Two Sigma's Large Bank Of America Investment: What Does It Mean For BAC Stock?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Massive Bank of America Investment: Bullish Signal or Strategic Move?

Two Sigma, the highly respected quantitative investment firm, recently made headlines with a significant increase in its Bank of America (BAC) holdings. This substantial investment has sent ripples through the financial markets, sparking considerable speculation about the future trajectory of BAC stock. But what does this move really mean for investors? Let's delve into the details.

Two Sigma's Strategic Stake:

Two Sigma's SEC filings reveal a considerable expansion of their Bank of America position. While the exact figures fluctuate depending on the reporting period, the sheer scale of the investment is undeniably noteworthy. This isn't a small, passive holding; it's a significant bet on Bank of America's future performance. This bold move by a firm known for its data-driven, sophisticated investment strategies warrants close examination.

What's Driving Two Sigma's Confidence in BAC?

Several factors could be contributing to Two Sigma's bullish stance on Bank of America:

- Strong Earnings and Financial Health: Bank of America has consistently delivered solid earnings reports, demonstrating resilience in the face of economic uncertainty. Their strong capital position and effective risk management further bolster investor confidence.

- Interest Rate Hikes: The ongoing cycle of interest rate hikes by the Federal Reserve is generally positive for banks, as it allows them to widen their net interest margins. Bank of America, with its considerable loan portfolio, stands to benefit significantly from this trend.

- Growth Potential: Bank of America continues to invest in technology and digital banking, positioning itself for future growth and market share expansion. This strategic focus on innovation is attractive to forward-thinking investors like Two Sigma.

- Undervalued Stock: Some analysts believe that Bank of America's stock price may currently be undervalued relative to its fundamentals and future potential. This perception could be a key driver behind Two Sigma's significant investment.

What This Means for BAC Stock:

Two Sigma's substantial investment can be interpreted in several ways:

- Positive Market Sentiment: The move serves as a vote of confidence, potentially influencing other investors and boosting market sentiment surrounding BAC stock. This could lead to increased buying pressure and upward price movement.

- Strategic Partnership Potential: While less likely, the investment could signal a potential for a deeper, strategic partnership between Two Sigma and Bank of America in the future.

- Long-Term Investment Strategy: Two Sigma's investment likely reflects a long-term view on Bank of America's prospects, suggesting a belief in sustainable growth and profitability over an extended period.

Risks to Consider:

While the outlook appears positive, it's crucial to acknowledge potential risks:

- Economic Downturn: A significant economic slowdown could negatively impact Bank of America's performance, potentially affecting the value of Two Sigma's investment.

- Regulatory Changes: Changes in financial regulations could also impact Bank of America's profitability and its stock price.

- Competition: Increased competition within the banking sector could also pose a challenge to Bank of America's future growth.

Conclusion:

Two Sigma's large investment in Bank of America is a significant development that warrants attention from investors. While not a guaranteed predictor of future performance, it suggests a positive outlook on BAC's potential. However, as with any investment, careful consideration of both the potential upsides and the inherent risks is crucial before making any decisions. Always conduct thorough research and consult with a financial advisor before making investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Large Bank Of America Investment: What Does It Mean For BAC Stock?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

73 Arrested Boardwalk Closed Details On Jersey Shore Memorial Day Weekend Disturbances

May 27, 2025

73 Arrested Boardwalk Closed Details On Jersey Shore Memorial Day Weekend Disturbances

May 27, 2025 -

Driving Lessons Cost Barrier For Learners Before Tests

May 27, 2025

Driving Lessons Cost Barrier For Learners Before Tests

May 27, 2025 -

Hs 2 Probes Staffing Firms For West Midlands Section

May 27, 2025

Hs 2 Probes Staffing Firms For West Midlands Section

May 27, 2025 -

Their Dc Love Story A Journey From Afar Ended Too Soon

May 27, 2025

Their Dc Love Story A Journey From Afar Ended Too Soon

May 27, 2025 -

Macron Et Brigitte Au Vietnam Une Chamaillerie Dementie Par L Entourage Presidentiel

May 27, 2025

Macron Et Brigitte Au Vietnam Une Chamaillerie Dementie Par L Entourage Presidentiel

May 27, 2025

Latest Posts

-

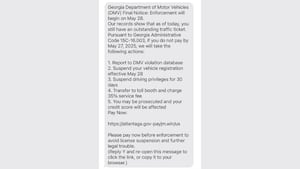

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025