Two Sigma's Significant Bank Of America Investment: Implications For BAC Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Big Bet on Bank of America: What it Means for BAC Stock

Two Sigma Investments, a prominent quantitative investment firm, has significantly increased its stake in Bank of America (BAC), sending ripples through the financial markets. This move has sparked considerable interest among investors, prompting questions about the future trajectory of BAC stock. This article delves into the implications of Two Sigma's investment, examining potential catalysts and risks for Bank of America's share price.

Two Sigma's reputation for sophisticated data analysis and algorithmic trading makes its investment decisions highly noteworthy. Their increased holdings suggest a bullish outlook on Bank of America's prospects. But what factors might be driving this confidence?

Potential Catalysts for BAC Stock Growth

Several factors could be contributing to Two Sigma's optimistic assessment of Bank of America:

-

Strong Earnings Performance: Bank of America has consistently delivered robust earnings reports in recent quarters, exceeding analysts' expectations. This demonstrates the bank's resilience in a challenging economic climate and its ability to generate strong returns for shareholders. [Link to recent Bank of America earnings report]

-

Interest Rate Hikes: The Federal Reserve's ongoing interest rate hikes are generally positive for banks like Bank of America. Higher rates allow banks to earn more on loans and investments, boosting profitability. This is a key factor driving the current banking sector rally.

-

Economic Recovery: While economic uncertainty persists, there are signs suggesting a potential economic recovery. This positive outlook could benefit Bank of America, as increased economic activity usually translates to higher loan demand and increased banking activity.

-

Two Sigma's Algorithmic Insight: It's crucial to remember that Two Sigma's investment decisions are driven by sophisticated algorithms and data analysis. Their increased stake likely reflects their models' prediction of future positive performance for BAC stock, based on factors that may not be immediately apparent to the average investor.

Potential Risks and Considerations

While the outlook appears positive, investors should be aware of potential risks:

-

Economic Slowdown: A sharper-than-expected economic slowdown could negatively impact Bank of America's loan portfolio and profitability. This remains a significant risk factor for the entire financial sector.

-

Geopolitical Uncertainty: Global geopolitical instability, including the ongoing war in Ukraine and rising inflation, continues to create uncertainty in the markets and could impact Bank of America's performance.

-

Regulatory Scrutiny: The banking sector is subject to significant regulatory oversight. Changes in regulations could impact profitability and strategic initiatives.

What Should Investors Do?

Two Sigma's significant investment in Bank of America is a strong signal of confidence in the bank's future performance. However, it's vital to conduct thorough due diligence before making any investment decisions. Consider diversifying your portfolio and seeking professional financial advice tailored to your risk tolerance and investment goals. This is not a recommendation to buy or sell BAC stock, but rather an analysis of the implications of a significant investment by a major player in the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Significant Bank Of America Investment: Implications For BAC Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Village Residents Clash With Developers Over Sewage Capacity Issues

May 28, 2025

Historic Village Residents Clash With Developers Over Sewage Capacity Issues

May 28, 2025 -

Sirius Xms Stock Market Success A Look At Its History And Future Potential

May 28, 2025

Sirius Xms Stock Market Success A Look At Its History And Future Potential

May 28, 2025 -

Environmental Concerns Dead Minke Whale Washes Ashore In Portstewart

May 28, 2025

Environmental Concerns Dead Minke Whale Washes Ashore In Portstewart

May 28, 2025 -

Trading California For Germany A Reluctant Expat Shares Her Story

May 28, 2025

Trading California For Germany A Reluctant Expat Shares Her Story

May 28, 2025 -

Us Tennis Prodigy Named For Moms Career Challenges Top Ranked Player

May 28, 2025

Us Tennis Prodigy Named For Moms Career Challenges Top Ranked Player

May 28, 2025

Latest Posts

-

Legal Setback For Trump Trade Court Rejects Global Tariff Policy

May 30, 2025

Legal Setback For Trump Trade Court Rejects Global Tariff Policy

May 30, 2025 -

Ohioans Face Higher Electricity Bills Duke Energy Rate Increase Details

May 30, 2025

Ohioans Face Higher Electricity Bills Duke Energy Rate Increase Details

May 30, 2025 -

Controversy Erupts In California High School Track Over Transgender Participation

May 30, 2025

Controversy Erupts In California High School Track Over Transgender Participation

May 30, 2025 -

Detroit Grand Prix 2025 Complete Guide To Free Events And Traffic Information

May 30, 2025

Detroit Grand Prix 2025 Complete Guide To Free Events And Traffic Information

May 30, 2025 -

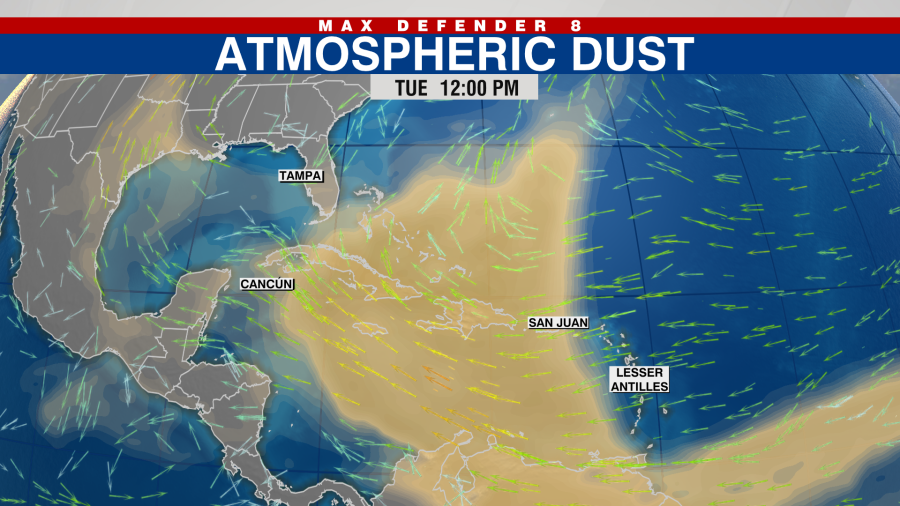

Saharan Dust Plumes Arrival In Florida Potential Effects On Weather And Health

May 30, 2025

Saharan Dust Plumes Arrival In Florida Potential Effects On Weather And Health

May 30, 2025