Two Sigma's Significant Stake In Bank Of America: Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Significant Stake in Bank of America: Implications for Investors

Two Sigma Investments, the quantitative investment firm known for its data-driven approach, has quietly amassed a substantial stake in Bank of America (BAC), sparking considerable interest and speculation among market analysts. This significant investment raises important questions about the future direction of both Bank of America and the broader financial sector. What does this move signify, and what are the potential implications for investors? Let's delve into the details.

Two Sigma's Strategic Move: A Vote of Confidence or Something More?

Two Sigma's investment in Bank of America is no small feat. The size of their holding, while not publicly disclosed in full detail due to reporting regulations, represents a considerable financial commitment. This bold move could be interpreted in several ways:

- A vote of confidence in Bank of America's long-term prospects: Two Sigma's reputation rests on rigorous data analysis. Their investment suggests a positive outlook on BAC's future performance, potentially driven by factors such as strong earnings growth, robust risk management, or anticipated market share gains.

- An opportunistic investment based on undervalued assets: Alternatively, Two Sigma may have identified Bank of America as an undervalued asset ripe for appreciation. Their sophisticated algorithms may have detected market inefficiencies or underestimated growth potential that others haven't recognized.

- A strategic play within a larger portfolio: Two Sigma manages a diverse portfolio. This investment might be part of a broader strategy to diversify holdings or capitalize on potential synergies between Bank of America and other companies within their portfolio.

Implications for Bank of America Shareholders:

The implications of Two Sigma's involvement are multifaceted for existing Bank of America shareholders:

- Potential for increased share price: A significant investor like Two Sigma can exert influence on a company's stock price, potentially driving up demand and boosting the share value.

- Enhanced corporate governance: While the extent of Two Sigma's influence remains to be seen, their substantial stake could encourage improved corporate governance and operational efficiency at Bank of America.

- Increased market scrutiny: The increased attention brought by Two Sigma's investment will likely lead to more market scrutiny of Bank of America's performance, potentially benefiting long-term shareholders through increased transparency and accountability.

What This Means for Other Investors:

Two Sigma's move provides several valuable insights for other investors considering a position in Bank of America or similar financial institutions:

- The importance of fundamental analysis: Two Sigma's success highlights the crucial role of fundamental analysis and data-driven decision-making in successful investment strategies.

- Identifying undervalued assets: The investment underscores the potential for identifying undervalued assets in seemingly mature sectors like finance.

- Diversification and risk management: Two Sigma's approach emphasizes the importance of diversification and robust risk management within a well-structured investment portfolio.

Looking Ahead: Uncertainty and Opportunity

While Two Sigma's investment in Bank of America suggests a positive outlook, it's crucial to remember that the financial markets remain inherently unpredictable. This move doesn't guarantee future success for Bank of America, but it does offer a compelling case study in how sophisticated investors approach the market. Investors should conduct their own due diligence before making any investment decisions and consider consulting with a financial advisor. Stay tuned for further developments and market reactions as this story unfolds. This situation highlights the dynamic nature of the investment landscape and the continuous need for informed decision-making.

Keywords: Two Sigma, Bank of America, BAC, investment, stock market, quantitative investment, financial markets, data-driven investing, portfolio diversification, corporate governance, undervalued assets, market analysis, investment strategy, shareholder value.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Significant Stake In Bank Of America: Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wwii Plane Crash Eleven Dead Four Airmen Identified After Decades

May 27, 2025

Wwii Plane Crash Eleven Dead Four Airmen Identified After Decades

May 27, 2025 -

Driving Lessons Cost Concerns Rise As Learners Face Pre Test Payment Hurdles

May 27, 2025

Driving Lessons Cost Concerns Rise As Learners Face Pre Test Payment Hurdles

May 27, 2025 -

French Open R1 In Depth Preview And Predictions For Zverev Tien Mensik And Muller

May 27, 2025

French Open R1 In Depth Preview And Predictions For Zverev Tien Mensik And Muller

May 27, 2025 -

Jersey Shore Violence Investigation Launched After Seaside Heights Stabbings

May 27, 2025

Jersey Shore Violence Investigation Launched After Seaside Heights Stabbings

May 27, 2025 -

Everest Speed Climb Concerns Rise Over Anesthetic Gas Assistance

May 27, 2025

Everest Speed Climb Concerns Rise Over Anesthetic Gas Assistance

May 27, 2025

Latest Posts

-

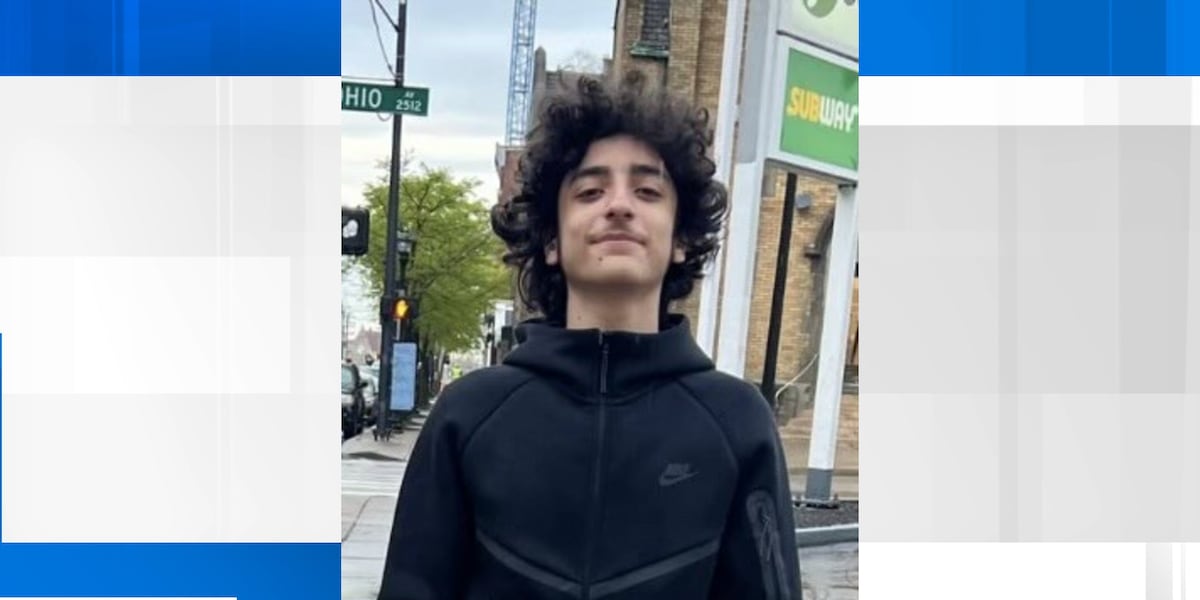

Lexington Teen Missing Police Investigation And Community Search Underway

May 31, 2025

Lexington Teen Missing Police Investigation And Community Search Underway

May 31, 2025 -

Understanding The Saharan Dust Plumes Effects On Florida

May 31, 2025

Understanding The Saharan Dust Plumes Effects On Florida

May 31, 2025 -

Elon Musk Steps Down Analyzing His Time In The Trump Administration

May 31, 2025

Elon Musk Steps Down Analyzing His Time In The Trump Administration

May 31, 2025 -

Total Disaster Internal Tory Criticism Mounts Against Kemi Badenoch

May 31, 2025

Total Disaster Internal Tory Criticism Mounts Against Kemi Badenoch

May 31, 2025 -

Devastation In Switzerland Glacier Collapse Destroys Blatten

May 31, 2025

Devastation In Switzerland Glacier Collapse Destroys Blatten

May 31, 2025