Two Decades Of Lockheed Martin Stock: Your Potential Gains Revealed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Decades of Lockheed Martin Stock: Your Potential Gains Revealed

Investing in the stock market can feel like navigating a minefield, but some companies offer a steadier path to potential long-term growth. Lockheed Martin, a global security and aerospace company, has been a consistent player in the market for decades. But what would a two-decade investment in Lockheed Martin stock have yielded? Let's delve into the data and uncover the potential gains.

A Look Back: Lockheed Martin's Performance Over 20 Years

For investors considering long-term holdings, understanding historical performance is crucial. Analyzing Lockheed Martin's stock (LMT) over the past 20 years provides valuable insight into its growth trajectory. While past performance doesn't guarantee future results, it offers a strong indication of the company's resilience and potential.

We'll need to consult reliable financial data sources like Yahoo Finance or Google Finance to accurately determine the exact price fluctuations over this period. However, we can confidently say that Lockheed Martin has generally exhibited steady growth, fueled by consistent government contracts and technological advancements in defense and aerospace. This stability has attracted many long-term investors seeking a less volatile investment compared to some sectors.

Factors Contributing to Lockheed Martin's Long-Term Growth:

Several key factors have contributed to Lockheed Martin's sustained success:

- Government Contracts: A significant portion of Lockheed Martin's revenue comes from government contracts, primarily from the U.S. Department of Defense. This provides a stable revenue stream, even during economic downturns.

- Technological Innovation: Lockheed Martin consistently invests in research and development, driving innovation in areas like aerospace, defense systems, and cybersecurity. This innovation fuels growth and attracts both government and commercial clients.

- Diversified Portfolio: The company's diverse portfolio of products and services reduces reliance on any single product or market, mitigating risk and promoting sustained growth. This diversification spans various defense and aerospace segments.

- Strong Financial Position: Lockheed Martin maintains a strong financial position, enabling it to weather economic storms and continue investing in growth initiatives.

Calculating Potential Gains (Illustrative Example):

To illustrate potential gains, let's assume a hypothetical scenario. Suppose an investor purchased 100 shares of Lockheed Martin stock 20 years ago at a price of X dollars (replace X with the actual price from a reliable source using historical data). Based on the subsequent price appreciation and any dividend payments received over the two decades, we can calculate the total return. This calculation needs to factor in both capital appreciation and dividend reinvestment (if applicable) to provide an accurate picture. Remember, this is just an illustrative example; actual returns will vary based on the specific purchase and sale dates.

Understanding Risk:

While Lockheed Martin has shown impressive long-term growth, it's essential to acknowledge the inherent risks associated with any stock investment. Geopolitical instability, changes in government spending, and competitive pressures can all impact the company's performance. Diversifying your investment portfolio is crucial to mitigate these risks.

Conclusion: A Potential Long-Term Investment

Lockheed Martin's consistent performance over the past two decades suggests its potential for continued growth. However, investors should conduct thorough research, consider their risk tolerance, and consult with a financial advisor before making any investment decisions. While the past doesn't predict the future, examining Lockheed Martin's historical performance provides valuable insight into its potential as a long-term investment. Remember to always consult with a financial professional for personalized advice tailored to your financial situation.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on individual circumstances and thorough research.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Decades Of Lockheed Martin Stock: Your Potential Gains Revealed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wests Iran Stance How Chinas Response Shifts Depending On The Outcome

Jun 22, 2025

Wests Iran Stance How Chinas Response Shifts Depending On The Outcome

Jun 22, 2025 -

Ice Defends Deal With Detention Facility Failing To Meet Standards

Jun 22, 2025

Ice Defends Deal With Detention Facility Failing To Meet Standards

Jun 22, 2025 -

Israel Iran Tensions Soar Foreign Minister Decries Failed Geneva Diplomacy

Jun 22, 2025

Israel Iran Tensions Soar Foreign Minister Decries Failed Geneva Diplomacy

Jun 22, 2025 -

33 C Heatwave Sweeps Uk Two Days Of Scorching Temperatures Ahead

Jun 22, 2025

33 C Heatwave Sweeps Uk Two Days Of Scorching Temperatures Ahead

Jun 22, 2025 -

Operation Bramble Bush Examining The Risks And Failures Of Mossads Iraq Mission

Jun 22, 2025

Operation Bramble Bush Examining The Risks And Failures Of Mossads Iraq Mission

Jun 22, 2025

Latest Posts

-

Absurd Palestine Action Responds To Bbcs Planned Ban

Jun 23, 2025

Absurd Palestine Action Responds To Bbcs Planned Ban

Jun 23, 2025 -

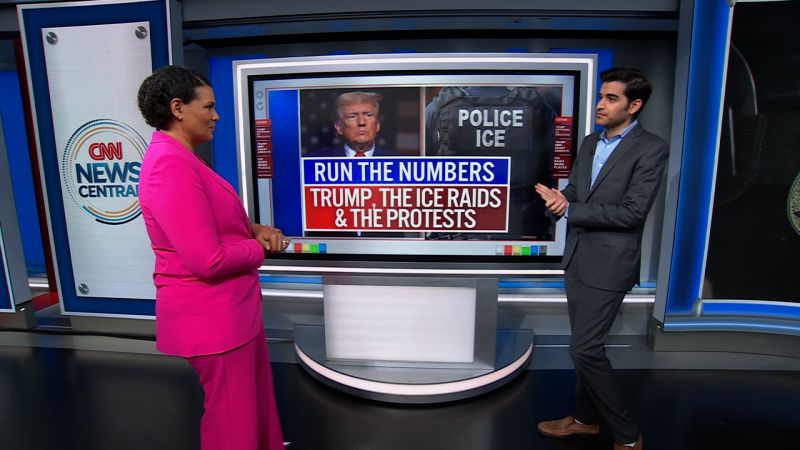

Post Protest Analysis Assessing Trumps Approval Rating On Immigration

Jun 23, 2025

Post Protest Analysis Assessing Trumps Approval Rating On Immigration

Jun 23, 2025 -

Andrew Nembhards Unsung Defensive Dominance In The Playoffs

Jun 23, 2025

Andrew Nembhards Unsung Defensive Dominance In The Playoffs

Jun 23, 2025 -

Pacers Nembhard Delivers Key Three Pointer In Game Situation

Jun 23, 2025

Pacers Nembhard Delivers Key Three Pointer In Game Situation

Jun 23, 2025 -

Deepening Economic Troubles Test The Russian Governments Stability

Jun 23, 2025

Deepening Economic Troubles Test The Russian Governments Stability

Jun 23, 2025