Two Sigma's Large Bank Of America Investment: What Does It Mean For Investors?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Massive Bank of America Investment: What it Means for Investors

Two Sigma, the quantitative investment firm known for its data-driven approach, has made a significant investment in Bank of America (BAC), sending ripples through the financial markets. This move has sparked considerable interest and speculation among investors, prompting questions about the future performance of both the investment firm and the banking giant. What does this substantial investment signify, and what implications does it hold for investors?

This article delves into the details of Two Sigma's investment, analyzing its potential impact on Bank of America's stock price and the broader financial landscape. We'll examine the factors driving this strategic move and offer insights for investors considering their own positions.

The Significance of Two Sigma's Investment

Two Sigma's investment in Bank of America is noteworthy for several reasons:

-

Scale of Investment: The exact figures haven't been publicly disclosed, but reports suggest a substantial stake, signaling a strong vote of confidence in Bank of America's future prospects. This level of investment implies a thorough due diligence process by Two Sigma, indicating a positive outlook on BAC's long-term performance.

-

Two Sigma's Data-Driven Approach: Unlike traditional investment firms, Two Sigma relies heavily on quantitative analysis and advanced algorithms to identify undervalued assets. Their investment in Bank of America suggests that their models have predicted positive growth and potential for increased returns. This data-driven approach lends credibility to their decision.

-

Potential Market Indicators: Large institutional investors like Two Sigma rarely make such substantial investments without rigorous analysis. Their move could be interpreted as a bullish signal for Bank of America's stock, potentially influencing other investors to follow suit. This could lead to increased demand and a rise in BAC's share price.

What Drives Two Sigma's Confidence in Bank of America?

Several factors likely contributed to Two Sigma's decision:

-

Bank of America's Financial Strength: Bank of America has consistently demonstrated strong financial performance, showcasing resilience in the face of economic uncertainty. Their robust balance sheet and diverse revenue streams likely played a significant role in Two Sigma's assessment.

-

Growth Potential: The bank's strategic initiatives, including investments in technology and digital banking, may have impressed Two Sigma's analysts. These initiatives aim to enhance efficiency and attract new customers, indicating substantial growth potential.

-

Undervalued Asset: Two Sigma's data-driven models may have identified Bank of America as an undervalued asset in the current market. This suggests that they see an opportunity for significant capital appreciation.

What Should Investors Do?

Two Sigma's investment in Bank of America is certainly a significant event. However, it's crucial for investors to remember that this doesn't guarantee future success. Before making any investment decisions, consider the following:

-

Conduct Your Own Due Diligence: Don't solely rely on the actions of other investors. Conduct your own thorough research to understand Bank of America's financial position, risks, and future growth potential.

-

Diversification is Key: Never put all your eggs in one basket. Diversifying your investment portfolio across different asset classes and sectors is crucial for mitigating risk.

-

Consult a Financial Advisor: Consider seeking advice from a qualified financial advisor who can help you make informed decisions based on your individual financial goals and risk tolerance.

Conclusion:

Two Sigma's large investment in Bank of America is a compelling development that warrants attention from investors. While it signifies a positive outlook on BAC's future, it's essential to conduct thorough research and consider your personal risk tolerance before making any investment decisions. Remember to consult with a financial professional for personalized guidance. The financial landscape is complex, and informed decisions are crucial for achieving your investment objectives.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Large Bank Of America Investment: What Does It Mean For Investors?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alexandra Daddarios Sheer Lace Dior Cruise Outfit A Closer Look

May 28, 2025

Alexandra Daddarios Sheer Lace Dior Cruise Outfit A Closer Look

May 28, 2025 -

Viral Video Sparks Debate Macrons Interaction With Wife Brigitte Examined

May 28, 2025

Viral Video Sparks Debate Macrons Interaction With Wife Brigitte Examined

May 28, 2025 -

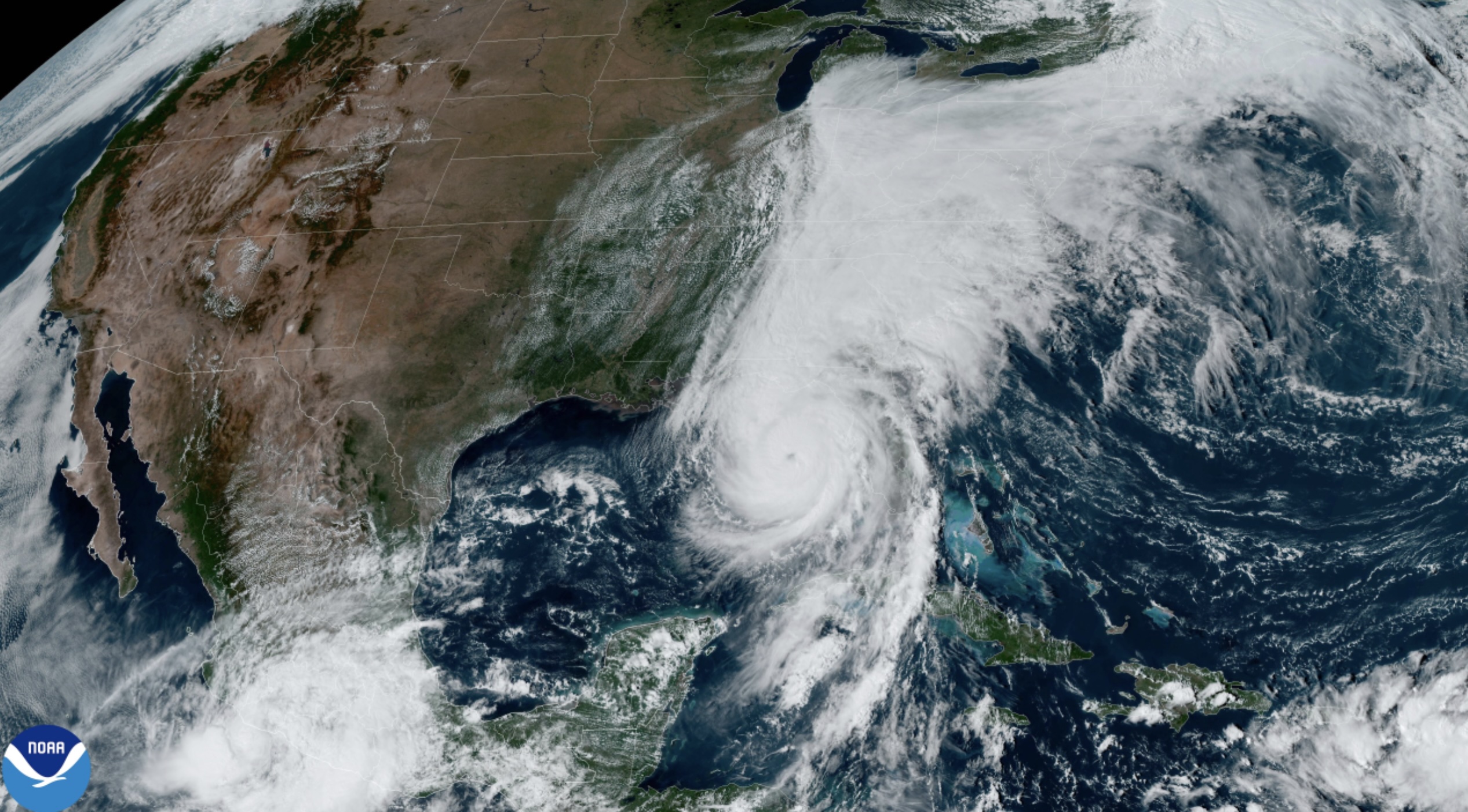

Up To 10 Hurricanes Possible This Summer Above Normal Atlantic Season Predicted

May 28, 2025

Up To 10 Hurricanes Possible This Summer Above Normal Atlantic Season Predicted

May 28, 2025 -

See Alexandra Daddarios See Through Gown At The Dior Cruise Event

May 28, 2025

See Alexandra Daddarios See Through Gown At The Dior Cruise Event

May 28, 2025 -

New Orleans Jail Escape The Roles Of Seven Alleged Accomplices Revealed

May 28, 2025

New Orleans Jail Escape The Roles Of Seven Alleged Accomplices Revealed

May 28, 2025

Latest Posts

-

Althea Gibsons Impact Central Theme Of The 2025 Us Open

May 31, 2025

Althea Gibsons Impact Central Theme Of The 2025 Us Open

May 31, 2025 -

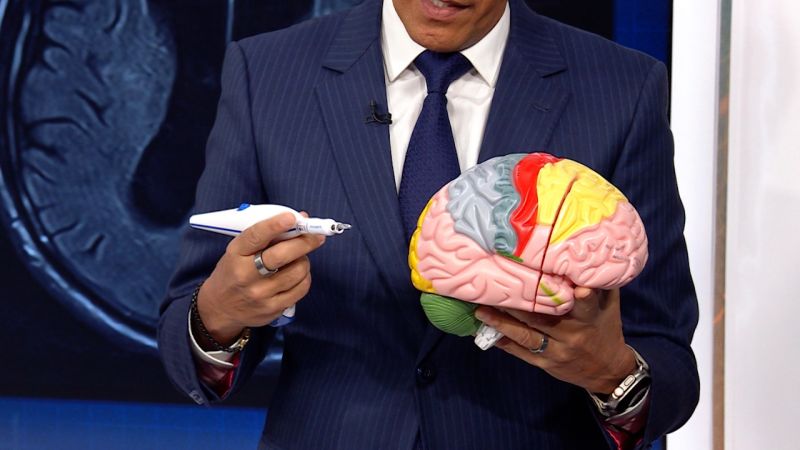

Understanding Billy Joels Neurological Disorder A Medical Perspective From Dr Sanjay Gupta

May 31, 2025

Understanding Billy Joels Neurological Disorder A Medical Perspective From Dr Sanjay Gupta

May 31, 2025 -

New York Knicks Ending The Drought And Contending For A Championship

May 31, 2025

New York Knicks Ending The Drought And Contending For A Championship

May 31, 2025 -

Sheinelle Jones Husband Uche Ojeh Dies At 45

May 31, 2025

Sheinelle Jones Husband Uche Ojeh Dies At 45

May 31, 2025 -

Early Heart Disease Risk Elevated By Smoking Weed And Consuming Thc Edibles Study

May 31, 2025

Early Heart Disease Risk Elevated By Smoking Weed And Consuming Thc Edibles Study

May 31, 2025