U.S. Housing Market: Sellers Dominate As Buyer Demand Falls

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Housing Market: Sellers Still Hold the Upper Hand as Buyer Demand Cools

The U.S. housing market, once a frenzied battleground for buyers, is showing signs of a significant shift. While prices remain elevated in many areas, the undeniable trend is a cooling of buyer demand, leaving sellers – for now – firmly in control. This shift, however, is complex and presents both opportunities and challenges for different segments of the market.

A Market in Transition: From Frenzy to Measured Pace

The rapid price increases and bidding wars that characterized the housing market throughout much of 2021 and early 2022 are becoming less common. Rising interest rates, fueled by the Federal Reserve's efforts to combat inflation, have significantly impacted affordability. Higher mortgage rates translate to larger monthly payments, pushing many potential buyers out of the market or forcing them to reconsider their budget. This reduced demand is creating a noticeable change in market dynamics.

Key Factors Contributing to the Shift:

- Increased Mortgage Rates: The most significant factor driving the change is the sharp increase in mortgage interest rates. This has dramatically reduced purchasing power for many prospective homebuyers. [Link to relevant Federal Reserve data on interest rates]

- Inflation and Economic Uncertainty: High inflation and concerns about a potential recession are also contributing to buyer hesitancy. Uncertainty about job security and future income makes committing to a large mortgage a riskier proposition.

- Reduced Inventory Still a Factor: While the market is cooling, inventory remains relatively low compared to pre-pandemic levels. This means that although buyers have more negotiating power than a year ago, it's not a buyer's market in the traditional sense. Finding the right property still requires diligence and often involves compromise.

- Regional Variations: It's crucial to remember that the housing market is not monolithic. While a cooling trend is evident nationwide, the impact varies significantly by region. Some markets are experiencing more pronounced slowdowns than others, reflecting local economic conditions and housing supply.

What Does This Mean for Sellers?

While the days of multiple offers and significantly above-asking prices may be fading, sellers still hold a degree of leverage. The low inventory continues to support prices, and motivated sellers can still command strong prices, especially for well-maintained properties in desirable locations. However, the expectation of immediate, high-dollar offers is no longer the norm. Sellers should be prepared for a more measured sales process and possibly some negotiation.

What Lies Ahead for the U.S. Housing Market?

Predicting the future of the housing market is always challenging. However, most analysts anticipate a continued slowdown in sales volume, with a gradual stabilization of prices in many areas. The market is likely to remain competitive, but the intense frenzy of the past couple of years is likely to give way to a more balanced environment. [Link to a reputable source providing housing market forecasts].

Conclusion:

The U.S. housing market is undergoing a significant transformation. While buyers have gained some negotiating leverage, the market is far from a buyer's paradise. Sellers who price strategically and present their homes effectively can still achieve successful sales. Ultimately, understanding the current market dynamics – including interest rates, inflation, and local market conditions – is crucial for both buyers and sellers navigating this evolving landscape. Staying informed through reputable sources like [mention a relevant news source or real estate website] will be key to making informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Housing Market: Sellers Dominate As Buyer Demand Falls. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

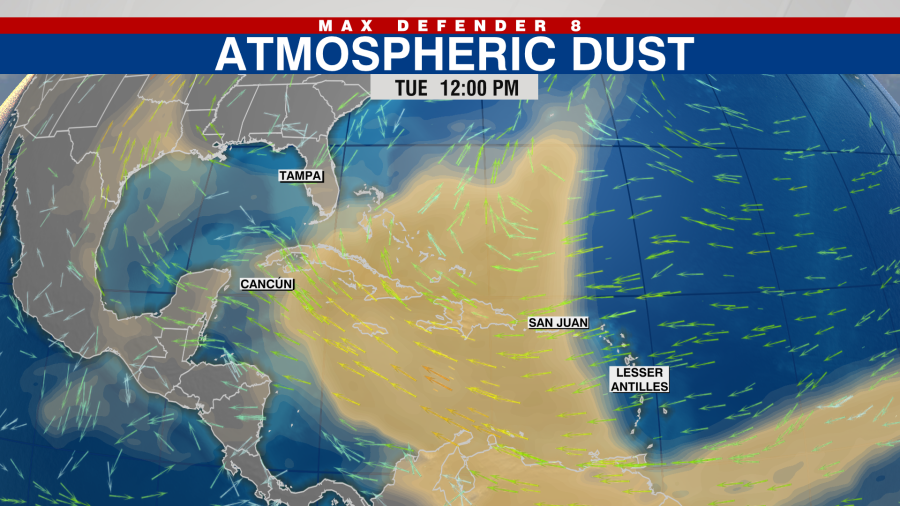

Saharan Dust Plume Impacts Florida Health And Environmental Concerns

May 30, 2025

Saharan Dust Plume Impacts Florida Health And Environmental Concerns

May 30, 2025 -

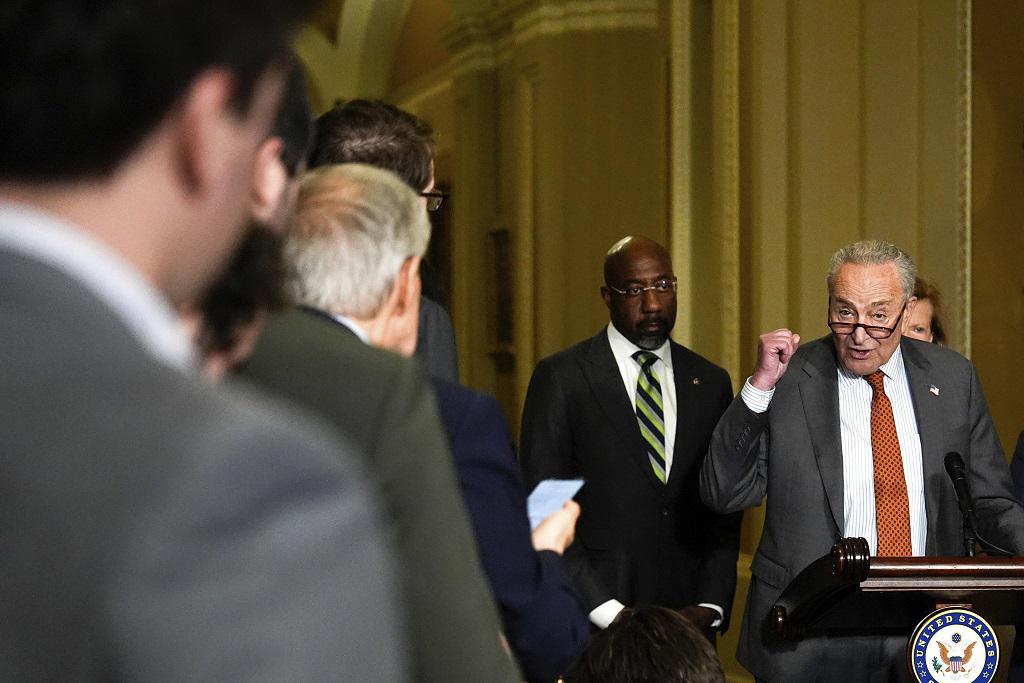

Senate Democrats Strategy To Defeat The Big Beautiful Bill Unveiled

May 30, 2025

Senate Democrats Strategy To Defeat The Big Beautiful Bill Unveiled

May 30, 2025 -

Chaos On Delta Flight Passengers Chase Loose Birds In The Cabin

May 30, 2025

Chaos On Delta Flight Passengers Chase Loose Birds In The Cabin

May 30, 2025 -

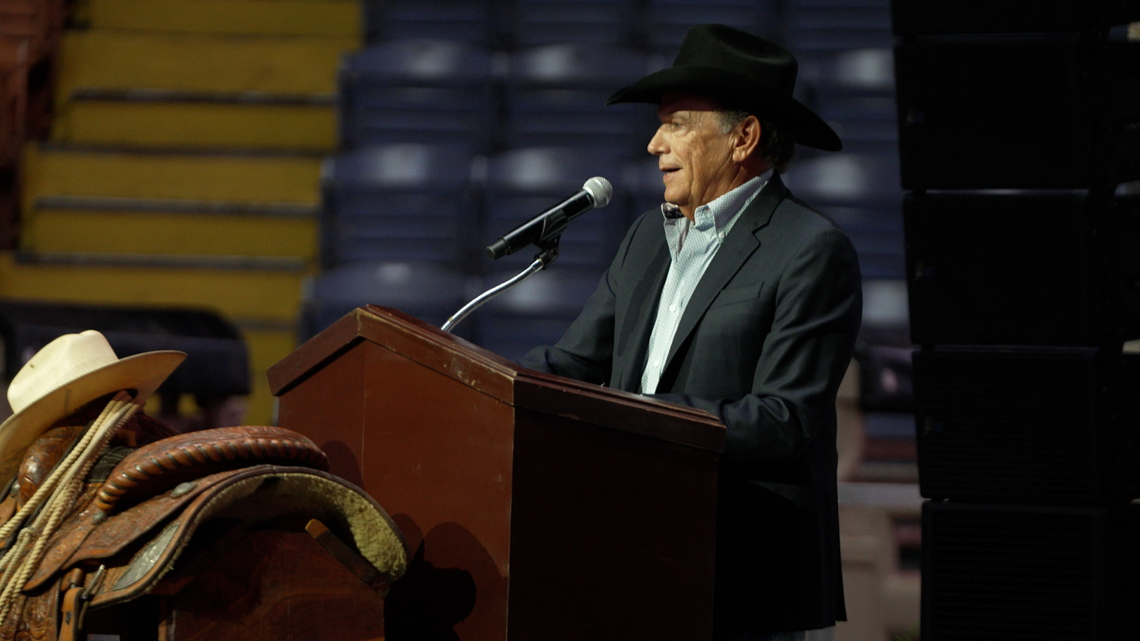

George Strait Pays Respects To Deceased Hero A Moving Tribute

May 30, 2025

George Strait Pays Respects To Deceased Hero A Moving Tribute

May 30, 2025 -

Sheinelle Jones Husband Uche Ojeh Passes Away Todays Announcement

May 30, 2025

Sheinelle Jones Husband Uche Ojeh Passes Away Todays Announcement

May 30, 2025

Latest Posts

-

Trumps Pardon Spree Continues Focus On Convicted Republicans

May 31, 2025

Trumps Pardon Spree Continues Focus On Convicted Republicans

May 31, 2025 -

North Sea Collision Captain Denies Guilt In Court

May 31, 2025

North Sea Collision Captain Denies Guilt In Court

May 31, 2025 -

Suge Knight Calls On Diddy To Take The Stand Seeking Self Humanization

May 31, 2025

Suge Knight Calls On Diddy To Take The Stand Seeking Self Humanization

May 31, 2025 -

2025 French Open Your Complete Guide To Watching The Third Round

May 31, 2025

2025 French Open Your Complete Guide To Watching The Third Round

May 31, 2025 -

F1 Spanish Grand Prix 2025 Qualifying Live Timing Results And Radio Coverage From Barcelona

May 31, 2025

F1 Spanish Grand Prix 2025 Qualifying Live Timing Results And Radio Coverage From Barcelona

May 31, 2025