Two Sigma's Recent Stake In Bank Of America (BAC): A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Recent Stake in Bank of America (BAC): A Detailed Analysis

Two Sigma Investments, a prominent quantitative investment firm, recently increased its stake in Bank of America (BAC), sparking considerable interest and speculation within the financial community. This move, detailed in recent SEC filings, signals a potential vote of confidence in the banking giant's future performance, but also raises questions about Two Sigma's investment strategy and the broader outlook for the financial sector. This article delves into the details of this significant investment, exploring the potential implications for both Bank of America and the market as a whole.

Understanding Two Sigma's Investment Approach:

Two Sigma isn't your typical investment firm. Known for its data-driven, quantitative approach, they leverage advanced algorithms and vast datasets to identify undervalued assets and predict market trends. Their investment in BAC suggests a thorough analysis indicating positive growth potential, potentially overlooked by other investors. This contrasts with more traditional fundamental analysis, focusing on qualitative factors like management quality and industry trends. This focus on quantitative analysis makes their decision to increase their BAC holdings all the more significant.

Why Bank of America? A Look at the Fundamentals:

Bank of America, one of the "Big Four" US banks, has been steadily strengthening its financial position in recent years. Several factors likely contributed to Two Sigma's decision:

- Strong Earnings Growth: BAC has consistently reported robust earnings, fueled by rising interest rates and increased loan demand. This financial stability is a key attraction for quantitative investors like Two Sigma.

- Improved Efficiency: Bank of America has implemented cost-cutting measures and streamlined operations, boosting profitability and shareholder returns.

- Robust Capital Position: A strong capital position provides a buffer against potential economic downturns, mitigating risk for investors.

- Diversified Revenue Streams: BAC's diversified business model, encompassing retail banking, investment banking, and wealth management, lessens its vulnerability to fluctuations in any single sector.

The Implications of Two Sigma's Investment:

Two Sigma's increased stake in Bank of America could have several implications:

- Market Confidence: The move could signal increased confidence in BAC's future prospects, potentially driving up the stock price. Other institutional investors might follow suit, further bolstering BAC's value.

- Strategic Partnership Potential: While unlikely in the immediate future, it's possible that this increased stake could pave the way for future collaborations between the two entities.

- Increased Scrutiny: The investment will undoubtedly lead to increased scrutiny of Bank of America's performance and future strategies. This increased attention could benefit BAC by highlighting its strengths to a broader audience.

Looking Ahead: Potential Risks and Opportunities:

While the investment appears promising, it's crucial to consider potential risks:

- Economic Slowdown: A significant economic downturn could negatively impact Bank of America's performance, affecting Two Sigma's investment.

- Regulatory Changes: Changes in banking regulations could also impact profitability and profitability.

- Competition: Intense competition within the financial services industry remains a challenge.

Despite these risks, Bank of America’s current trajectory and Two Sigma’s data-driven approach suggest a positive outlook. The investment highlights BAC's potential for continued growth and profitability in a dynamic market environment.

Conclusion:

Two Sigma's increased stake in Bank of America represents a significant development in the financial world. Their quantitative investment strategy, focusing on data-driven analysis, lends further credence to the positive outlook for BAC. While inherent risks exist in any investment, the combination of BAC's improving fundamentals and Two Sigma's sophisticated approach suggests a potentially lucrative and strategically sound move. The coming months will be crucial in observing the long-term impact of this investment and its implications for both companies and the broader market. Keep an eye on both BAC's performance and Two Sigma's future investment decisions for further insights.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Recent Stake In Bank Of America (BAC): A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Incident Macron Macron L Elysee S Explique Sur La Video Qui Circule

May 27, 2025

Incident Macron Macron L Elysee S Explique Sur La Video Qui Circule

May 27, 2025 -

Michael Gaine Missing Kerry Farmer Found Deceased Human Remains Identified

May 27, 2025

Michael Gaine Missing Kerry Farmer Found Deceased Human Remains Identified

May 27, 2025 -

French Open Round 1 Zverev Vs Tien And Mensik Vs Muller Predictions

May 27, 2025

French Open Round 1 Zverev Vs Tien And Mensik Vs Muller Predictions

May 27, 2025 -

I Phone I Os 18 4 1 Is It Worth Installing A Detailed Analysis

May 27, 2025

I Phone I Os 18 4 1 Is It Worth Installing A Detailed Analysis

May 27, 2025 -

Social Security Recipients Preparing For Potential 15 Payment Cuts In June 2025

May 27, 2025

Social Security Recipients Preparing For Potential 15 Payment Cuts In June 2025

May 27, 2025

Latest Posts

-

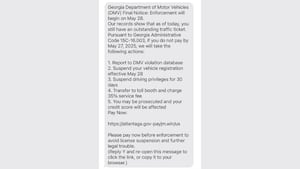

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025