Two US Stocks Buffett Dumped: Implications For American Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two US Stocks Buffett Dumped: Implications for American Investors

Warren Buffett's recent moves have sent ripples through the investment world. The Oracle of Omaha, renowned for his long-term investment strategy, significantly reduced his holdings in two major US companies: Occidental Petroleum (OXY) and Bank of America (BAC). This news has left many American investors wondering: what does this mean for their portfolios? Should they follow suit and sell? Let's delve into the implications.

Buffett's Reduced Stake: Occidental Petroleum and Bank of America

Buffett's Berkshire Hathaway significantly decreased its stake in Occidental Petroleum, a move that surprised many analysts. While Berkshire Hathaway remains a major shareholder, the reduction signals a potential shift in Buffett's outlook on the energy sector. This could be interpreted in several ways: a belief that OXY's stock price has reached its peak, a reassessment of the long-term prospects of the oil and gas industry in the face of growing environmental concerns, or a simple portfolio rebalancing strategy.

Similarly, the reduction in Bank of America holdings, although less dramatic than the OXY move, is also noteworthy. Bank of America, a major player in the US financial sector, has faced challenges recently, including concerns about rising interest rates and a potential economic slowdown. This decrease in holdings could reflect Buffett’s cautious approach to the banking sector’s current climate.

What Should American Investors Do?

Buffett's actions are never insignificant, but they shouldn't be interpreted as definitive buy or sell signals. His investment decisions are based on a complex analysis of various factors, and mimicking his every move is rarely a sound investment strategy.

Instead of blindly following Buffett's lead, American investors should:

- Conduct thorough due diligence: Before making any investment decisions, research the companies individually. Analyze their financial statements, future prospects, and competitive landscape. Consider consulting with a qualified financial advisor.

- Assess your own risk tolerance: Buffett's investment strategy is known for its long-term, value-oriented approach. If your investment goals and risk tolerance differ significantly from his, simply mirroring his actions could be detrimental.

- Diversify your portfolio: Never put all your eggs in one basket. A diversified portfolio across different sectors and asset classes is crucial for mitigating risk.

- Consider the broader economic context: Geopolitical events, inflation rates, and interest rate hikes all impact stock performance. Factor these external factors into your investment strategy.

The Bigger Picture: Beyond Individual Stocks

While Buffett's decisions regarding OXY and BAC are important, it's crucial to remember that they are just two pieces of a much larger puzzle. Focusing solely on these individual stock movements risks neglecting the broader economic landscape and your own long-term investment goals.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Related Articles:

- [Link to an article about Warren Buffett's investment philosophy]

- [Link to an article about the current state of the energy sector]

- [Link to an article about the US banking sector]

This article aims to help American investors understand the context of Buffett's recent moves and encourages them to make informed decisions based on their own research and risk tolerance. It emphasizes the importance of diversification and seeking professional advice. The inclusion of internal and external links further enhances the article's SEO value and provides readers with additional resources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two US Stocks Buffett Dumped: Implications For American Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Buffetts Recent Us Investment Sell Off A Shift In Strategy

Jun 05, 2025

Buffetts Recent Us Investment Sell Off A Shift In Strategy

Jun 05, 2025 -

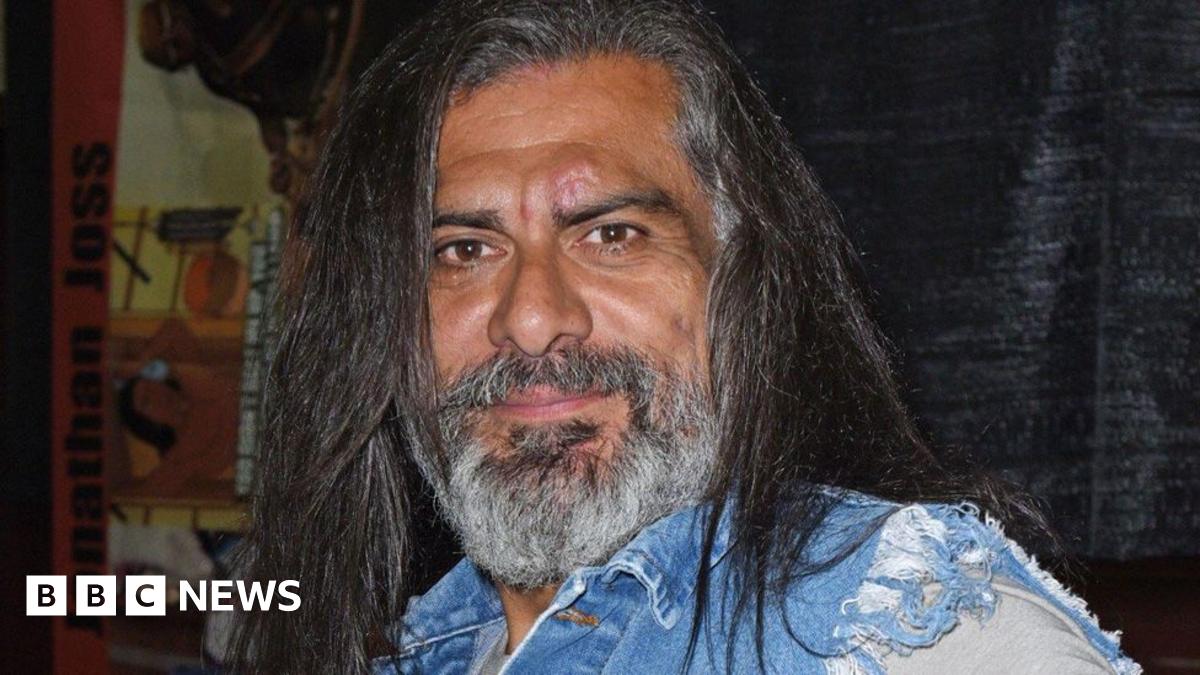

Tragic News Jonathan Joss King Of The Hills John Redcorn Dead After Shooting

Jun 05, 2025

Tragic News Jonathan Joss King Of The Hills John Redcorn Dead After Shooting

Jun 05, 2025 -

Late Night Comedy Jon Stewart On Elon Musk Leaving Government Service

Jun 05, 2025

Late Night Comedy Jon Stewart On Elon Musk Leaving Government Service

Jun 05, 2025 -

Wwii Bomb Discovery Prompts Major Evacuation In Cologne

Jun 05, 2025

Wwii Bomb Discovery Prompts Major Evacuation In Cologne

Jun 05, 2025 -

Buffett Sells 39 Of Bank Of America Stake The Billionaires Big Consumer Brand Bet

Jun 05, 2025

Buffett Sells 39 Of Bank Of America Stake The Billionaires Big Consumer Brand Bet

Jun 05, 2025

Latest Posts

-

Rise In Reports Prompts Surrey Police Crackdown On Jogging Harassment And Catcalling

Aug 17, 2025

Rise In Reports Prompts Surrey Police Crackdown On Jogging Harassment And Catcalling

Aug 17, 2025 -

After A Decade Two Badlands Tracks Get The Music Video Treatment From Halsey

Aug 17, 2025

After A Decade Two Badlands Tracks Get The Music Video Treatment From Halsey

Aug 17, 2025 -

Farage Demands Pm Include Reform Party Members In The House Of Lords

Aug 17, 2025

Farage Demands Pm Include Reform Party Members In The House Of Lords

Aug 17, 2025 -

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025 -

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025