Two Sigma's Bank Of America (BAC) Stake: Analysis And Market Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Bank of America (BAC) Stake: A Deeper Dive into the Investment and Market Outlook

Two Sigma, the renowned quantitative investment firm, recently revealed a significant increase in its stake in Bank of America (BAC), sparking considerable interest and speculation within the financial markets. This move carries significant weight, given Two Sigma's reputation for data-driven investment strategies and its sophisticated analytical capabilities. This article will delve into the implications of this investment, analyzing the potential reasons behind Two Sigma's decision and exploring the broader market outlook for Bank of America and the financial sector.

Why Two Sigma's BAC Stake Matters

Two Sigma's investment isn't just another market transaction; it's a powerful signal. The firm's quantitative approach relies heavily on complex algorithms and vast datasets to identify undervalued assets and predict future performance. Their increased stake in BAC suggests a positive outlook on the bank's future prospects, potentially indicating:

- Strong Financial Fundamentals: Two Sigma likely identified robust financial indicators within Bank of America's recent performance. This could include strong earnings growth, improved loan quality, or efficient cost management. Analyzing Bank of America's latest quarterly reports [link to Bank of America investor relations] is crucial to understanding these fundamentals.

- Growth Potential in a Changing Market: The current economic climate presents both challenges and opportunities for financial institutions. Two Sigma's bet on BAC might reflect their belief in the bank's ability to navigate these complexities and capitalize on emerging trends, such as digital banking and wealth management.

- Undervalued Asset: Two Sigma's sophisticated models might have identified Bank of America as an undervalued asset compared to its peers. This could be based on various factors, including market sentiment, future earnings projections, and a comparative analysis of similar financial institutions.

Market Outlook for Bank of America (BAC)

The outlook for Bank of America is complex and depends on several interconnected factors:

- Interest Rate Hikes: The Federal Reserve's monetary policy significantly impacts the profitability of banks. While higher interest rates boost net interest margins in the short term, they can also slow economic growth, potentially leading to increased loan defaults. [Link to Federal Reserve website]

- Economic Growth: A robust economy generally translates to increased lending activity and higher profits for banks. Conversely, economic slowdown can negatively impact loan demand and increase credit risk. Keep an eye on key economic indicators like GDP growth and unemployment rates.

- Competition: The banking sector remains highly competitive, with both traditional banks and fintech companies vying for market share. Bank of America's ability to innovate and adapt to changing consumer preferences will be crucial for its future success.

Analyzing Two Sigma's Strategy: A Data-Driven Approach

Two Sigma's investment decisions are rarely impulsive. Their strategy likely involves:

- Extensive Data Analysis: They would have meticulously analyzed a vast range of data points, including financial statements, macroeconomic indicators, and market sentiment, to inform their decision.

- Risk Management: Two Sigma's investment wouldn't be made without a comprehensive risk assessment. Their sophisticated models would have considered potential downside risks and developed strategies to mitigate them.

- Long-Term Perspective: While short-term market fluctuations can be significant, Two Sigma's investment suggests a long-term view on Bank of America's potential.

Conclusion: A Cautious Optimism

Two Sigma's increased stake in Bank of America warrants attention. While it signals a potentially positive outlook, investors should conduct their own thorough due diligence before making any investment decisions. The market outlook for BAC remains intertwined with broader economic conditions and the competitive landscape of the financial sector. Staying informed on macroeconomic trends and Bank of America's performance is crucial for navigating this dynamic environment. This insightful analysis offers valuable information, but remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Bank Of America (BAC) Stake: Analysis And Market Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

11 Dead In Wwii Bomber Crash Four Airmens Remains To Be Returned To Families

May 28, 2025

11 Dead In Wwii Bomber Crash Four Airmens Remains To Be Returned To Families

May 28, 2025 -

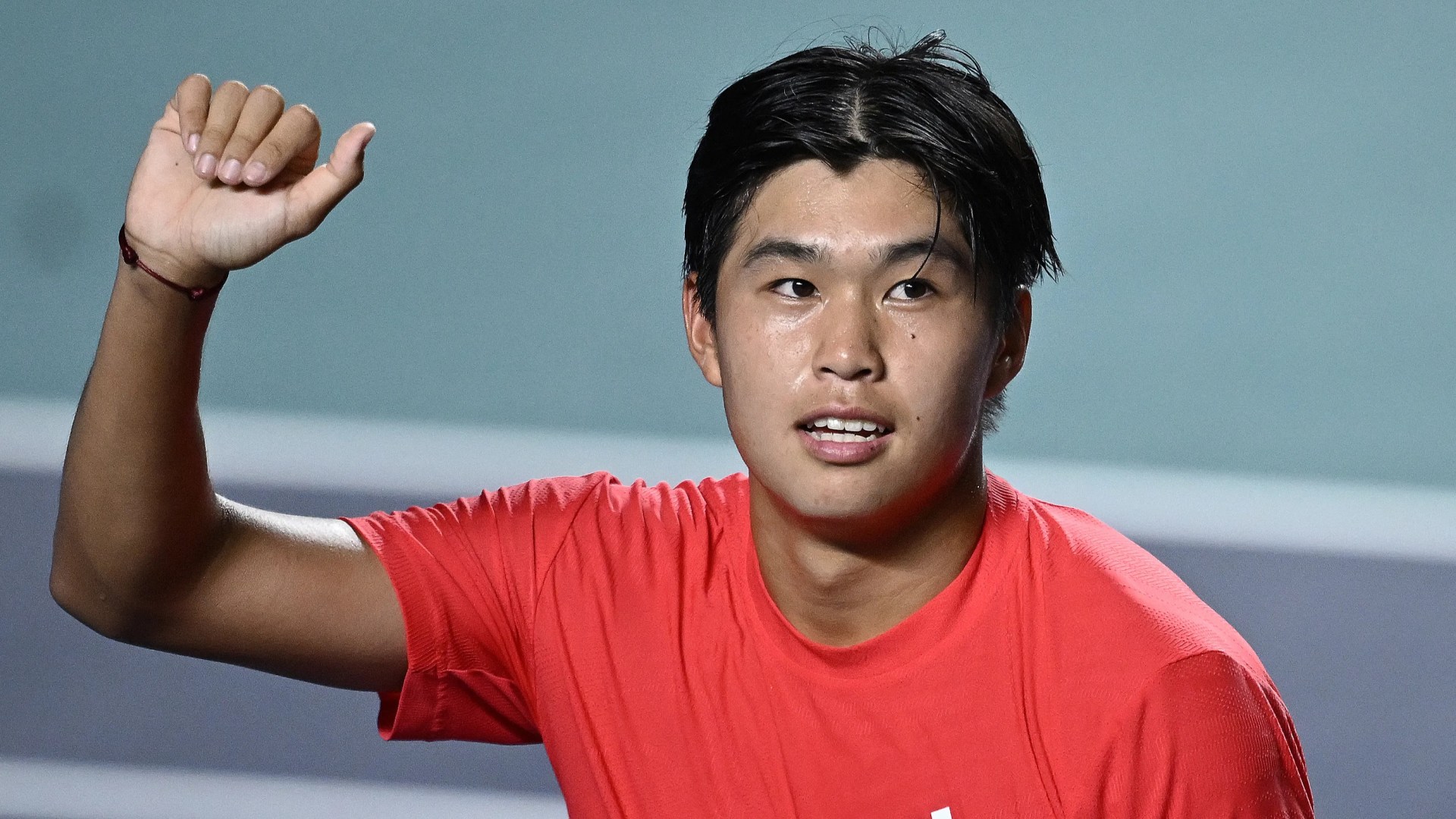

From Moms Job To Tennis Prodigy Us Star Targets World No 3

May 28, 2025

From Moms Job To Tennis Prodigy Us Star Targets World No 3

May 28, 2025 -

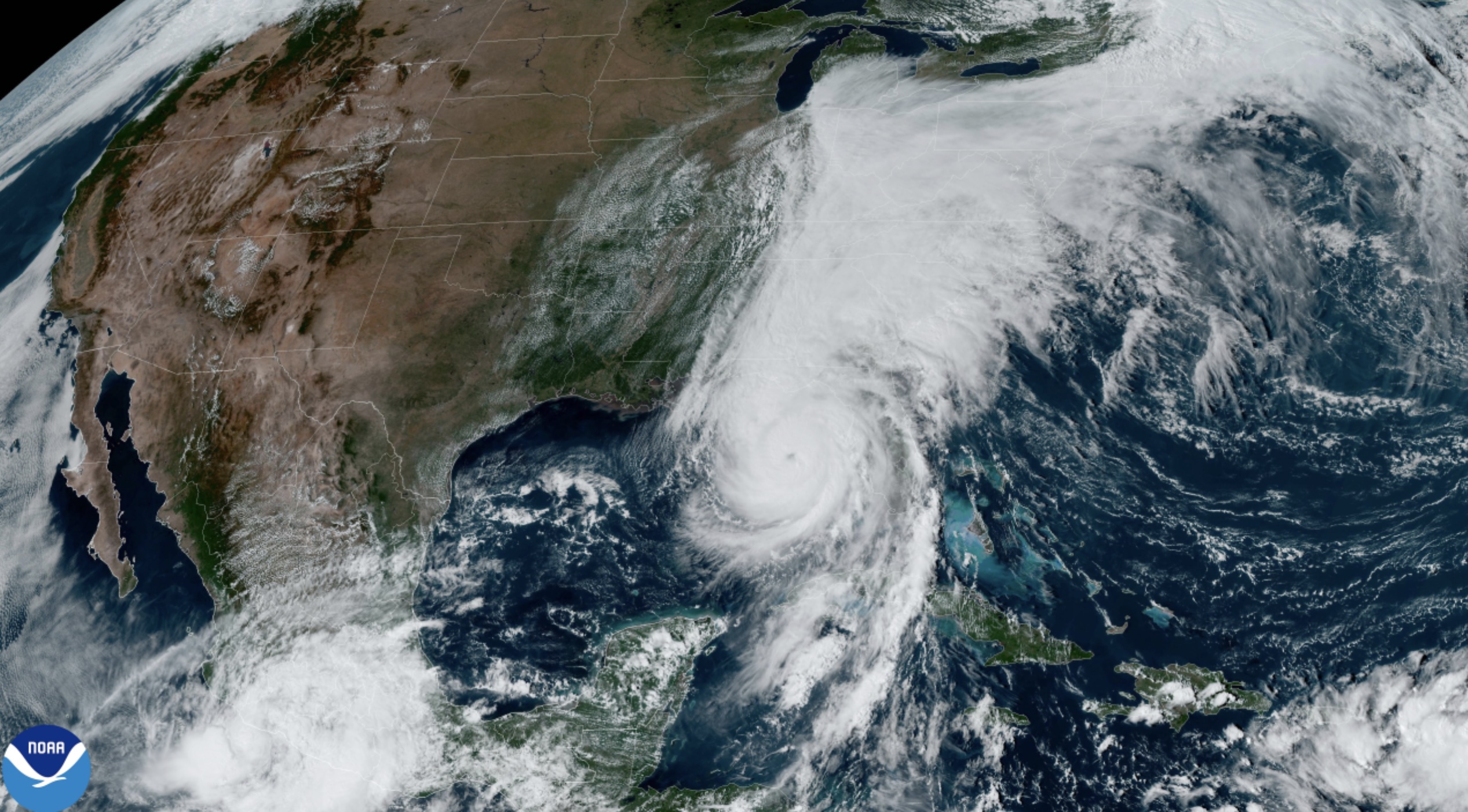

Above Normal Hurricane Season Forecast 10 Storms Could Hit The Us

May 28, 2025

Above Normal Hurricane Season Forecast 10 Storms Could Hit The Us

May 28, 2025 -

Jersey Shore Chaos Multiple Stabbings And Brawls Plague Seaside Heights Boardwalk

May 28, 2025

Jersey Shore Chaos Multiple Stabbings And Brawls Plague Seaside Heights Boardwalk

May 28, 2025 -

Baroness Mone A Case Study In Entrepreneurial Success And Failure

May 28, 2025

Baroness Mone A Case Study In Entrepreneurial Success And Failure

May 28, 2025

Latest Posts

-

Manchester Dog Attack Baby And Two Adults Fighting For Their Lives

Jun 01, 2025

Manchester Dog Attack Baby And Two Adults Fighting For Their Lives

Jun 01, 2025 -

Expert Roland Garros Picks Zverev Cobolli Griekspoor Quinn

Jun 01, 2025

Expert Roland Garros Picks Zverev Cobolli Griekspoor Quinn

Jun 01, 2025 -

Major Archaeological Find 3 000 Year Old Mayan Complex Revealed

Jun 01, 2025

Major Archaeological Find 3 000 Year Old Mayan Complex Revealed

Jun 01, 2025 -

Suge Knight Vs Diddy A Public Plea For Testimony And Humanization

Jun 01, 2025

Suge Knight Vs Diddy A Public Plea For Testimony And Humanization

Jun 01, 2025 -

Rehabilitation And Release A Flamstead Hawks Path To Freedom

Jun 01, 2025

Rehabilitation And Release A Flamstead Hawks Path To Freedom

Jun 01, 2025