Two Sigma's Bank Of America Bet: $236.55 Million Investment Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Big Bet: $236.55 Million Investment in Bank of America Explained

Two Sigma Investments, LP, a prominent quantitative investment firm, recently made headlines with a significant investment in Bank of America (BAC). The firm disclosed a staggering $236.55 million stake, sparking considerable interest and speculation within the financial world. This article delves into the details of this substantial investment, exploring the potential motivations behind Two Sigma's move and its implications for both the investor and Bank of America.

Understanding Two Sigma's Investment Strategy:

Two Sigma isn't your typical long-term buy-and-hold investor. Known for its data-driven, quantitative approach, the firm employs sophisticated algorithms and complex mathematical models to identify undervalued assets and potential market inefficiencies. Their investment strategy is characterized by:

- High-frequency trading: Two Sigma utilizes advanced technology to execute trades at incredibly high speeds, capitalizing on minuscule price fluctuations.

- Diversification: Their portfolio is remarkably diverse, spanning across various asset classes, including equities, fixed income, and derivatives.

- Algorithmic trading: Their core strategy relies heavily on proprietary algorithms to analyze vast datasets and predict market movements.

Why Bank of America? Deconstructing the Investment:

While Two Sigma rarely publicly discloses the reasoning behind specific investments, several factors may explain their significant stake in Bank of America:

- BAC's strong financial performance: Bank of America has demonstrated robust financial performance in recent years, recovering strongly from the 2008 financial crisis. Their consistent profitability and strong capital position make them an attractive investment for quantitative firms.

- Undervalued asset thesis: Two Sigma's algorithms may have identified Bank of America as an undervalued asset, presenting a potential for significant returns. This could be based on a variety of factors including future growth projections, earnings multiples, or even subtle market sentiment shifts detectable through their sophisticated data analysis.

- Macroeconomic factors: The current macroeconomic environment, including interest rate hikes and potential economic slowdown, could have influenced Two Sigma's decision. Bank of America's position in the financial sector makes it sensitive to these factors, presenting both risks and opportunities for investors like Two Sigma.

Implications for Bank of America and Investors:

Two Sigma's substantial investment could be interpreted as a vote of confidence in Bank of America's long-term prospects. This investment could potentially:

- Boost BAC's stock price: Large institutional investments often influence market sentiment, potentially leading to increased demand and a higher stock price.

- Attract further investment: The presence of a prominent quantitative firm like Two Sigma could attract other investors, further bolstering Bank of America's valuation.

- Signal market confidence: The investment could be seen as a positive indicator of overall confidence in the financial sector and the US economy.

Looking Ahead:

It remains to be seen how Two Sigma's investment in Bank of America will unfold. However, this significant move highlights the increasing influence of quantitative investment strategies in shaping the financial markets. The firm's data-driven approach and sophisticated algorithms continue to challenge traditional investment methods, emphasizing the growing importance of technology and analytics in the world of finance. Further analysis of Two Sigma's portfolio and market movements will be crucial in understanding the long-term impact of this substantial investment. Keep an eye on future financial news for updates on this developing story.

Keywords: Two Sigma, Bank of America, BAC, investment, quantitative investment, algorithmic trading, high-frequency trading, stock market, financial news, market analysis, investment strategy, macroeconomic factors, financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Bank Of America Bet: $236.55 Million Investment Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bank Of America Bac Among Top 8 Holdings For Financial Avengers Inc

May 27, 2025

Bank Of America Bac Among Top 8 Holdings For Financial Avengers Inc

May 27, 2025 -

Emotional Tribute French Open Bids Adieu To Rafael Nadal

May 27, 2025

Emotional Tribute French Open Bids Adieu To Rafael Nadal

May 27, 2025 -

5 108 Social Security Checks Payment Schedule And Eligibility

May 27, 2025

5 108 Social Security Checks Payment Schedule And Eligibility

May 27, 2025 -

The Meteoric Rise And Fall Of Baroness Mone

May 27, 2025

The Meteoric Rise And Fall Of Baroness Mone

May 27, 2025 -

Gary Lineker Exits Bbc His Final Match Of The Day Broadcast Marks 26 Year Legacy

May 27, 2025

Gary Lineker Exits Bbc His Final Match Of The Day Broadcast Marks 26 Year Legacy

May 27, 2025

Latest Posts

-

Pre Installation Planning Key To A Smooth Heat Pump Upgrade

May 31, 2025

Pre Installation Planning Key To A Smooth Heat Pump Upgrade

May 31, 2025 -

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies From Brain Cancer

May 31, 2025

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies From Brain Cancer

May 31, 2025 -

Althea Gibsons Legacy Celebrated 2025 Us Open Theme Unveiled

May 31, 2025

Althea Gibsons Legacy Celebrated 2025 Us Open Theme Unveiled

May 31, 2025 -

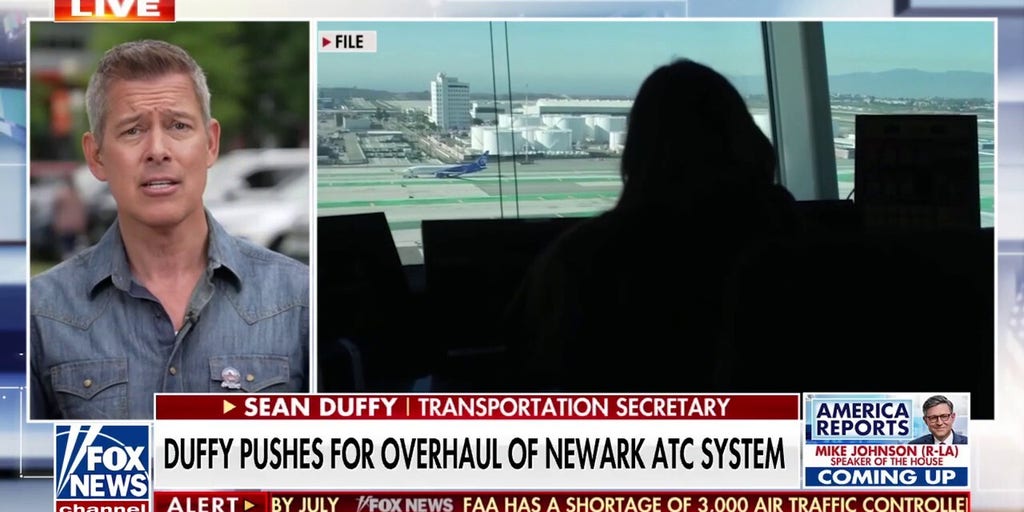

Newark Airport Delays Increase As Sec Duffy Presses For Air Traffic Control Reform

May 31, 2025

Newark Airport Delays Increase As Sec Duffy Presses For Air Traffic Control Reform

May 31, 2025 -

Analysis Kemi Badenochs Controversial Actions And The Tory Backlash

May 31, 2025

Analysis Kemi Badenochs Controversial Actions And The Tory Backlash

May 31, 2025