Two Sigma's Large Bank Of America (BAC) Position: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Massive Bank of America (BAC) Stake: What it Means for Investors

Two Sigma, the quantitative investment firm known for its sophisticated algorithms and data-driven strategies, recently revealed a significantly large position in Bank of America (BAC). This move has sent ripples through the financial markets, leaving many investors wondering: what does this mean for the future of Bank of America, and should you be adjusting your portfolio accordingly?

The sheer size of Two Sigma's investment signals a strong vote of confidence in Bank of America's prospects. While the exact details of their holdings remain partially obscured due to regulatory reporting complexities, the magnitude of their involvement suggests a bullish outlook on the bank's long-term performance. This is particularly noteworthy given Two Sigma's reputation for rigorous analysis and risk management. They don't typically make such substantial bets without a deep dive into the fundamentals.

What Factors Might Be Driving Two Sigma's Investment?

Several factors could be contributing to Two Sigma's significant investment in BAC:

-

Strong Earnings and Growth Potential: Bank of America has consistently shown strong earnings growth in recent quarters, driven by factors such as rising interest rates and increased loan demand. This robust performance is a key attraction for any long-term investor.

-

Improved Efficiency and Cost Management: The bank has implemented significant cost-cutting measures and streamlined operations, leading to improved profitability and a stronger balance sheet. These internal improvements are crucial for long-term sustainability.

-

Positive Economic Outlook (Potentially): While economic uncertainty persists globally, a relatively positive outlook – at least in the short to medium term – could be factored into Two Sigma's assessment. This suggests a belief that Bank of America is well-positioned to weather potential economic headwinds.

-

Undervalued Asset: Two Sigma's sophisticated algorithms might have identified Bank of America as an undervalued asset, presenting a compelling opportunity for significant returns. Their quantitative approach allows them to identify subtle market inefficiencies that might be missed by traditional fundamental analysis.

What Should Investors Do?

Two Sigma's large position in Bank of America doesn't automatically translate into a "buy" signal for every investor. It's crucial to conduct your own thorough due diligence before making any investment decisions. Consider these points:

-

Your Risk Tolerance: Bank of America, like any financial institution, carries inherent risks. Assess whether this level of risk aligns with your overall investment strategy and risk tolerance.

-

Diversification: Remember the importance of diversification. Don't put all your eggs in one basket. Even with positive signals, a diversified portfolio is crucial for mitigating risk.

-

Long-Term vs. Short-Term Goals: Two Sigma's investment likely reflects a long-term view. Consider your own investment horizon before making any changes to your portfolio.

Conclusion:

Two Sigma's substantial investment in Bank of America is a significant development worthy of attention. While it indicates a strong belief in the bank's future performance, investors should conduct their own research and consider their individual circumstances before making any investment decisions. Always consult with a qualified financial advisor before making significant changes to your portfolio. Stay informed about market trends and financial news to make informed decisions. Learn more about and to better protect your investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Large Bank Of America (BAC) Position: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

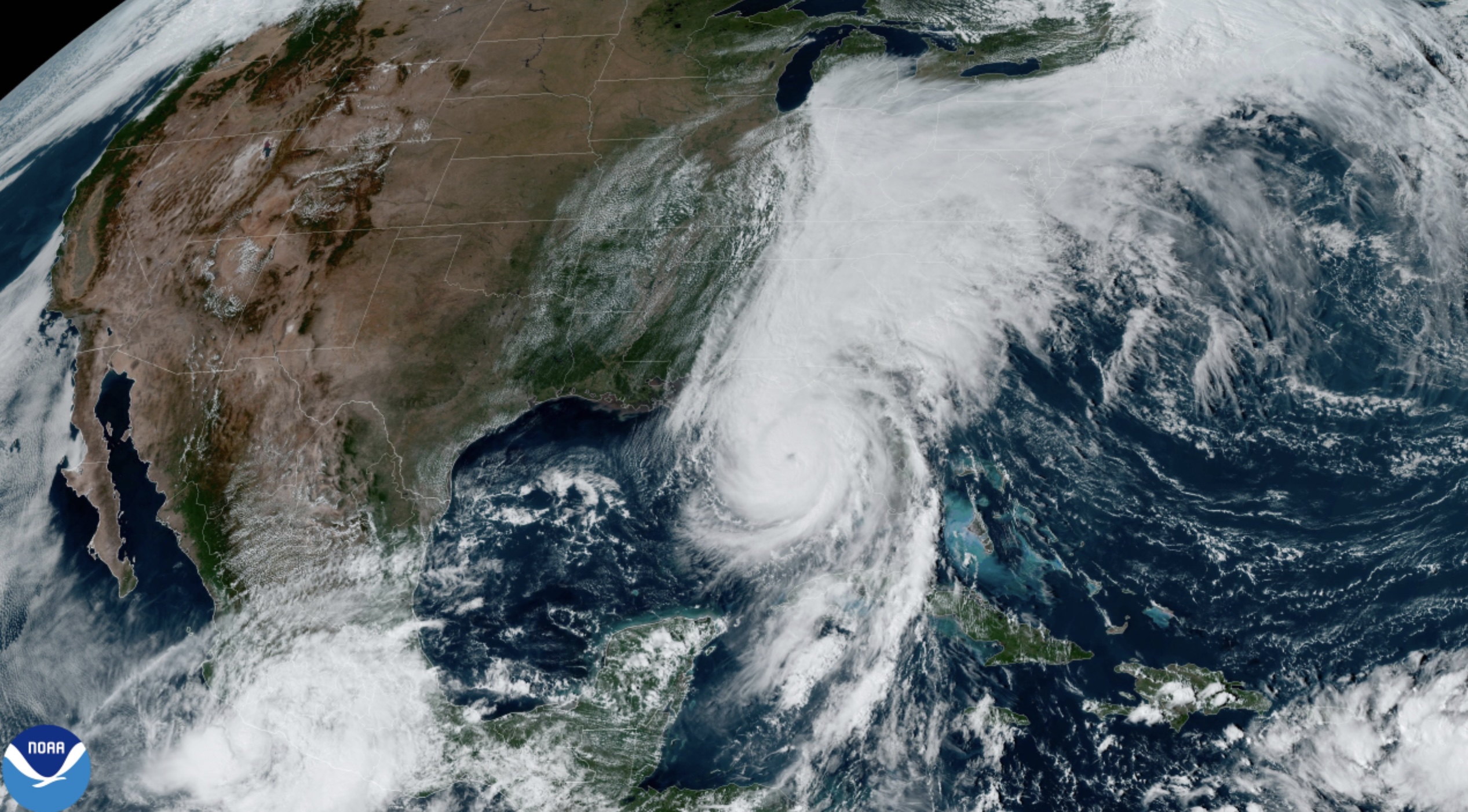

Us Summer Hurricane Outlook Above Normal Conditions Mean Increased Risk

May 28, 2025

Us Summer Hurricane Outlook Above Normal Conditions Mean Increased Risk

May 28, 2025 -

Canada Us Relations Navigating The Boycott And Travel Implications

May 28, 2025

Canada Us Relations Navigating The Boycott And Travel Implications

May 28, 2025 -

Livestock At Risk Examining The Link Between Climate Change Denial And Pest Resurgence Under Trump

May 28, 2025

Livestock At Risk Examining The Link Between Climate Change Denial And Pest Resurgence Under Trump

May 28, 2025 -

Pdd Holdings Reports Q1 2025 Financial Results E Commerce Growth And Performance Analysis

May 28, 2025

Pdd Holdings Reports Q1 2025 Financial Results E Commerce Growth And Performance Analysis

May 28, 2025 -

Birmingham Capital Management Co Inc Al Adjusts Bank Of America Bac Position

May 28, 2025

Birmingham Capital Management Co Inc Al Adjusts Bank Of America Bac Position

May 28, 2025

Latest Posts

-

Trumps Anger At Putin Fuels Consideration Of Fresh Sanctions

May 29, 2025

Trumps Anger At Putin Fuels Consideration Of Fresh Sanctions

May 29, 2025 -

Us Imposes Stricter Visa Requirements Social Media Checks Expand

May 29, 2025

Us Imposes Stricter Visa Requirements Social Media Checks Expand

May 29, 2025 -

Viral Video Passengers Unlikely Encounter With Birds On Delta Plane

May 29, 2025

Viral Video Passengers Unlikely Encounter With Birds On Delta Plane

May 29, 2025 -

The Psychology Behind Americas Manhunt Mania Analyzing Recent Jailbreaks

May 29, 2025

The Psychology Behind Americas Manhunt Mania Analyzing Recent Jailbreaks

May 29, 2025 -

Roland Garros 2024 A Epica Vitoria De Henrique Rocha

May 29, 2025

Roland Garros 2024 A Epica Vitoria De Henrique Rocha

May 29, 2025