Two Households, One Income: Challenges And Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Households, One Income: Navigating the Challenges and Finding Solutions

The rising cost of living is squeezing many families, and for those operating on a single income across two households – whether due to childcare responsibilities, career breaks, or other circumstances – the financial strain can be particularly acute. This article explores the unique challenges faced by dual-household, single-income families and offers practical solutions to help navigate these difficult times.

The Unique Pressures of a Single Income, Two Households

The traditional model of two incomes supporting one household is increasingly uncommon. Many families now find themselves juggling the responsibilities of two separate homes, often with children involved, on the income of a single earner. This situation presents a unique set of financial, logistical, and emotional challenges:

- Increased Housing Costs: Maintaining two separate residences significantly increases housing expenses, including rent, mortgage payments, utilities, and property taxes. This immediately impacts the available budget for other necessities.

- Childcare Expenses: If children are involved, childcare costs can be substantial, further depleting the available income. Finding affordable, reliable childcare is a major concern for many families in this situation.

- Transportation Costs: Traveling between households adds to transportation costs, whether through fuel, public transport, or ride-sharing services. This seemingly small expense can accumulate rapidly.

- Emotional Stress: The added pressure of managing finances, logistics, and potentially divided family time can lead to significant emotional stress for all members of the family. This stress can affect mental and physical health.

Practical Solutions for Financial Stability

Overcoming these challenges requires a multi-pronged approach focusing on budgeting, financial planning, and potential income generation:

1. Creating a Realistic Budget:

- Track your spending: Use budgeting apps or spreadsheets to meticulously track every expense. Identifying areas where spending can be reduced is crucial.

- Prioritize essential expenses: Focus on necessities like housing, food, and childcare before considering discretionary spending.

- Negotiate lower bills: Contact utility providers, insurance companies, and other service providers to negotiate lower rates.

2. Exploring Income Generation Opportunities:

- Part-time work: Even a few extra hours of part-time work can make a significant difference. Consider remote work options or flexible schedules.

- Freelancing or gig work: Explore online platforms offering freelance writing, graphic design, or other skills.

- Selling unused items: Decluttering and selling unused items online or at consignment shops can generate extra cash.

3. Seeking Support and Resources:

- Government assistance programs: Research local and national programs providing financial assistance to families in need. Eligibility criteria vary depending on location. (Link to relevant government resources here – Example: [link to relevant government website])

- Community resources: Many communities offer support services, including food banks, affordable housing assistance, and childcare subsidies.

- Financial counseling: A financial advisor can help create a personalized financial plan and offer guidance on managing debt and investing.

4. Open Communication and Family Support:

Open communication between household members is vital. Sharing financial burdens and responsibilities can significantly ease the pressure. Seeking support from family and friends can also provide much-needed emotional and practical assistance.

Looking Ahead: Building a Sustainable Future

Living in two households with one income presents significant challenges, but with careful planning, resourcefulness, and a supportive network, it's possible to achieve financial stability and build a sustainable future. By focusing on realistic budgeting, exploring income generation opportunities, and seeking available resources, families can navigate these difficulties and create a more secure life for themselves and their children. Remember to seek professional advice when needed – don't hesitate to reach out for help.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Households, One Income: Challenges And Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Disqualification For Rob Cross Ex Darts Champions Tax Problems Lead To Director Ban

Jun 07, 2025

Disqualification For Rob Cross Ex Darts Champions Tax Problems Lead To Director Ban

Jun 07, 2025 -

Ibms Comeback New Tech And A Renewed Image

Jun 07, 2025

Ibms Comeback New Tech And A Renewed Image

Jun 07, 2025 -

Maxwell Anderson Trial Ends Key Details And Jurys Decision

Jun 07, 2025

Maxwell Anderson Trial Ends Key Details And Jurys Decision

Jun 07, 2025 -

Nhl Playoffs Dallas Stars Dismiss Coach De Boer Post West Finals

Jun 07, 2025

Nhl Playoffs Dallas Stars Dismiss Coach De Boer Post West Finals

Jun 07, 2025 -

Matthew Hussey Announces First Baby With Wife

Jun 07, 2025

Matthew Hussey Announces First Baby With Wife

Jun 07, 2025

Latest Posts

-

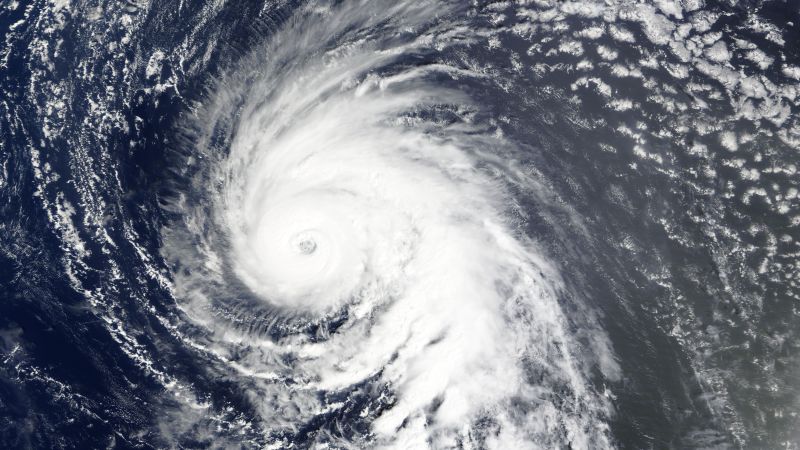

Forecasting Hurricanes The Unexpected Role Of Ghost Hurricanes

Jun 07, 2025

Forecasting Hurricanes The Unexpected Role Of Ghost Hurricanes

Jun 07, 2025 -

Maxwell Anderson Trial Ends Key Details And Jurys Decision

Jun 07, 2025

Maxwell Anderson Trial Ends Key Details And Jurys Decision

Jun 07, 2025 -

Ibm Stock Underperforms Market Analysis And Reasons For Lag

Jun 07, 2025

Ibm Stock Underperforms Market Analysis And Reasons For Lag

Jun 07, 2025 -

Military Experts Weigh In Assessing The Significance Of Ukraines Airfield Attacks

Jun 07, 2025

Military Experts Weigh In Assessing The Significance Of Ukraines Airfield Attacks

Jun 07, 2025 -

Report Fifth Harmony Considering Reunion Camila Cabello Absent From Discussions

Jun 07, 2025

Report Fifth Harmony Considering Reunion Camila Cabello Absent From Discussions

Jun 07, 2025