U.S. Treasury Market Responds: Yields Fall Following Fed's Rate Cut Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Responds: Yields Fall Following Fed's Rate Cut Announcement

The U.S. Treasury market experienced a significant shift on [Date of Fed announcement], with yields across the curve falling sharply following the Federal Reserve's announcement of a [size] rate cut. This unexpected move, aimed at mitigating the economic risks posed by [reason for rate cut, e.g., banking sector instability, inflation concerns], sent ripples through the financial markets, prompting investors to reassess their risk appetite and seek the perceived safety of government bonds.

A Deeper Dive into the Yield Curve Shift

The Fed's decision to lower interest rates, the [nth] rate cut this year, marked a decisive shift in monetary policy. This action was widely anticipated by some analysts, but the magnitude of the cut surprised many. Consequently, the yield on the benchmark 10-year Treasury note plummeted by [percentage points], closing at [yield percentage]. Similarly, yields across the entire Treasury curve experienced declines, reflecting a flight to safety among investors.

This dramatic shift underscores the significant influence the Fed holds over the Treasury market. The central bank's actions directly impact interest rates, influencing the attractiveness of Treasury bonds relative to other investments. When the Fed lowers rates, it makes Treasury bonds less attractive compared to other higher-yielding investments. However, in this instance, the market reacted to the perceived need for stability in an uncertain economic environment, pushing yields down.

Why the Flight to Safety?

The sharp drop in Treasury yields is primarily attributed to a surge in demand for safe-haven assets. Investors, concerned about [mention specific economic concerns, e.g., potential recession, ongoing banking sector turmoil], sought the perceived safety and liquidity offered by U.S. Treasury securities. This increased demand naturally pushed prices up and yields down.

- Increased Uncertainty: The current economic climate, characterized by [mention relevant economic indicators, e.g., high inflation, slowing growth], has fueled uncertainty and risk aversion among investors.

- Banking Sector Concerns: The recent instability in the banking sector has further exacerbated these concerns, prompting investors to seek refuge in the perceived stability of government bonds.

- Inflation Expectations: While inflation remains a concern, the rate cut suggests the Fed prioritizes mitigating economic slowdown risks over combating inflation at this juncture. This shift in priorities influenced investor sentiment.

What This Means for Investors

The fall in Treasury yields presents both opportunities and challenges for investors. Lower yields mean lower returns on newly purchased bonds, but existing bondholders benefit from increased prices. This situation highlights the importance of a diversified investment portfolio and careful consideration of risk tolerance in the current market environment.

Looking Ahead: Future Implications

The market's reaction to the Fed's rate cut will be closely monitored in the coming weeks and months. The long-term implications remain unclear and depend heavily on future economic developments and the Fed's subsequent policy decisions. Analysts will be closely scrutinizing economic data, including inflation figures and employment reports, to gauge the effectiveness of the rate cut and assess the need for further monetary policy adjustments.

Further Resources:

- [Link to Federal Reserve website]

- [Link to relevant financial news source]

This significant event in the U.S. Treasury market highlights the interconnectedness of monetary policy, investor sentiment, and overall economic stability. As the situation unfolds, continuous monitoring of market trends and economic indicators is crucial for investors and policymakers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Responds: Yields Fall Following Fed's Rate Cut Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Transparency Concerns Jon Jones On Ufcs Handling Of Tom Aspinall Injury

May 21, 2025

Transparency Concerns Jon Jones On Ufcs Handling Of Tom Aspinall Injury

May 21, 2025 -

Down To The Wire The Fate Of Brexit Hangs In The Balance

May 21, 2025

Down To The Wire The Fate Of Brexit Hangs In The Balance

May 21, 2025 -

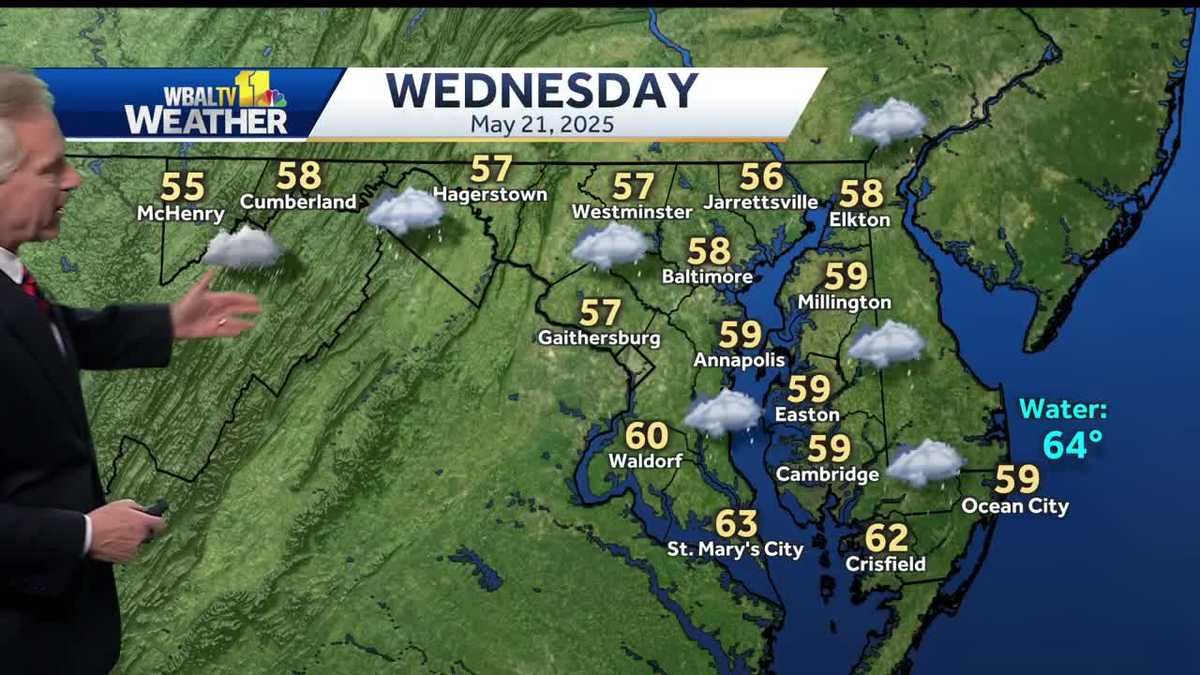

Regional Weather Forecast Rain And Cold To Continue Through Wednesday

May 21, 2025

Regional Weather Forecast Rain And Cold To Continue Through Wednesday

May 21, 2025 -

The Last Of Us Proves Slow Burns Can Be Brilliantly Heartbreaking

May 21, 2025

The Last Of Us Proves Slow Burns Can Be Brilliantly Heartbreaking

May 21, 2025 -

Gary Lineker Exit From Bbc Analyzing The Fallout And Future Of Match Of The Day

May 21, 2025

Gary Lineker Exit From Bbc Analyzing The Fallout And Future Of Match Of The Day

May 21, 2025

Latest Posts

-

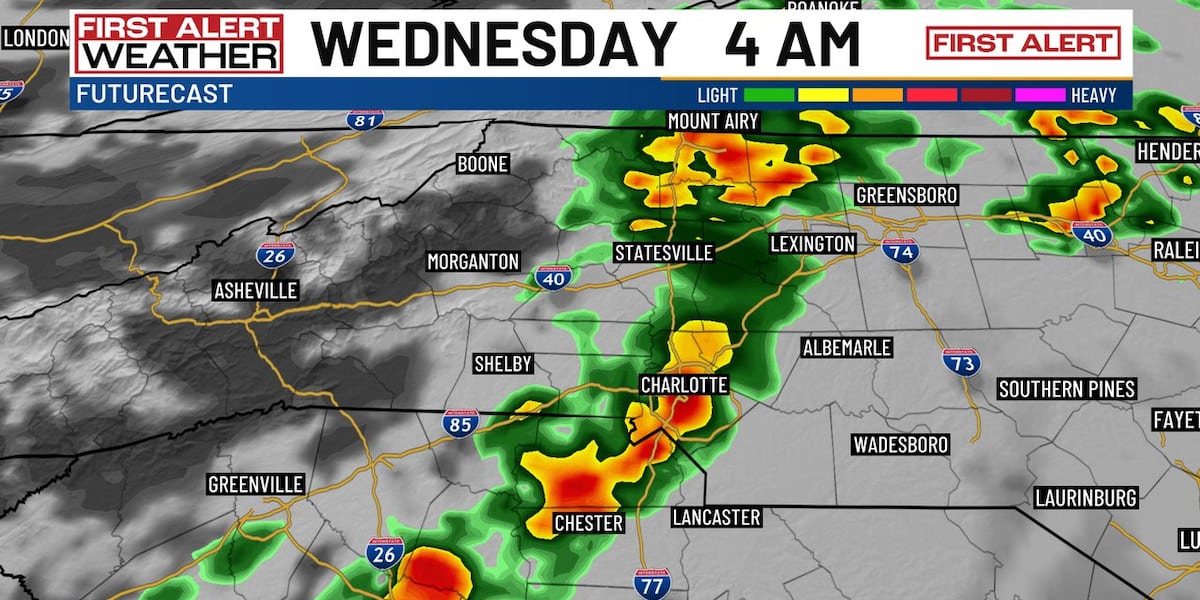

Overnight Rain And Storms Severe Weather Warning Issued For North Carolina

May 21, 2025

Overnight Rain And Storms Severe Weather Warning Issued For North Carolina

May 21, 2025 -

Protecting Children A Familys Fight Against The Proposed Changes To Paedophile Parental Rights

May 21, 2025

Protecting Children A Familys Fight Against The Proposed Changes To Paedophile Parental Rights

May 21, 2025 -

From Captivity To Home A Familys Journey Of Hope And Reunion

May 21, 2025

From Captivity To Home A Familys Journey Of Hope And Reunion

May 21, 2025 -

Increased Corporate Value Through Environmental Stewardship 160 Japanese Companies And 13 Industry Benchmarks

May 21, 2025

Increased Corporate Value Through Environmental Stewardship 160 Japanese Companies And 13 Industry Benchmarks

May 21, 2025 -

Expect Overnight Storms In Charlotte Cooler Weather Arriving Soon

May 21, 2025

Expect Overnight Storms In Charlotte Cooler Weather Arriving Soon

May 21, 2025