Two Sigma's $236.55 Million Bank Of America Investment: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's $236.55 Million Bank of America Investment: A Bullish Signal or Calculated Risk?

Two Sigma, the highly respected quantitative investment firm, recently made headlines with a significant investment in Bank of America (BAC), acquiring shares valued at approximately $236.55 million. This substantial investment has sent ripples through the financial markets, prompting questions about its implications for both Bank of America and investors at large. Is this a bullish signal on the future of BAC, or a calculated risk by a firm known for its sophisticated data-driven strategies? Let's delve into the details.

Two Sigma's Investment Strategy: Data-Driven and Diversified

Two Sigma isn't known for impulsive decisions. Their investment strategy relies heavily on advanced data analytics and complex algorithms to identify undervalued assets and manage risk effectively. This $236.55 million investment in Bank of America suggests that their models have identified a compelling opportunity within the financial giant. While the exact reasoning behind the investment remains undisclosed, several factors likely contributed to Two Sigma's decision.

Potential Factors Influencing Two Sigma's Decision:

-

Bank of America's Strong Financial Performance: BAC has demonstrated robust financial performance in recent quarters, reporting healthy earnings growth and a stable balance sheet. This stability, in a fluctuating economic climate, could be a key attraction for a firm like Two Sigma.

-

Undervalued Asset Thesis: Two Sigma's investment strategy frequently targets companies they believe are undervalued by the market. It's possible their quantitative models suggest Bank of America's current stock price doesn't fully reflect its intrinsic value or future growth potential.

-

Diversification Strategy: Two Sigma's portfolio is highly diversified across various asset classes and sectors. The Bank of America investment might be part of a broader diversification strategy, aiming to reduce overall portfolio risk while generating attractive returns.

What This Means for Investors:

Two Sigma's investment carries significant weight in the financial world. Their decision to allocate such a substantial amount to Bank of America can be interpreted as a vote of confidence in the bank's long-term prospects. However, it's crucial to remember that even sophisticated quantitative firms aren't immune to losses.

Should You Follow Suit?

While Two Sigma's investment is encouraging, it's not a guaranteed indicator of future success. Investors should conduct their own thorough due diligence before making any investment decisions. Consider consulting with a qualified financial advisor to assess your risk tolerance and determine if Bank of America aligns with your individual investment goals. Remember, past performance is not indicative of future results.

Understanding the Risks:

Investing in any stock, including Bank of America, carries inherent risks. Economic downturns, regulatory changes, and competitive pressures could all negatively impact BAC's performance. Before investing, carefully consider these risks and your ability to withstand potential losses.

Conclusion:

Two Sigma's substantial investment in Bank of America is a noteworthy event, sparking considerable interest within the investment community. While it suggests a positive outlook on BAC's future, investors should approach this development with caution and conduct their own comprehensive analysis before making any investment decisions. This move underscores the importance of data-driven analysis in modern investment strategies and highlights the ongoing evolution of the financial landscape. Remember to always prioritize responsible investing and seek professional guidance when needed. Stay tuned for further updates as this story develops.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's $236.55 Million Bank Of America Investment: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

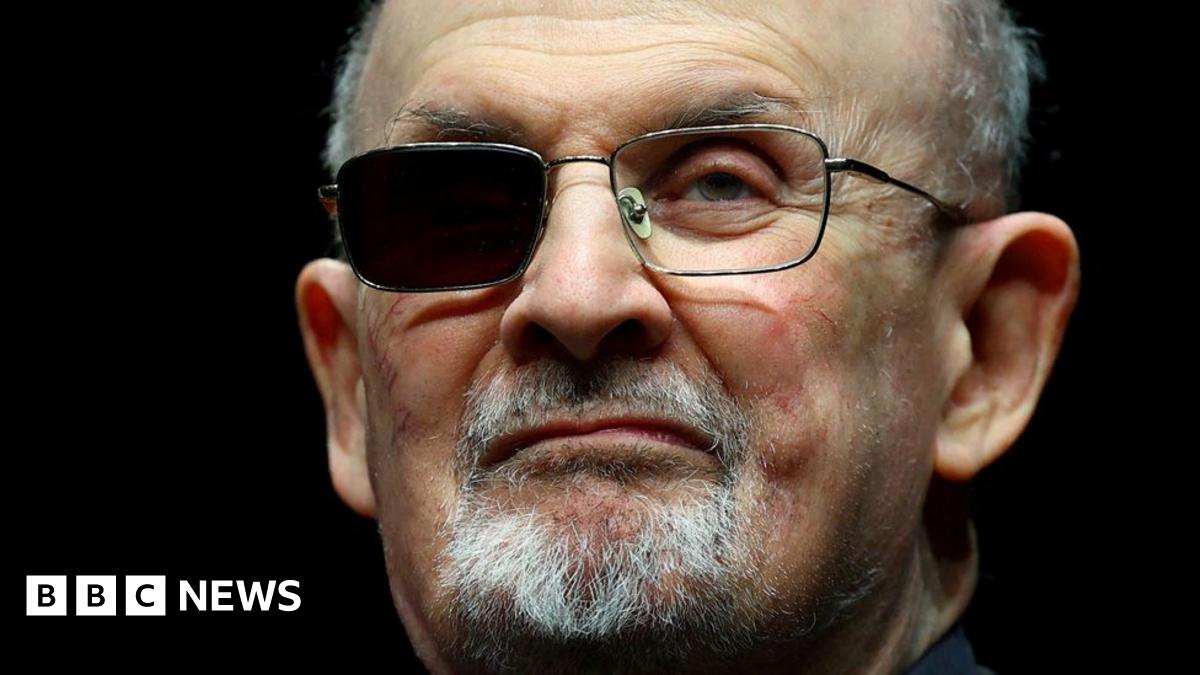

Attackers Maximum Sentence In Salman Rushdie Case Authors Reaction

May 27, 2025

Attackers Maximum Sentence In Salman Rushdie Case Authors Reaction

May 27, 2025 -

Gary Linekers Final Match Of The Day Bbc Departure After 26 Years

May 27, 2025

Gary Linekers Final Match Of The Day Bbc Departure After 26 Years

May 27, 2025 -

North Koreas Failed Warship Launch Results In High Ranking Arrest

May 27, 2025

North Koreas Failed Warship Launch Results In High Ranking Arrest

May 27, 2025 -

Stricter Rules Target Developers With Unfinished Housing Sites

May 27, 2025

Stricter Rules Target Developers With Unfinished Housing Sites

May 27, 2025 -

Anson Mounts Discomfort A Challenging Scene In Strange New Worlds

May 27, 2025

Anson Mounts Discomfort A Challenging Scene In Strange New Worlds

May 27, 2025

Latest Posts

-

Us Travelers In Canada Navigating The Current Boycott

May 29, 2025

Us Travelers In Canada Navigating The Current Boycott

May 29, 2025 -

Doc Rivers Impact Milwaukee Bucks Desperate Attempt To Retain Giannis

May 29, 2025

Doc Rivers Impact Milwaukee Bucks Desperate Attempt To Retain Giannis

May 29, 2025 -

Soaring Beef Prices Push Food Inflation To 12 Month High

May 29, 2025

Soaring Beef Prices Push Food Inflation To 12 Month High

May 29, 2025 -

Stellantis New Ceo Meet Antonio Filosa

May 29, 2025

Stellantis New Ceo Meet Antonio Filosa

May 29, 2025 -

Emergency Response Launched Following Huge Explosion At Chinese Chemical Plant

May 29, 2025

Emergency Response Launched Following Huge Explosion At Chinese Chemical Plant

May 29, 2025