U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at 2025 Rate Cuts

U.S. Treasury yields experienced a noticeable decline following the Federal Reserve's projection of interest rate cuts in 2025. This move signals a shift in market sentiment, reflecting a growing belief that inflation is cooling and the aggressive tightening cycle may soon be over. The implications for investors and the broader economy are significant and warrant careful consideration.

The Federal Open Market Committee (FOMC) meeting, concluded on [Insert Date of FOMC Meeting], revealed a revised economic outlook. While the Fed maintained its commitment to fighting inflation, the projections for future rate cuts sparked a ripple effect across financial markets. The median projection now anticipates rate cuts beginning in 2025, a more dovish stance than previously indicated. This shift has led to a reassessment of the trajectory of interest rates and their impact on various asset classes, including U.S. Treasury bonds.

Understanding the Impact on Treasury Yields

Treasury yields and bond prices move inversely. When yields decline, bond prices rise, and vice versa. The Fed's projection of future rate cuts fueled increased demand for U.S. Treasury bonds, pushing yields lower. Investors, anticipating lower interest rates in the future, are willing to accept lower yields on existing bonds.

This decrease in yields signifies several key factors:

- Easing Inflation Concerns: The projected rate cuts reflect the Fed's belief that inflation is gradually subsiding. While inflation remains above the Fed's target, the anticipated cooling trend is bolstering investor confidence.

- Economic Slowdown Expectations: Some analysts interpret the rate cut projections as a signal that the Fed anticipates a potential economic slowdown or even a recession in the coming years. Lower rates would be a tool to stimulate economic growth if needed.

- Shifting Market Sentiment: The change in the Fed's outlook represents a significant shift in market sentiment. This shift influences investor behavior and investment strategies, contributing to the decline in Treasury yields.

What This Means for Investors

The decline in Treasury yields presents both opportunities and challenges for investors. While lower yields mean lower returns on new Treasury investments, existing bondholders benefit from increased bond values. This situation necessitates a reassessment of investment portfolios, considering the implications for:

- Fixed-Income Strategies: Investors with fixed-income portfolios need to re-evaluate their strategies, considering the impact of lower yields on future returns. Diversification remains crucial.

- Risk Tolerance: The uncertainty surrounding future economic growth requires investors to carefully assess their risk tolerance and adjust their investment strategies accordingly.

- Alternative Investments: With lower returns on traditional fixed-income assets, some investors may seek alternative investment opportunities with higher potential returns, though these often carry greater risk.

Looking Ahead: Uncertainty Remains

While the Fed's projection offers a glimpse into its anticipated future actions, significant uncertainty remains. The actual path of interest rates will depend heavily on future economic data, including inflation figures, employment numbers, and overall economic growth. Investors should closely monitor economic indicators and adjust their strategies based on evolving market conditions. Staying informed through reputable financial news sources is critical for making informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: U.S. Treasury Yields, Federal Reserve, Interest Rate Cuts, Bond Prices, Inflation, Economic Growth, Investment Strategies, Fixed Income, Market Sentiment, FOMC, 2025 Rate Projections, Treasury Bonds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Extinction Crisis Could Glitter Help Save Wales Water Vole Population

May 21, 2025

Extinction Crisis Could Glitter Help Save Wales Water Vole Population

May 21, 2025 -

Record Viewership For Snls 50th Season Finale A Look Back At The Highlights

May 21, 2025

Record Viewership For Snls 50th Season Finale A Look Back At The Highlights

May 21, 2025 -

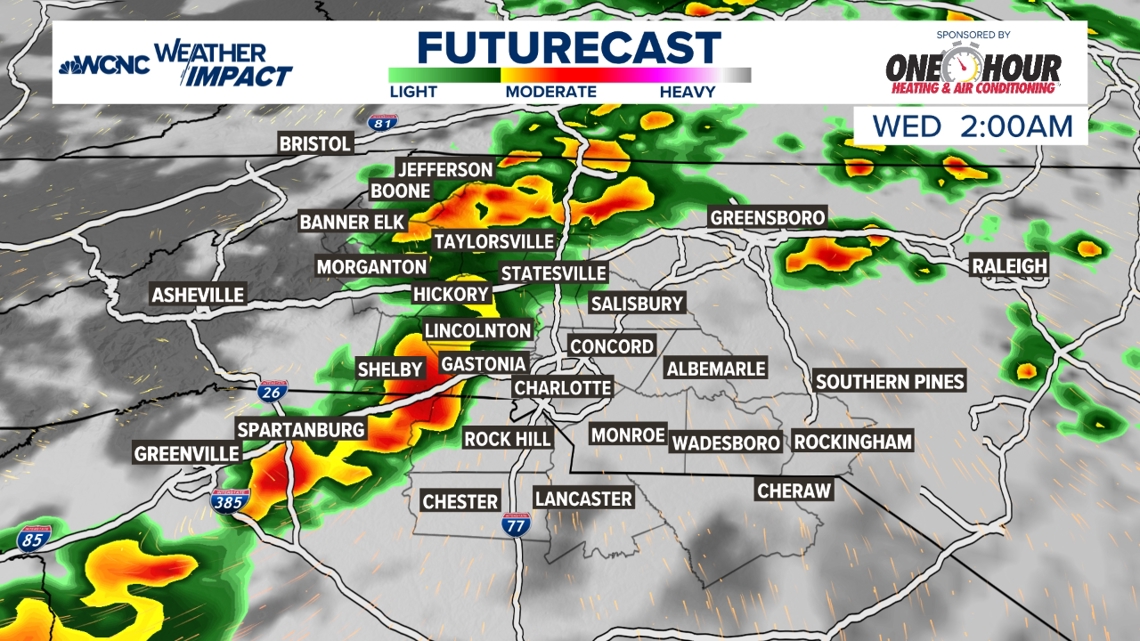

North Carolina Weather Alert Intense Rain And Storms Expected Overnight

May 21, 2025

North Carolina Weather Alert Intense Rain And Storms Expected Overnight

May 21, 2025 -

Peaky Blinders Future Creator Reveals New Series And A Pivotal Change

May 21, 2025

Peaky Blinders Future Creator Reveals New Series And A Pivotal Change

May 21, 2025 -

Us Treasury Yields Fall As Federal Reserve Hints At One Rate Cut In 2025

May 21, 2025

Us Treasury Yields Fall As Federal Reserve Hints At One Rate Cut In 2025

May 21, 2025

Latest Posts

-

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025 -

Political Fallout Sesame Street Shifts To Netflix After Funding Dispute

May 21, 2025

Political Fallout Sesame Street Shifts To Netflix After Funding Dispute

May 21, 2025 -

Limited Chance Of Severe Weather Tuesday Night Forecast Update

May 21, 2025

Limited Chance Of Severe Weather Tuesday Night Forecast Update

May 21, 2025 -

Post Office Data Breach Details Of Compensation Payments

May 21, 2025

Post Office Data Breach Details Of Compensation Payments

May 21, 2025 -

Sesame Street Finds New Home On Netflix After Trump Funding Loss

May 21, 2025

Sesame Street Finds New Home On Netflix After Trump Funding Loss

May 21, 2025