UK First-Time Buyers: The 31-Year Mortgage Trend Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK First-Time Buyers: The 31-Year Mortgage Trend Explained

For many aspiring homeowners in the UK, the dream of owning a property feels further out of reach than ever. Soaring house prices coupled with increasing interest rates have created a perfect storm, pushing the average mortgage term to a staggering 31 years – the longest on record. This unprecedented trend raises serious questions about financial stability and long-term planning for first-time buyers. Let's delve into the factors driving this alarming shift and explore its implications.

The Rise of the 31-Year Mortgage: A Perfect Storm of Factors

Several interconnected factors have contributed to the lengthening mortgage term for first-time buyers in the UK:

-

Skyrocketing House Prices: House prices in many parts of the UK have consistently outpaced wage growth for years. This widening gap means that even with a significant deposit, many potential buyers find themselves needing larger mortgages to afford their desired property. [Link to relevant housing market statistics website].

-

Increased Interest Rates: The Bank of England's efforts to combat inflation have led to a significant increase in interest rates. Higher interest rates translate to higher monthly mortgage payments, forcing borrowers to extend their loan terms to manage affordability.

-

Tightening Lending Criteria: Following the 2008 financial crisis, lending criteria for mortgages have become stricter. This makes it more difficult for some individuals to qualify for a mortgage, potentially leading to longer loan terms to reduce monthly payments.

-

Cost of Living Crisis: The ongoing cost of living crisis has squeezed household budgets, leaving less disposable income available for mortgage payments. This has pushed many first-time buyers towards longer-term mortgages to keep monthly outgoings manageable.

The Implications of Longer Mortgage Terms

A 31-year mortgage presents several significant challenges:

-

Increased Total Interest Paid: Extending the mortgage term dramatically increases the total amount of interest paid over the life of the loan. This can significantly impact long-term financial health.

-

Reduced Financial Flexibility: A longer mortgage term ties up a larger portion of a borrower's income for a longer period, potentially limiting their ability to save for other financial goals, such as retirement or children's education.

-

Increased Vulnerability to Economic Shocks: Borrowers with longer-term mortgages are more vulnerable to economic downturns or unexpected changes in interest rates, as they face higher overall interest payments and a longer period of exposure to risk.

What Can First-Time Buyers Do?

Despite the challenging market, there are steps first-time buyers can take to navigate the current climate:

-

Save a Larger Deposit: A larger deposit can significantly reduce the amount borrowed and, consequently, the monthly payments and overall interest paid.

-

Explore Government Schemes: The UK government offers various schemes aimed at helping first-time buyers, such as Help to Buy and shared ownership. [Link to relevant government website].

-

Seek Independent Financial Advice: Consulting a qualified financial advisor can provide valuable guidance on navigating mortgage options and creating a sound financial plan.

-

Consider Location: Exploring areas with more affordable housing can help reduce the overall cost of purchasing a property.

Looking Ahead: A Challenging but Not Impossible Market

The 31-year mortgage trend highlights the significant challenges facing first-time buyers in the UK. While the market remains challenging, it's not insurmountable. By understanding the factors driving this trend and taking proactive steps, aspiring homeowners can increase their chances of achieving their dream of owning a property. Careful planning, informed decision-making, and seeking expert advice are crucial for navigating this complex landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK First-Time Buyers: The 31-Year Mortgage Trend Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Average Mortgage Length First Timers Face 31 Year Loans

Jun 04, 2025

Average Mortgage Length First Timers Face 31 Year Loans

Jun 04, 2025 -

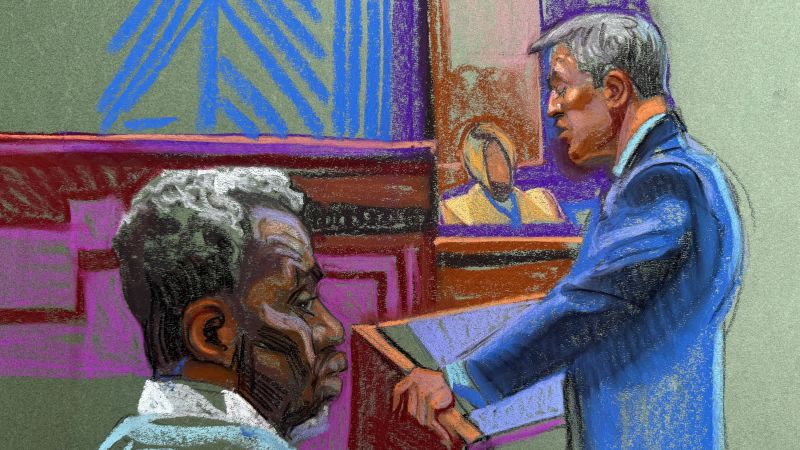

Following The Case The Sean Diddy Combs Trial Key Updates

Jun 04, 2025

Following The Case The Sean Diddy Combs Trial Key Updates

Jun 04, 2025 -

Thames Water Preferred Bidder Withdraws Leaving Future Uncertain

Jun 04, 2025

Thames Water Preferred Bidder Withdraws Leaving Future Uncertain

Jun 04, 2025 -

Austin Tice Case Syrian Government Files Expose Years Of Captivity

Jun 04, 2025

Austin Tice Case Syrian Government Files Expose Years Of Captivity

Jun 04, 2025 -

Ladenburg Thalmann Issues Hold Rating For Northwestern Energy Group Nwe

Jun 04, 2025

Ladenburg Thalmann Issues Hold Rating For Northwestern Energy Group Nwe

Jun 04, 2025

Latest Posts

-

The Impact Of First Bacteria On Future Health A Microbiome Perspective

Jun 06, 2025

The Impact Of First Bacteria On Future Health A Microbiome Perspective

Jun 06, 2025 -

Secure Your Pair Buying The Nike Air Max 95 Og Bright Mandarin

Jun 06, 2025

Secure Your Pair Buying The Nike Air Max 95 Og Bright Mandarin

Jun 06, 2025 -

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025 -

Dallas Stars Future Uncertain After Coaching Change Announcement

Jun 06, 2025

Dallas Stars Future Uncertain After Coaching Change Announcement

Jun 06, 2025 -

Maxwell Anderson Found Guilty Milwaukee Jury Announces Verdict

Jun 06, 2025

Maxwell Anderson Found Guilty Milwaukee Jury Announces Verdict

Jun 06, 2025