UK Government Bans Rob Cross, Former World Darts Champion, From Company Directorships Following Tax Investigation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Government Bans Rob Cross from Company Directorships After Tax Investigation

Former world darts champion Rob Cross has been disqualified from acting as a company director for seven years following a tax investigation, the Insolvency Service announced. The ban, a significant blow to the professional darts player, highlights the increasing scrutiny placed on high-profile individuals' financial dealings. This decision underscores the government's commitment to tackling tax evasion and ensuring corporate accountability.

The Insolvency Service confirmed that Cross's disqualification stems from a tax investigation uncovering significant irregularities. While specifics remain undisclosed due to ongoing legal proceedings, the investigation revealed substantial non-compliance with UK tax laws. The severity of the breaches led to the lengthy disqualification, preventing Cross from holding any directorial positions for a considerable period.

<h3>The Impact on Cross's Career and Reputation</h3>

This development significantly impacts Cross's professional career beyond the oche. Beyond his darts career, Cross has various business interests, including ventures related to his sponsorship deals and personal branding. The seven-year ban effectively prevents him from directly managing these business ventures, necessitating a significant restructuring of his financial affairs. The reputational damage could also impact his future sponsorship opportunities and overall public image. The details of the tax irregularities remain confidential pending further legal developments.

<h3>The Government's Stance on Tax Evasion</h3>

The government's swift action in this case demonstrates a proactive approach towards tackling tax evasion, particularly among high-profile individuals. This serves as a warning to others that non-compliance will not be tolerated. The decision sends a strong message that everyone, regardless of their profession or public profile, is subject to the same laws and will face consequences for breaking them. The government is increasingly focusing resources on investigating complex tax avoidance schemes. This proactive approach is designed to ensure fairness and transparency within the UK's tax system.

<h3>What Happens Next?</h3>

The seven-year ban represents a substantial penalty. During this time, Cross will be unable to take on any directorial roles in companies registered in the UK. He may appeal the decision, but this is an uphill battle given the seriousness of the offences. His legal team is currently reviewing the options available. Further information may be released as the legal process progresses. The case underscores the importance of thorough financial management and compliance for all businesses, regardless of size.

<h3>The Broader Implications for Professional Athletes</h3>

This case serves as a cautionary tale for other professional athletes who have multiple business interests. It emphasizes the critical need for robust financial planning and absolute compliance with tax regulations. Failing to do so can have devastating consequences, extending far beyond the sporting arena. Professional athletes often manage significant incomes and complex financial arrangements, requiring meticulous attention to detail and professional financial advice.

This significant development in the world of professional sports and business underlines the seriousness with which the UK government treats tax evasion. It serves as a strong reminder of the importance of financial transparency and compliance for everyone. While the specifics remain limited, the long-term implications for Rob Cross are significant. The case will undoubtedly be closely followed by others in similar positions.

Keywords: Rob Cross, Darts, Tax Evasion, Company Directorship, Insolvency Service, UK Government, Tax Investigation, Disqualification, Professional Athletes, Financial Management, Business, Sponsorship.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Government Bans Rob Cross, Former World Darts Champion, From Company Directorships Following Tax Investigation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Israeli Raid Leads To Bbc Teams Detention In Southern Syria

Jun 07, 2025

Israeli Raid Leads To Bbc Teams Detention In Southern Syria

Jun 07, 2025 -

Walton Goggins Clarifies Instagram Unfollow Of Aimee Lou Wood

Jun 07, 2025

Walton Goggins Clarifies Instagram Unfollow Of Aimee Lou Wood

Jun 07, 2025 -

Find The Nike Air Max 95 Og Bright Mandarin Retailers And Stockists

Jun 07, 2025

Find The Nike Air Max 95 Og Bright Mandarin Retailers And Stockists

Jun 07, 2025 -

Reform Party Leader Rejects Mps Burka Ban Proposal

Jun 07, 2025

Reform Party Leader Rejects Mps Burka Ban Proposal

Jun 07, 2025 -

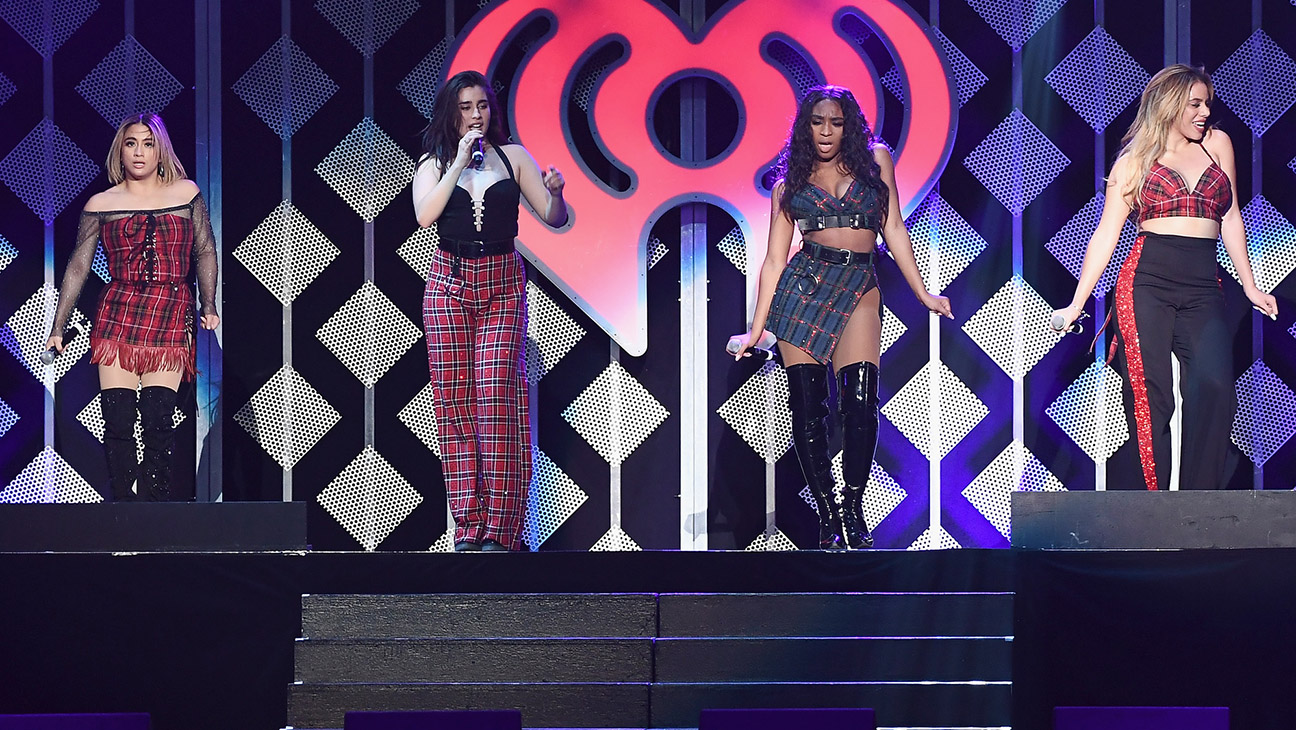

Report Fifth Harmony Members Discuss Potential Reunion Excluding Camila Cabello

Jun 07, 2025

Report Fifth Harmony Members Discuss Potential Reunion Excluding Camila Cabello

Jun 07, 2025

Latest Posts

-

Nfl Star Chris Conleys Post Football Career A Focus On Film

Jun 07, 2025

Nfl Star Chris Conleys Post Football Career A Focus On Film

Jun 07, 2025 -

Demonstrators Block Ice After Controversial San Diego Restaurant Raid

Jun 07, 2025

Demonstrators Block Ice After Controversial San Diego Restaurant Raid

Jun 07, 2025 -

Hamilton By Election Results What Reforms Strong Showing Means

Jun 07, 2025

Hamilton By Election Results What Reforms Strong Showing Means

Jun 07, 2025 -

Kepa Arrizabalaga To Arsenal Deal Imminent Sources Say

Jun 07, 2025

Kepa Arrizabalaga To Arsenal Deal Imminent Sources Say

Jun 07, 2025 -

Israel Confirms Arming Hamas Rivals Amidst Growing Opposition Backlash

Jun 07, 2025

Israel Confirms Arming Hamas Rivals Amidst Growing Opposition Backlash

Jun 07, 2025