U.S. Treasury Yields Dip As Fed Hints At Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at Limited Rate Cuts

U.S. Treasury yields experienced a decline following Federal Reserve Chair Jerome Powell's recent comments suggesting a more cautious approach to future interest rate cuts. This shift in the market reflects a growing expectation that the Fed might not engage in the aggressive rate reduction cycle some had anticipated. The implications for investors and the broader economy are significant and warrant close examination.

The market's reaction underscores the delicate balancing act the Federal Reserve faces. While inflation shows signs of cooling, it remains above the central bank's target, and the labor market continues to demonstrate resilience. This complex economic landscape necessitates a nuanced approach to monetary policy.

Powell's Cautious Tone Shifts Market Expectations

Powell's testimony before Congress subtly shifted the narrative surrounding future interest rate adjustments. Instead of signaling a series of substantial rate cuts, he emphasized a data-dependent approach, indicating that future decisions will hinge on incoming economic data and the evolving inflation picture. This cautious tone contrasts with earlier market predictions of more aggressive easing.

This change in rhetoric led to a noticeable dip in Treasury yields. Yields on 2-year and 10-year Treasury notes, key indicators of investor sentiment and future interest rate expectations, fell significantly. This signifies a decrease in the perceived risk associated with holding these bonds.

Implications for Investors and the Economy

The shift in market expectations presents several implications for investors and the broader economy:

-

Bond Market: The decline in Treasury yields suggests increased demand for bonds, reflecting investors' search for safety in a potentially uncertain economic environment. This could lead to further price appreciation in the bond market. (External link to Investopedia).

-

Stock Market: The more cautious stance by the Fed could have mixed implications for the stock market. While lower interest rates generally support stock valuations, the uncertainty surrounding the pace of future rate cuts could introduce volatility.

-

Economic Growth: The Federal Reserve's approach to monetary policy plays a crucial role in shaping economic growth. A slower pace of rate cuts might dampen economic expansion but could also help to prevent a resurgence of inflation. This delicate balancing act is key to maintaining economic stability.

-

Inflation Expectations: The market's reaction highlights the ongoing sensitivity to inflation data. Any unexpected uptick in inflation could lead to a reassessment of the Fed's policy stance and potentially reverse the recent decline in Treasury yields.

Looking Ahead: Uncertainty Remains

The economic outlook remains uncertain. While inflation appears to be cooling, the persistence of robust employment and the potential for unforeseen economic shocks create a backdrop of considerable uncertainty. The Federal Reserve's commitment to a data-dependent approach suggests that future monetary policy decisions will be highly sensitive to incoming economic data. Investors and economists will be closely monitoring key economic indicators, including inflation reports, employment data, and consumer spending figures, to gauge the likely trajectory of interest rates.

In conclusion, the recent dip in U.S. Treasury yields reflects a shift in market sentiment following the Federal Reserve's indication of a more cautious approach to future rate cuts. This development underscores the complexities of navigating the current economic landscape and highlights the importance of monitoring economic data for clues about the future direction of monetary policy. The coming months will be crucial in determining the ultimate impact of the Fed's evolving strategy on the economy and financial markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Fed Hints At Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Snls 50th Season Finale Became A Ratings Phenomenon

May 20, 2025

How Snls 50th Season Finale Became A Ratings Phenomenon

May 20, 2025 -

Lock In Your Mlb Wagers Best Bets For White Sox Cubs Red Sox Braves And More

May 20, 2025

Lock In Your Mlb Wagers Best Bets For White Sox Cubs Red Sox Braves And More

May 20, 2025 -

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025 -

2027 The Projected Uk Launch Date For Driverless Cars Ubers Perspective

May 20, 2025

2027 The Projected Uk Launch Date For Driverless Cars Ubers Perspective

May 20, 2025 -

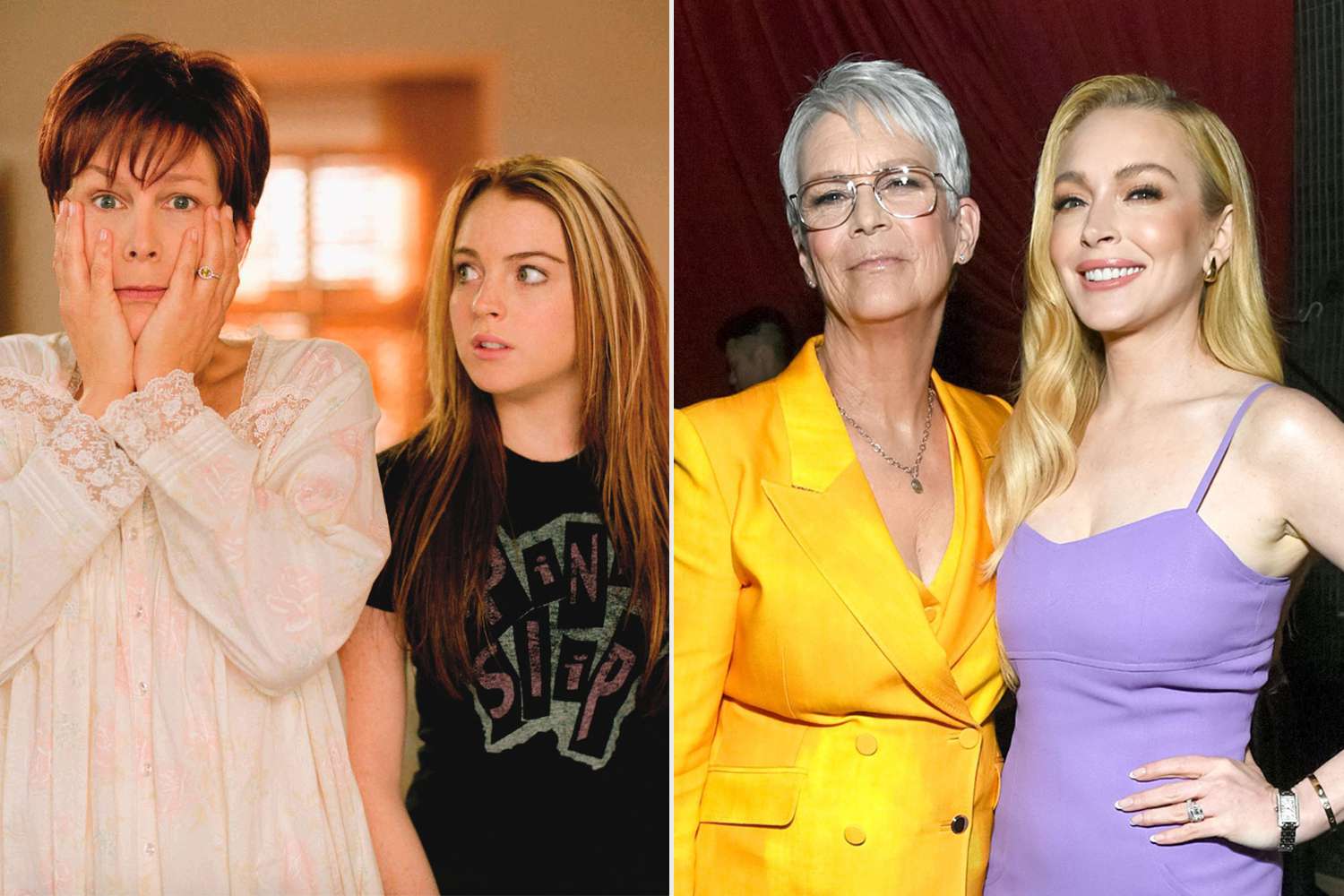

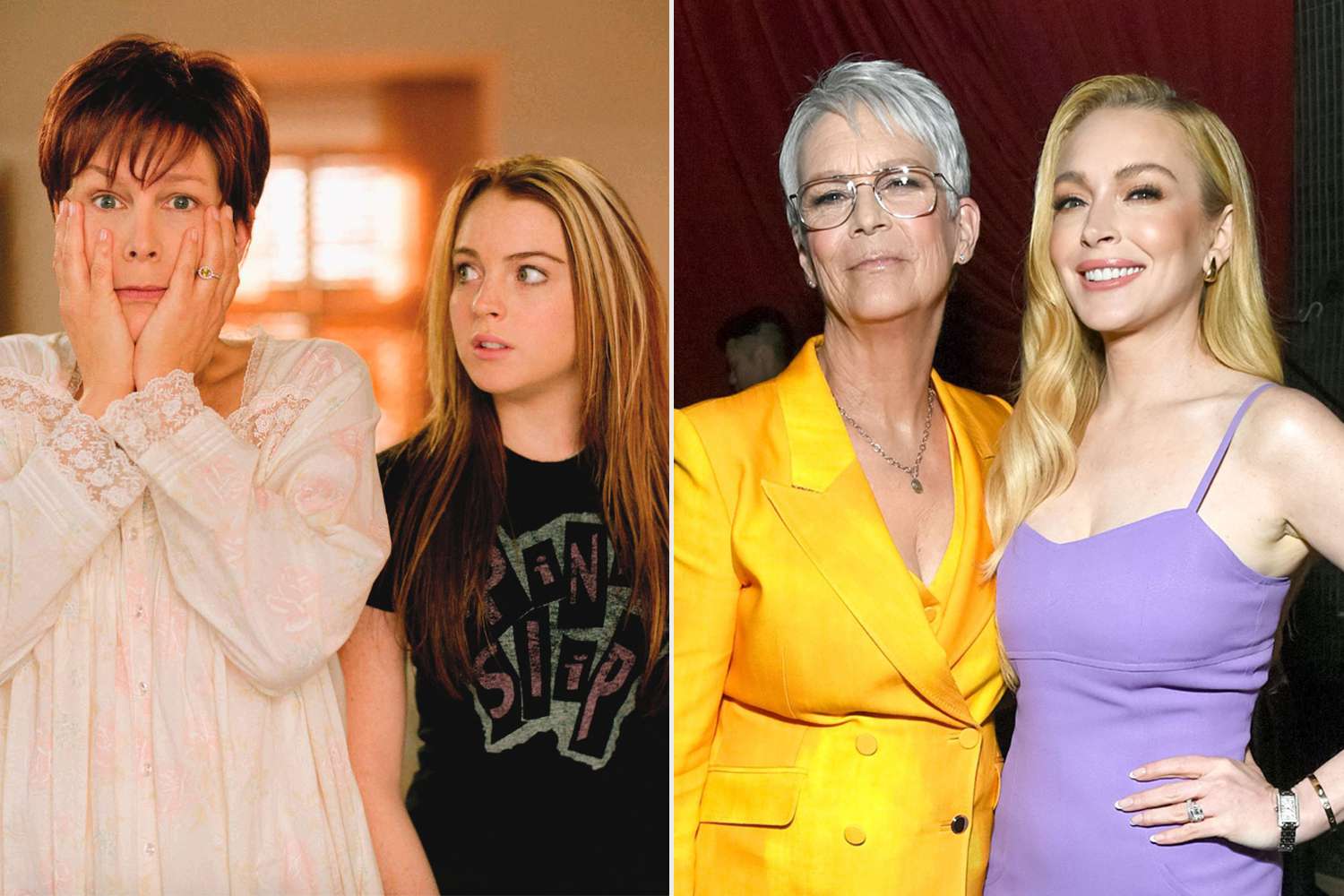

Jamie Lee Curtis Opens Up About Her Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Opens Up About Her Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Latest Posts

-

Ufc News Jon Jones Hints At Retirement Amidst Aspinall Contract Delay

May 21, 2025

Ufc News Jon Jones Hints At Retirement Amidst Aspinall Contract Delay

May 21, 2025 -

Latest Updates President Bidens Health And Prostate Cancer Treatment

May 21, 2025

Latest Updates President Bidens Health And Prostate Cancer Treatment

May 21, 2025 -

Increased Regulation For Buy Now Pay Later Services A Guide For Consumers

May 21, 2025

Increased Regulation For Buy Now Pay Later Services A Guide For Consumers

May 21, 2025 -

Jamie Lee Curtis Shares Update On Her Bond With Lindsay Lohan Following Freaky Friday

May 21, 2025

Jamie Lee Curtis Shares Update On Her Bond With Lindsay Lohan Following Freaky Friday

May 21, 2025 -

Olympic Gold Medalist Alleges Coachs Emotional And Physical Abuse

May 21, 2025

Olympic Gold Medalist Alleges Coachs Emotional And Physical Abuse

May 21, 2025