UK Economy Slowdown: Interest Rates Hit Two-Year Low

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Economy Slowdown: Interest Rates Plunge to Two-Year Low Amidst Growing Concerns

The UK economy is facing headwinds, with the Bank of England (BoE) slashing interest rates to a two-year low in a desperate attempt to stave off a recession. This dramatic move, announced earlier today, signals a growing concern among policymakers about the fragility of the British economy. The rate cut, from 0.75% to 0.5%, is the first reduction since August 2016 and represents a significant shift in monetary policy. But will it be enough to prevent a looming economic downturn?

The Reasons Behind the Rate Cut:

The BoE's decision reflects a confluence of worrying economic indicators. Brexit uncertainty continues to cast a long shadow, dampening business investment and consumer confidence. The global economic slowdown, particularly in key trading partners like the Eurozone and the US, is also impacting UK exports and growth prospects. Furthermore, the recent slowdown in the UK housing market and weakening retail sales point towards a broader economic malaise.

- Brexit Uncertainty: The ongoing negotiations surrounding the UK's departure from the European Union are creating significant uncertainty for businesses, hindering investment decisions and impacting long-term planning. [Link to relevant government Brexit website]

- Global Economic Slowdown: A weakening global economy is reducing demand for UK goods and services, impacting export-oriented industries and contributing to slower overall growth. [Link to a reputable source on global economic forecasts]

- Weak Domestic Demand: Consumer spending, a key driver of the UK economy, is showing signs of weakness, with retail sales figures lagging behind expectations. This reflects concerns about job security and rising living costs.

What Does This Mean for the Average Briton?

The interest rate cut is intended to stimulate borrowing and spending. Lower interest rates make it cheaper for businesses to invest and for consumers to borrow money, potentially boosting economic activity. However, the impact on individual Britons will be mixed:

- Borrowers: Those with mortgages or other loans will see a reduction in their monthly repayments, freeing up some disposable income.

- Savers: Savers, on the other hand, will likely see a decrease in the interest earned on their savings accounts, potentially impacting their returns.

- Inflation: While lower interest rates can boost economic activity, they can also contribute to inflation if demand increases faster than supply. The BoE will be carefully monitoring inflation figures in the coming months.

Looking Ahead: The Road to Recovery?

The effectiveness of the interest rate cut remains to be seen. Some economists argue that monetary policy alone is insufficient to address the underlying structural challenges facing the UK economy, particularly those related to Brexit. Others believe that the cut will provide a much-needed boost to confidence and help avert a recession.

The coming months will be crucial in determining the success of this policy intervention. The BoE will closely monitor economic data and may take further action if necessary. The situation remains fluid and requires careful observation.

Call to Action: Stay informed about the evolving economic situation by following reputable financial news sources and consulting with financial advisors for personalized guidance. Understanding the current economic climate is essential for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Economy Slowdown: Interest Rates Hit Two-Year Low. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Outcry Over Rushanara Alis Increased London Rents

Aug 09, 2025

Public Outcry Over Rushanara Alis Increased London Rents

Aug 09, 2025 -

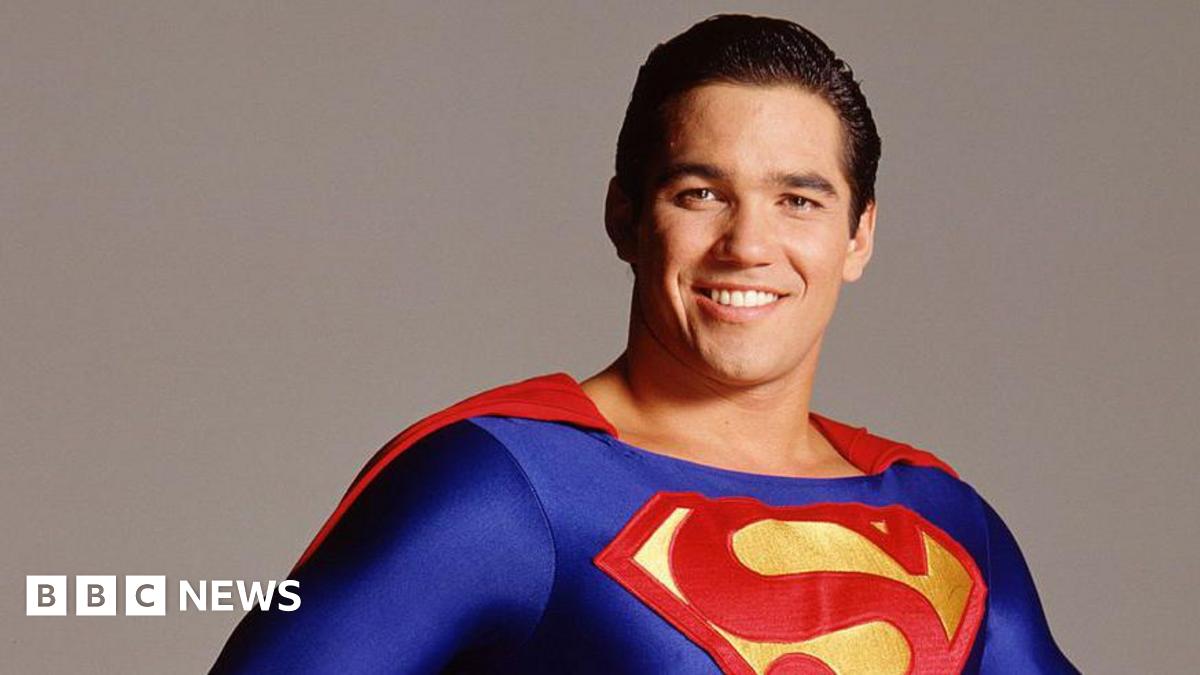

Former Superman Actor Dean Cain Embraces New Role As Ice Agent

Aug 09, 2025

Former Superman Actor Dean Cain Embraces New Role As Ice Agent

Aug 09, 2025 -

How Chat Gpt Is Reshaping The Ai Industry A Competitive Analysis

Aug 09, 2025

How Chat Gpt Is Reshaping The Ai Industry A Competitive Analysis

Aug 09, 2025 -

Exploring Tommy Fleetwoods Career Success And Romantic Life

Aug 09, 2025

Exploring Tommy Fleetwoods Career Success And Romantic Life

Aug 09, 2025 -

Ecuadors Gang Violence A Cnn Investigation Into The Conflict

Aug 09, 2025

Ecuadors Gang Violence A Cnn Investigation Into The Conflict

Aug 09, 2025

Latest Posts

-

500 Arrested Escalation In Palestine Action Protests

Aug 13, 2025

500 Arrested Escalation In Palestine Action Protests

Aug 13, 2025 -

West Bank Displacement Crisis Jeremy Bowen On Intensified Settler Campaign

Aug 13, 2025

West Bank Displacement Crisis Jeremy Bowen On Intensified Settler Campaign

Aug 13, 2025 -

30 Billion Chagos Compensation And The Gaza Crisis A Comparison Of Global Priorities

Aug 13, 2025

30 Billion Chagos Compensation And The Gaza Crisis A Comparison Of Global Priorities

Aug 13, 2025 -

Arthurs Seat Fire Extent Of Damage And Ongoing Investigation

Aug 13, 2025

Arthurs Seat Fire Extent Of Damage And Ongoing Investigation

Aug 13, 2025