Two US Stocks Buffett Sold: Understanding The Investment Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two US Stocks Buffett Sold: Understanding the Investment Shift

Warren Buffett, the Oracle of Omaha, recently made headlines for shedding significant portions of his holdings in two major US companies. This move, while seemingly minor in the grand scheme of Berkshire Hathaway's vast portfolio, signals a potential shift in investment strategy and warrants closer examination. Understanding the reasons behind these divestments offers valuable insights into the current market landscape and the evolving preferences of one of the world's most successful investors.

Which Stocks Did Buffett Sell?

The two stocks that saw significant reductions in Berkshire Hathaway's holdings were [Insert Stock Symbol 1, e.g., KO (Coca-Cola)] and [Insert Stock Symbol 2, e.g., BAC (Bank of America)]. While the exact percentages sold and the reasons behind the sales were not explicitly stated by Berkshire Hathaway, market analysts have offered several plausible explanations. It’s crucial to remember that any analysis is speculative until official confirmation from Berkshire Hathaway itself.

Potential Reasons Behind the Sell-Off:

Several factors could have influenced Buffett's decision to reduce his stake in these companies:

-

Profit Taking: After significant gains in these stocks, realizing profits and reallocating capital to other opportunities is a common practice for investors. This is particularly relevant given the current market volatility and the search for higher returns.

-

Portfolio Rebalancing: Maintaining a diversified portfolio is a cornerstone of successful investing. Reducing exposure in certain sectors might be a strategic move to balance risk and exposure across different asset classes. This could involve shifting funds towards sectors seen as having higher growth potential in the current economic climate.

-

Market Outlook: Buffett's investment decisions are often seen as indicators of his outlook on the broader economy. The sale might reflect a cautious approach to certain sectors, indicating potential headwinds or a perceived overvaluation of these particular stocks. For example, the banking sector has faced increased scrutiny recently, potentially affecting investor sentiment.

-

Strategic Allocation: Berkshire Hathaway is known for its long-term investment strategy. However, the company also actively manages its portfolio, constantly evaluating and adjusting its holdings to optimize returns. This sale might simply represent a strategic reallocation of capital to other ventures deemed more promising.

What Does This Mean for Investors?

Buffett's actions, while not a direct recommendation to sell, certainly warrant careful consideration by individual investors. It’s crucial to conduct thorough due diligence before making any investment decisions based on the actions of any single investor, no matter how successful. Instead of blindly following Buffett's every move, investors should use this as an opportunity to reassess their own portfolios and risk tolerance.

Analyzing the Broader Market Context:

It’s important to consider the broader economic context. Factors such as inflation, interest rate hikes, and geopolitical instability all play a role in shaping investment decisions. Understanding these macro-economic trends is crucial for informed investing. Resources like the [link to reputable financial news source] can offer valuable insights into these factors.

Conclusion:

The sale of these two stocks by Warren Buffett highlights the dynamic nature of investing. While the specific reasons remain somewhat opaque, the event provides a valuable case study in strategic portfolio management and highlights the importance of continuous evaluation and adaptation in the ever-changing world of finance. Investors should always conduct independent research and consult with a financial advisor before making any significant investment decisions. Stay informed, stay diversified, and stay vigilant.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two US Stocks Buffett Sold: Understanding The Investment Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heterosexual Womans Reverse Discrimination Lawsuit Supreme Court Ruling

Jun 05, 2025

Heterosexual Womans Reverse Discrimination Lawsuit Supreme Court Ruling

Jun 05, 2025 -

Closing The Gap Jack Drapers Path To French Open Glory Against Alcaraz And Sinner

Jun 05, 2025

Closing The Gap Jack Drapers Path To French Open Glory Against Alcaraz And Sinner

Jun 05, 2025 -

Mike Sullivan Welcomes David Quinn Back To The Rangers Coaching Staff

Jun 05, 2025

Mike Sullivan Welcomes David Quinn Back To The Rangers Coaching Staff

Jun 05, 2025 -

Instability In The Netherlands Coalition Collapse Following Wilders Exit

Jun 05, 2025

Instability In The Netherlands Coalition Collapse Following Wilders Exit

Jun 05, 2025 -

Industry Challenges Contribute To Powins Significant Financial Strain

Jun 05, 2025

Industry Challenges Contribute To Powins Significant Financial Strain

Jun 05, 2025

Latest Posts

-

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025 -

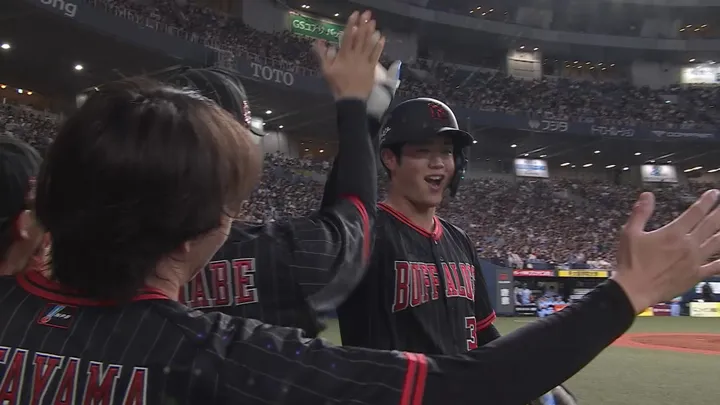

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025 -

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025 -

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025