U.S. Treasury Market Reaction: One Rate Cut In 2025, According To The Fed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reaction: One Rate Cut in 2025, According to the Fed

The U.S. Treasury market experienced a noticeable shift following the Federal Reserve's recent pronouncements suggesting only one interest rate cut is anticipated in 2025. This announcement, while seemingly subtle, has significant implications for investors and the broader economy, sending ripples through bond yields and sparking considerable debate among financial analysts. Understanding this reaction requires examining the Fed's reasoning and the market's subsequent response.

The Fed's Outlook: A Cautious Approach to Rate Cuts

The Federal Reserve's projections point to a persistent, albeit gradually easing, inflationary environment. While acknowledging some progress in taming inflation, the central bank remains wary of premature rate cuts that could reignite price pressures. The projected single rate cut in 2025 signals a belief that current interest rates will need to remain relatively high for an extended period to effectively cool the economy and stabilize inflation near its 2% target. This cautious approach contrasts with some market expectations of more aggressive rate reductions.

Market Reaction: Bond Yields and Investor Sentiment

The Treasury market's reaction to this news was largely in line with expectations. Following the announcement, longer-term Treasury yields, such as the 10-year and 30-year notes, experienced a modest increase. This upward movement reflects investors’ adjusting their expectations for future interest rate levels. Higher yields generally indicate a decreased demand for bonds, as investors seek potentially higher returns elsewhere.

The impact on shorter-term Treasury yields was less pronounced, indicating a degree of confidence that the Fed's projected single rate cut in 2025 is a relatively manageable adjustment within a broader context of sustained higher interest rates.

Analyzing the Implications: Economic Growth and Inflation

The Fed's projection raises important questions about the future trajectory of the U.S. economy. The expectation of only one rate cut suggests that the central bank anticipates a continued period of relatively robust economic growth, albeit at a slower pace than previously observed. However, this growth needs to be balanced against the need to maintain downward pressure on inflation. A too-rapid economic expansion risks rekindling inflationary pressures, negating the progress already made.

What Does This Mean for Investors?

For investors, the Fed's forecast necessitates a reassessment of investment strategies. The anticipation of sustained higher interest rates makes fixed-income investments less attractive compared to periods of lower rates. This could lead investors to explore alternative investments with higher potential returns, potentially increasing the volatility in certain sectors. Diversification remains key in navigating this evolving economic landscape.

Looking Ahead: Uncertainty and Potential Shifts

While the Fed's projection provides a valuable insight into its current thinking, it's crucial to acknowledge the inherent uncertainties in economic forecasting. Unforeseen economic shocks, shifts in global markets, or unexpected inflationary pressures could necessitate adjustments to the Fed's monetary policy. Therefore, investors and analysts should remain vigilant and closely monitor economic data and the Fed's subsequent communications for potential changes in the anticipated rate cut trajectory. The market’s response will continue to be a key indicator of investor confidence and the overall health of the U.S. economy.

Further Reading:

This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reaction: One Rate Cut In 2025, According To The Fed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

President Biden Receives Prostate Cancer Diagnosis What We Know So Far

May 20, 2025

President Biden Receives Prostate Cancer Diagnosis What We Know So Far

May 20, 2025 -

New Measures To Improve Tourist Conduct In Bali A Response To Growing Concerns

May 20, 2025

New Measures To Improve Tourist Conduct In Bali A Response To Growing Concerns

May 20, 2025 -

Autonomous Vehicles In The Uk Ubers Early Adoption 2027 Regulatory Outlook

May 20, 2025

Autonomous Vehicles In The Uk Ubers Early Adoption 2027 Regulatory Outlook

May 20, 2025 -

Understanding And Addressing The Bare Beating Phenomenon In Public Transportation

May 20, 2025

Understanding And Addressing The Bare Beating Phenomenon In Public Transportation

May 20, 2025 -

Saturdays Mlb Home Run Prop Bets Ketel Marte James Wood And More

May 20, 2025

Saturdays Mlb Home Run Prop Bets Ketel Marte James Wood And More

May 20, 2025

Latest Posts

-

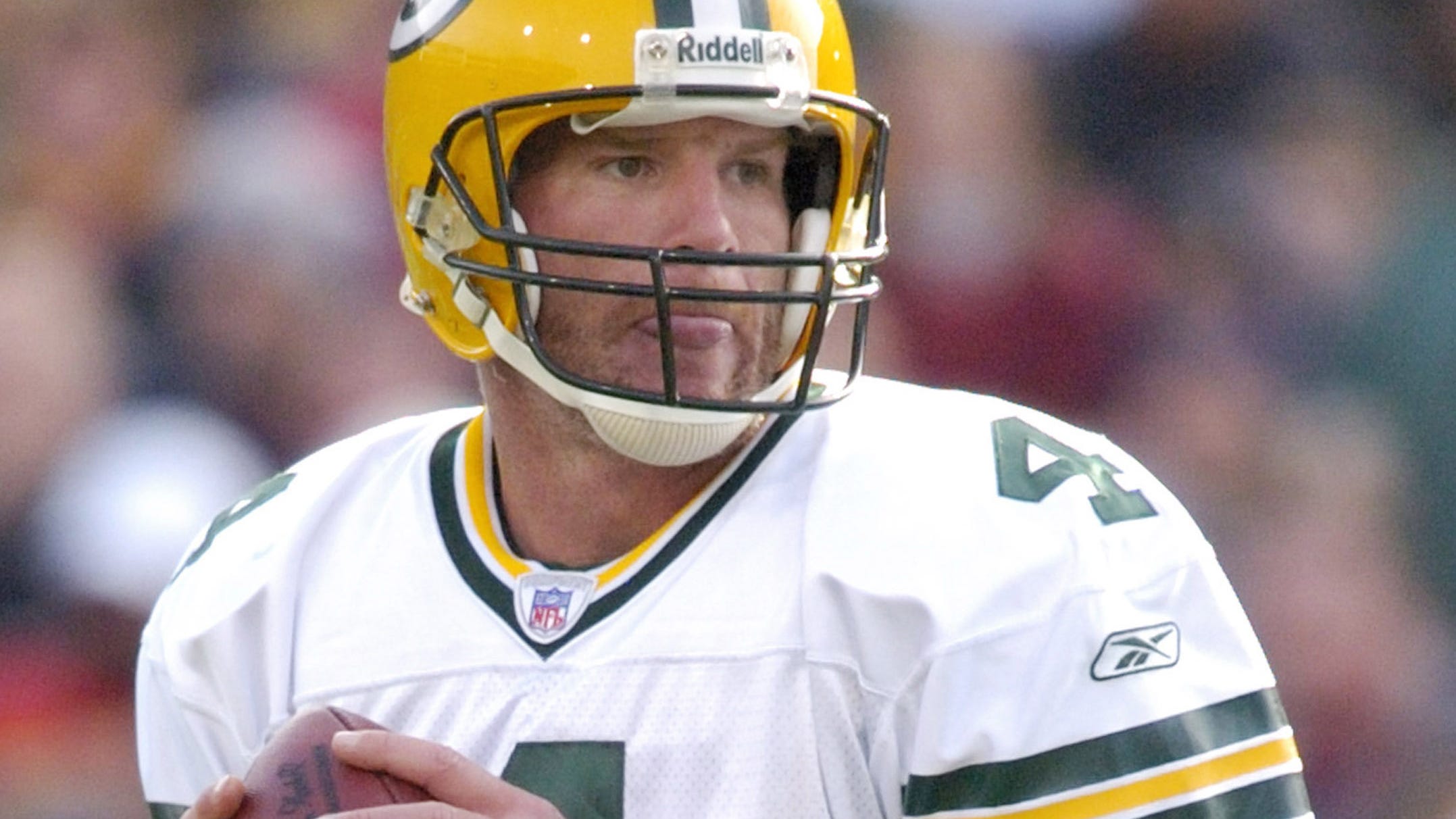

Behind The Scenes Of Fall Of Favre A Directors Perspective On The Controversial Documentary

May 20, 2025

Behind The Scenes Of Fall Of Favre A Directors Perspective On The Controversial Documentary

May 20, 2025 -

Jones Vs Ufc The Controversy Over Aspinalls Injury Information

May 20, 2025

Jones Vs Ufc The Controversy Over Aspinalls Injury Information

May 20, 2025 -

Curbing Bad Tourist Behavior In Bali The New Guidelines Explained

May 20, 2025

Curbing Bad Tourist Behavior In Bali The New Guidelines Explained

May 20, 2025 -

St Louis Tornado Community Recovery Begins After Devastating Damage

May 20, 2025

St Louis Tornado Community Recovery Begins After Devastating Damage

May 20, 2025 -

Client Confidentiality Breached Legal Aid Data Hack Reveals Criminal Records

May 20, 2025

Client Confidentiality Breached Legal Aid Data Hack Reveals Criminal Records

May 20, 2025