U.S. Treasury Market Responds To Fed's Conservative 2025 Rate Cut Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Responds Cautiously to Fed's Conservative 2025 Rate Cut Forecast

The U.S. Treasury market reacted with a degree of caution following the Federal Reserve's recent announcement projecting a more conservative approach to interest rate cuts in 2025. The Fed's revised "dot plot," which reflects individual policymakers' interest rate expectations, indicated a slower pace of easing monetary policy than previously anticipated, sending ripples through the bond market. This shift in perspective has significant implications for investors and the broader economy.

A More Measured Approach to Rate Cuts:

The Fed's updated forecast suggests a more measured approach to lowering interest rates next year. While acknowledging the potential for economic slowdown, the central bank emphasized its commitment to bringing inflation down to its 2% target. This conservative stance contrasts with earlier predictions of more aggressive rate cuts, leading to a reassessment by market participants. The perceived slower pace of easing suggests the Fed believes inflation remains a persistent threat, requiring a more prolonged period of tighter monetary policy.

Impact on Treasury Yields:

The market's response to the Fed's announcement was nuanced. Treasury yields, which move inversely to prices, initially saw a slight increase, reflecting a degree of uncertainty. Investors, grappling with the implications of a slower-than-expected easing cycle, re-evaluated their bond holdings. This shift, however, was not dramatic, suggesting a degree of market resilience and adaptation to the evolving economic landscape. Longer-term Treasury yields, which are more sensitive to long-term economic expectations, showed a more pronounced reaction. This highlights the market's sensitivity to the Fed's long-term outlook and its impact on future economic growth.

Analyzing the Market's Reaction:

Several factors contributed to the market's relatively measured response:

- Persistent Inflation Concerns: Lingering inflation concerns continue to influence investor behavior. The possibility of inflation remaining stubbornly high suggests that the Fed might need to maintain a more restrictive monetary policy for an extended period.

- Stronger-Than-Expected Economic Data: Recent economic data releases, while showing signs of slowing growth, have not indicated a significant downturn. This has provided some support to the Fed's more cautious approach.

- Geopolitical Uncertainty: Ongoing geopolitical tensions and global economic instability add another layer of complexity to the market's assessment of future interest rate movements.

Looking Ahead: Implications for Investors:

The Fed's conservative forecast presents both challenges and opportunities for investors. Those holding longer-term Treasury bonds might experience some short-term volatility. However, the potential for higher yields in the longer term could attract investors seeking income generation. Diversification and a thorough understanding of individual risk tolerance remain crucial for navigating this evolving market environment.

Conclusion:

The U.S. Treasury market's reaction to the Fed's conservative 2025 rate cut forecast highlights the ongoing interplay between monetary policy, inflation, and investor sentiment. While the market displayed a degree of caution, the response was relatively contained, suggesting a level of adaptability to shifting economic conditions. Continued monitoring of economic data and Fed pronouncements will be essential for investors navigating this dynamic landscape. Investors are advised to consult with financial professionals to make informed investment decisions based on their individual circumstances and risk tolerance. Stay tuned for further updates as the economic picture unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Responds To Fed's Conservative 2025 Rate Cut Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2027 The Year Driverless Cars Might Arrive In The Uk Ubers Perspective

May 21, 2025

2027 The Year Driverless Cars Might Arrive In The Uk Ubers Perspective

May 21, 2025 -

Client Data Theft Legal Aid Hack Reveals Criminal Record Information

May 21, 2025

Client Data Theft Legal Aid Hack Reveals Criminal Record Information

May 21, 2025 -

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025 -

Putins Recent Moves Underscore Trumps Waning International Impact

May 21, 2025

Putins Recent Moves Underscore Trumps Waning International Impact

May 21, 2025 -

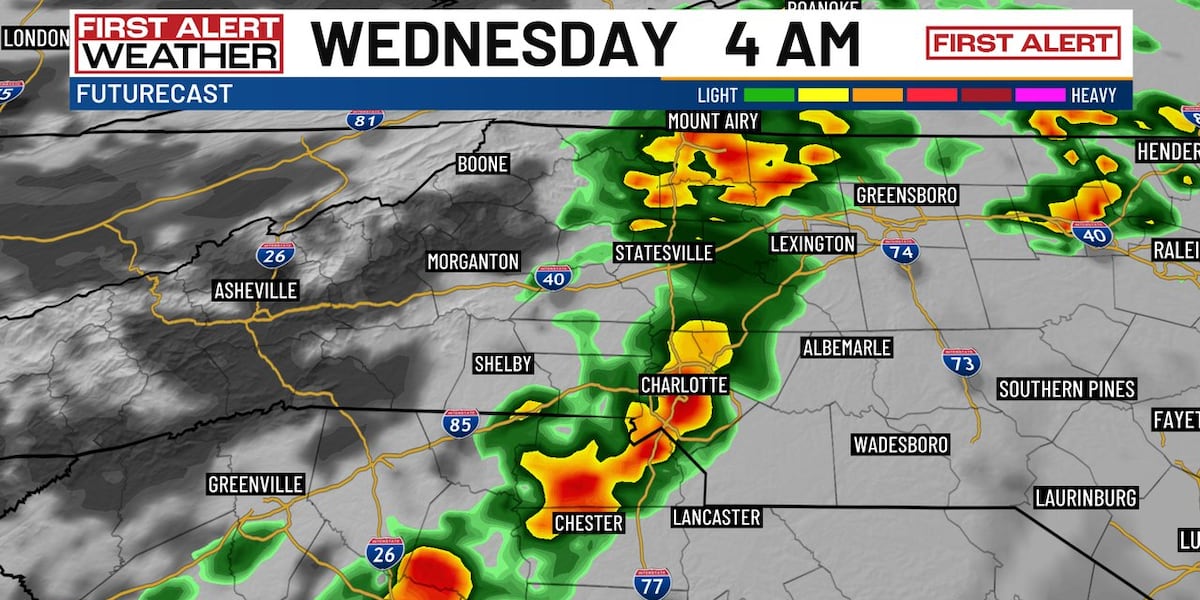

Charlotte Weather Incoming Overnight Storms Bring Cooler Temperatures

May 21, 2025

Charlotte Weather Incoming Overnight Storms Bring Cooler Temperatures

May 21, 2025

Latest Posts

-

Post Office Data Breach Hundreds To Receive Compensation

May 21, 2025

Post Office Data Breach Hundreds To Receive Compensation

May 21, 2025 -

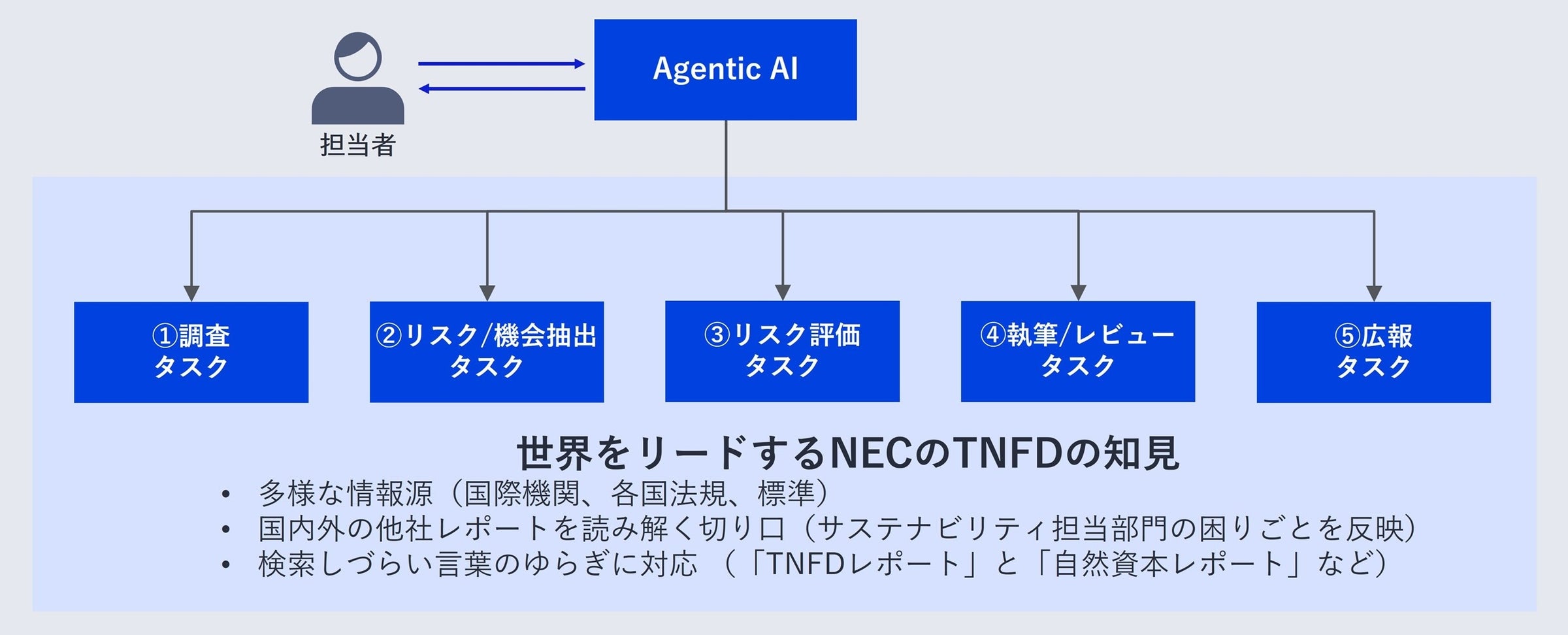

Nec Ai Agentic Ai Tnfd

May 21, 2025

Nec Ai Agentic Ai Tnfd

May 21, 2025 -

May 21, 2025

May 21, 2025 -

Church Bathroom Vandalized Two Boys Face Charges

May 21, 2025

Church Bathroom Vandalized Two Boys Face Charges

May 21, 2025 -

Monkey Kidnappings On A Panamanian Island Unraveling The Puzzle

May 21, 2025

Monkey Kidnappings On A Panamanian Island Unraveling The Puzzle

May 21, 2025