Wave Of Finfluencer Arrests Authorities Target Misleading Financial Advice

Jun 08, 2025

Wave Of Finfluencer Arrests Authorities Target Misleading Financial Advice

Jun 08, 2025 -

Death Cap Mushroom Poisoning A Warning From A Devastating Australian Incident

Jun 08, 2025

Death Cap Mushroom Poisoning A Warning From A Devastating Australian Incident

Jun 08, 2025