Two Decades Of Lockheed Martin: Assessing Stock Returns And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Decades of Lockheed Martin: Assessing Stock Returns and Growth

Lockheed Martin (LMT), a titan in the aerospace and defense industry, has weathered economic storms and technological advancements over the past two decades. This article delves into the company's stock performance and growth trajectory over the last 20 years, analyzing its successes, challenges, and future prospects for investors. Understanding this history is crucial for anyone considering adding LMT to their portfolio or assessing their existing holdings.

A Look Back: Lockheed Martin's Stock Performance (2004-2024)

The past two decades have presented a mixed bag for Lockheed Martin investors. While the company has consistently delivered strong revenue growth, driven by government contracts and technological innovation, the stock's performance hasn't always mirrored this success. Analyzing the stock's performance requires looking beyond simple price movements and considering factors like dividends, splits, and inflation.

To truly understand the return on investment (ROI), one must consider the total return, incorporating dividend reinvestment. While readily available financial data websites like and provide historical stock prices, it's crucial to utilize tools that account for dividend reinvestment to accurately calculate the total return over this period.

Key Growth Drivers:

Several factors have fueled Lockheed Martin's growth over the past 20 years:

- Government Spending: Increased defense budgets, both domestically and internationally, have consistently provided a strong foundation for LMT's revenue streams. This reliance on government contracts, however, presents both opportunities and risks, as budget fluctuations can impact the company's bottom line.

- Technological Innovation: Lockheed Martin's commitment to research and development in areas like aerospace, missiles, and cybersecurity has positioned it at the forefront of technological advancements within the defense sector. This continuous innovation drives both revenue growth and competitive advantage.

- Strategic Acquisitions: Strategic acquisitions have played a significant role in expanding Lockheed Martin's capabilities and market reach. These acquisitions have broadened the company's product portfolio and strengthened its position in various market segments.

- Global Reach: LMT's international presence has diversified its revenue streams and reduced its dependence on any single market. This global footprint has been a key contributor to long-term growth and stability.

Challenges Faced:

Despite its successes, Lockheed Martin has faced significant challenges:

- Competition: The aerospace and defense industry is intensely competitive. Lockheed Martin constantly faces pressure from both established rivals and emerging players.

- Economic Uncertainty: Global economic downturns can significantly impact government spending on defense, directly affecting LMT's revenue and profitability.

- Supply Chain Disruptions: Recent global events have highlighted the vulnerability of supply chains. Securing a reliable supply of materials and components is crucial for Lockheed Martin's operational efficiency.

Future Outlook:

Looking ahead, Lockheed Martin's future growth will depend on several key factors, including continued government investment in defense, successful execution of its technological roadmap, and its ability to navigate geopolitical uncertainties. The increasing focus on emerging technologies such as hypersonics and artificial intelligence presents both opportunities and challenges for the company.

Conclusion:

Assessing Lockheed Martin's stock performance over the past two decades requires a nuanced approach, considering both its impressive revenue growth and the inherent volatility associated with the defense industry. Investors should conduct thorough due diligence, carefully weighing the potential for future growth against the inherent risks before making any investment decisions. Consult with a financial advisor for personalized guidance.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Decades Of Lockheed Martin: Assessing Stock Returns And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

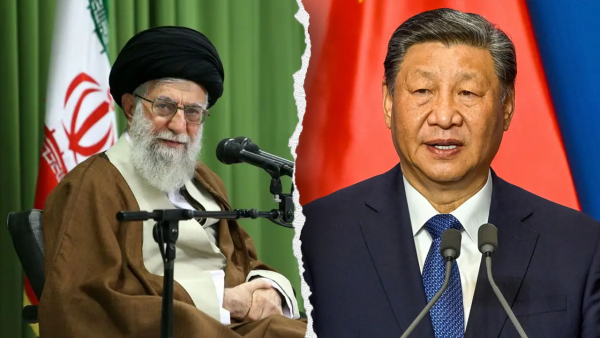

China And Iran The Implications Of Western Success Or Failure In The Conflict

Jun 22, 2025

China And Iran The Implications Of Western Success Or Failure In The Conflict

Jun 22, 2025 -

Between A Rock And A Hard Place Qatars Dilemma Amidst Escalating Israel Iran Tensions

Jun 22, 2025

Between A Rock And A Hard Place Qatars Dilemma Amidst Escalating Israel Iran Tensions

Jun 22, 2025 -

Meaning Behind Machine Gun Kellys Daughters Name An Exclusive Look

Jun 22, 2025

Meaning Behind Machine Gun Kellys Daughters Name An Exclusive Look

Jun 22, 2025 -

Seattle Storm Rout Los Angeles Sparks Impact Of Kelsey Plums Absence

Jun 22, 2025

Seattle Storm Rout Los Angeles Sparks Impact Of Kelsey Plums Absence

Jun 22, 2025 -

Columbia University Student Mahmoud Khalils Release On Bail

Jun 22, 2025

Columbia University Student Mahmoud Khalils Release On Bail

Jun 22, 2025

Latest Posts

-

Americas Middle East Predicament A Windfall For Chinas Strategic Ambitions

Jun 23, 2025

Americas Middle East Predicament A Windfall For Chinas Strategic Ambitions

Jun 23, 2025 -

Cozart On Trump A Presidential War Would End My Support

Jun 23, 2025

Cozart On Trump A Presidential War Would End My Support

Jun 23, 2025 -

Conflicto En Medio Oriente Reaccion Internacional Al Ataque Estadounidense En Iran

Jun 23, 2025

Conflicto En Medio Oriente Reaccion Internacional Al Ataque Estadounidense En Iran

Jun 23, 2025 -

Ben Felters Career Milestone A Love Story Update

Jun 23, 2025

Ben Felters Career Milestone A Love Story Update

Jun 23, 2025 -

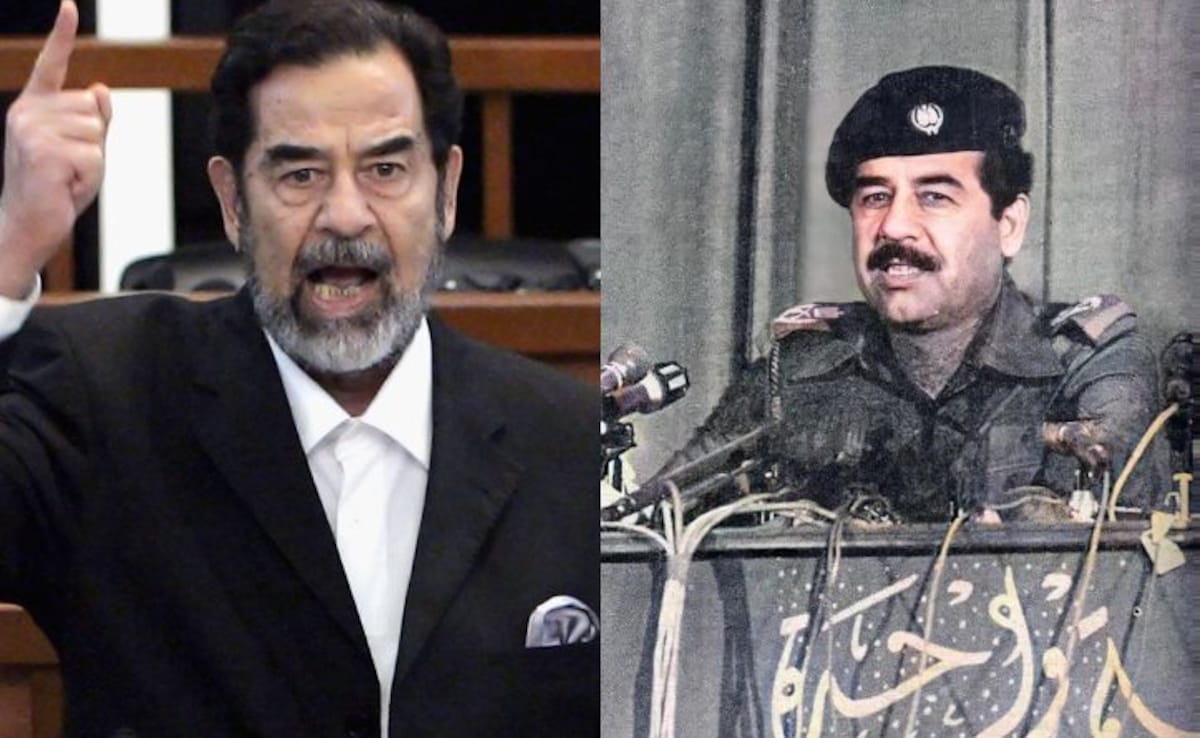

Operation Bramble Bush A Deep Dive Into Mossads Risky Plan Against Saddam Hussein

Jun 23, 2025

Operation Bramble Bush A Deep Dive Into Mossads Risky Plan Against Saddam Hussein

Jun 23, 2025